The cloudification of accounting systems is advancing in Indonesia, with the three major local cloud systemsAccurate, Zahir, and Jurnalleading the market. However, in reality, it is said that fewer than 8% of domestic companies have implemented accounting systems.

This is why new cloud-based accounting systems continue to be launched in what might seem like an already saturated Indonesian market. It suggests that both domestic and international IT startups see significant potential for cloud accounting systems to expand their market share locally.

In Indonesia, automated journal entries due to the widespread use of accounting systems have become commonplace, and over the past five years, the average score of corporate accountants on bookkeeping tests has reportedly declined. Conversely, English communication skills have improved. I think this phenomenon is similar to how university students have become less adept at touch typing since smartphones became widespread.

Even as accounting tasks have been systematized, manual intervention has always been inevitable at some point. This stems from the difficulty of evaluating assets in a two-dimensional world of accounting software or ledgers considering the concept of time while dealing with transactions that don’t involve physical movement of goods. This challenge arises because judgment criteria for the duality of acquisition cost (original cost) and current valuation (market value) have not been standardized. However, with Indonesia’s accounting standards, PSAK (Pernyataan Standar Akuntansi Keuangan), aligning with the global IFRS (International Financial Reporting Standards), there is now less room for debate in accounting treatments.

As cashless transactions become more prevalent and all corporate transactions are conducted through bank accounts, daily bookkeeping tasks could disappear as bank transactions are automatically journalized. Much like autonomous driving, human involvement in manual accounting tasks is expected to diminish. This raises the question of whether there remains value in studying bookkeeping or accounting in such an era.

This blog features articles on accounting-related topics aimed at helping people like me, who are engaged in work related to Indonesia, better understand the context (background) of various phenomena encountered in daily life and business settings.

Differences Between Perpetual Inventory Method and Three-Way Method in Accounting Systems

Meaning of Month-End Inventory Transfer in the Three-Way Method

In a three-way method (inventory valuation method) system, inventory receipts and issuances do not generate accounting entries. At month-end, manual entries transfer the beginning inventory amount to the Opening Stock account and the ending inventory amount to the Closing Stock account (a contra account to P/L) to synchronize accounting with inventory. The Opening Stock, Closing Stock, and Purchase accounts are then transferred to the Cost of Goods Sold account to calculate the cost of goods sold. Afterward, all P/L account balances are transferred to the Net Income account to calculate gross profit.

- Beginning inventory is transferred to Opening Stock (an expense account), and purchases are recorded in the Purchase (expense) account during the month, creating an excess expense state. At month-end, remaining inventory is transferred to Opening Stock (a negative expense account), reducing the incurred expense to COGS (Cost of Goods Sold). Opening Stock and Closing Stock entries occur at month-end, while Purchase entries are made during the month.

- The perpetual inventory method continuously tracks inventory amounts through the Merchandise account, eliminating the need for the three expense accounts Purchase, Opening Stock, and Closing Stock instead generating issuance entries without requiring month-end inventory transfers.

- Under the assumption that P/L and B/S are only produced at month-end, expensing purchases during the month and transferring inventory at month-end allows gross profit to be calculated. Further calculating cost of goods sold using the three-way method clarifies the P/L breakdown (displaying cost of goods sold in P/L is mandatory).

- As long as beginning and ending inventories are transferred to the relative accounts Opening Stock (debit) and Closing Stock (credit) as expenses, gross profit is correctly calculated even without transferring to the Cost of Goods Sold account using the three-way method.

In manual accounting, all P/L accounts are transferred to the Net-Income account at month-end to calculate profit. In system accounting, intermediate calculations for creating P/L and B/S can be black-boxed, so transfer entries are not generated. Instead, the three-way method calculates cost reports (material costs, manufacturing costs, cost of goods sold), assembling P/L and B/S.

In practice, the system internally calculates “incurred material costs ⇒ manufacturing costs ⇒ cost of goods sold” in that order. Rather than aggregating beginning inventory, current month receipts, and ending inventory into the Cost of Goods Sold or Purchase accounts, it directly collects and performs addition/subtraction on G/L data, pasting the results into the P/L format.

The process of calculating gross profit on the P/L using the three-way method is as follows:

- Record Purchase during the month

Total Revenue - Total Expenses = Pre-Transfer Gross Profit (all current month purchases are expensed) - Transfer beginning and ending inventory at month-end to create B/S

{(Total Revenue + Closing Stock) - (Total Expenses + Opening Stock)} = Gross Profit

The difference is reflected in inventory changes, completing the B/S. The P/L gross profit is correct, but cost of goods sold is not yet calculated. - Separate revenue into Sales and Other Revenue, and expenses into Cost of Goods Sold and Other Expenses to create P/L

{Sales - (Opening Stock + Current Month Purchases - Closing Stock)} + Other Revenue - Other Expenses = Gross Profit

In a perpetual inventory system, accounting entries are generated with every inventory receipt or issuance, with inventory valuation based on FIFO (First-In, First-Out) or moving average methods. Changing the order of receipts and issuances affects accurate valuation. Although cost of goods sold isn’t calculated using the three-way method, the cost of goods sold section on the P/L is written in a three-way style, which is often a source of confusion.

Contents of Adjusting Entries at Closing

■ Adjustments for accounts without counterparties

Accumulated Depreciation and Allowance for Doubtful Accounts are displayed as negative assets under B/S assets.

- (Debit) Depreciation Expense (Expense) (Credit) Accumulated Depreciation - Machinery (Negative Asset)

- (Debit) Bad Debt Expense (Expense) (Credit) Allowance for Doubtful Accounts (Negative Asset)

- (Debit) Retirement Benefit Expense (Expense) (Credit) Retirement Benefit Provision (Liability)

■ Expensing Supplies

- (Debit) Supplies Expense (Credit) Supplies

■ Transferring beginning and ending inventory to Opening Stock and Closing Stock to synchronize inventory with accounting, ensuring accurate B/S assets and P/L profit. The Difference Between the Perpetual Inventory Method and the Periodic Method in Accounting Systems In the perpetual inventory method, goods are recorded as a B/S (Balance Sheet) account called "Merchandise" when purchased, and each time goods are shipped, the Merchandise account is reduced to synchronize the inventory with the accounting balance of the Merchandise account. In contrast, in the periodic inventory method (three-way method), purchases are recorded as an expense in a P/L (Profit and Loss) account, and at the end of the month, the purchases, beginning inventory, and ending inventory valuation are transferred to the Cost of Goods Sold (COGS). 続きを見る

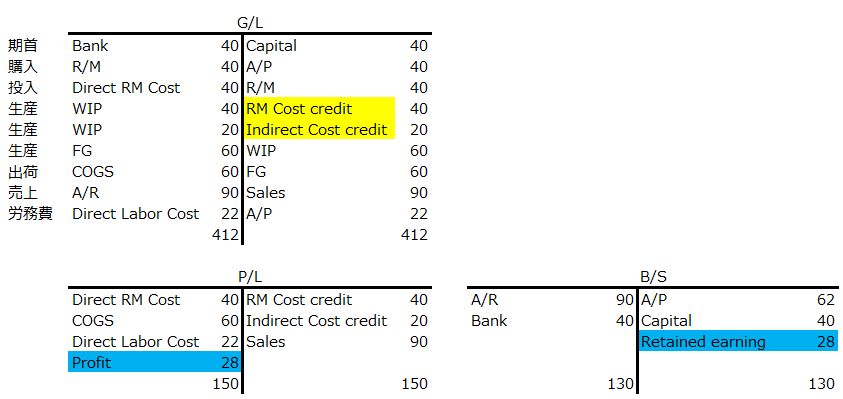

■ Calculating current month material costs, Cost of Goods Manufactured (COGM), and Cost of Goods Sold (COGS) using the three-way method.

■ Transferring all expense and revenue accounts to the Net Profit account, displaying credit balances (revenue) on P/L and B/S.

■ Displaying the Net Profit account balance on the B/S to balance it, and at year-end, transferring to Retained Earnings or Dividends Payable for profit appropriation.

When valuing month-end inventory using the lower of cost or market method in a cost management system, the valuation unit price from the previous month-end is automatically set in the month-end valuation unit price master. At the current month-end, a new unit price is either automatically set or adjusted by a fixed ratio, calculating “Valuation Unit Price - New Unit Price” to generate valuation loss entries based on the reason, updating the carryover inventory valuation for the next month.

Month-end inventory amounts are calculated using the total average method. Inventory valuation is possible during the month as Month-To-Date (from the beginning of the month to today) using the total average unit price, and negative inventory quantities during the month are acceptable. However, accounting applies the total average unit price at month-end.

The Three Financial Statements: Standard Format for Explaining Corporate Activities

Accounting Process Flow

- Monthly Tasks: Journal Entries (Purchases recorded as expense accounts)

- Inventory Closing: Stock Closing

- Accounting Closing (A/R, A/P, Journal)

- Foreign Exchange Revaluation

- Accounting Closing

■ Depreciation Expense

■ Transferring beginning and ending product inventory to Opening Stock and Closing Stock accounts ⇒ Inventory synchronized

■ Transferring Opening Stock, Closing Stock, and Purchase accounts to Cost of Goods Sold account to calculate COGS ⇒ Eliminating Opening Stock and Closing Stock accounts

■ Transferring expense and revenue accounts to Net-Profit account to calculate COGS - Trial Balance (T/B): P/L account balances become zero

- Balance Update (Inventory and Accounting)

Preparation of Financial Statements

- Cost of Goods Manufactured Report (COGM Report)

- Profit and Loss Statement (P/L)

- Balance Sheet (B/S)

- Cash Flow Statement (C/F): Cash-basis P/L

■ Direct Method: Aggregated from G/L (by transaction) with cash flow codes and displayed as totals

■ Indirect Method: Deductively adjusts from net profit, reconciling accrual-basis and cash-basis differences using Trial Balance (T/B) residuals (Account Balance) with plus/minus adjustments- Net Profit (Accrual-basis current period profit)

- Depreciation Expense added back (Amount subtracted from Net Profit in accrual-basis P/L)

- A/R balance subtracted (Portion not yet converted to Cash/Bank)

- A/P balance added (Portion preventing Cash/Bank outflow)

-

-

Three Financial Tables for Explaining Corporate Activities

The world-standard format representing corporate activities—movements of goods, amounts, and cash—is embodied in the three financial statements: the Profit and Loss Statement (P/L), the Balance Sheet (B/S), and the Cash Flow Statement (C/F). Even as business processes become increasingly systematized, this is knowledge that should be systematically understood to generate new ideas based on the essence of operations.

続きを見る

Flow of Current Period Net Profit Becoming Retained Earnings and Profit Appropriation in Accounting Systems

Net assets are recorded in the B/S net assets section in one of four forms: Legal Capital from company establishment or capital increases, Legal Capital Surplus from non-operating stock issuances, Retained Earnings from operating profits, or Earned Surplus Reserve as a pool for dividends. Legal Capital Surplus and Retained Earnings constitute internal reserves.

Items labeled “profit” pass through the P/L, while those labeled “capital” are unrelated to operations and sourced from shareholders. Profits from the P/L are housed in Retained Earnings, and amounts set aside for dividends are accumulated in Earned Surplus Reserve.

Due to prolonged deflation, large Japanese companies have accumulated internal reserves, resulting in Retained Earnings disproportionately large compared to Legal Capital.

Under Indonesian company law, from a creditor protection perspective, Legal Capital Surplus must be accumulated up to 20% of Legal Capital.

Generally, companies with growth potential prioritize thickening internal reserves for reinvestment in fixed assets like equipment, aiming for growth rather than shareholder returns through dividends.

Transferring Current Period Profit to Earned Surplus Reserve

- (Debit) Net Income 80 (Credit) Total Expenses 80

(Transfer all expense accounts to Net Income)

- (Debit) Total Revenue 100 (Credit) Net Income 100

(Transfer all revenue accounts to Net Income)

- (Debit) Net Income 20 (Credit) Retained Earnings 20

(Transfer the credit surplus of Net Income to Retained Earnings)

Dividends from Earned Surplus Reserve

- (Debit) Retained Earnings 10 (Credit) Earned Surplus Reserve 10

(Pool Retained Earnings into Earned Surplus Reserve)

- (Debit) Earned Surplus Reserve 10 (Credit) Dividends Payable 10

- (Debit) Dividends Payable 10 (Credit) Cash/Bank 10

Subsequent Cash/Bank Movements

- (Debit) Machinery 5 (Credit) Cash/Bank 5

Carrying over to Retained Earnings also carries over the cash/bank balance, but subsequent cash/bank movements occur independently of the above net asset movements. Internal reserves do not mean cash/bank remains in the company. The Flow of Net Profit for the Period Becoming Internal Reserves and Being Appropriated in an Accounting System It is said that a company’s internal reserves are not necessarily held as cash or deposits because, even though transferring profit/loss to retained earnings increases net assets, the accounts receivable, which are the substance of revenue, will eventually turn into cash or deposits. Meanwhile, the balance decreases due to capital expenditures or loan repayments, independent of the movements in net assets. 続きを見る

Functional Currency Change Due to Rupiah-Based Domestic Transactions in Indonesia

In accounting operations, three foreign exchange conversion flows occur: realized foreign exchange gains/losses at settlement of receivables/payables (difference between occurrence rate and settlement date rate), unrealized foreign exchange gains/losses at month-end (difference from revaluing asset/liability items at month-end rates), and conversion from functional currency to presentation currency (difference from revaluing asset/liability items at month-end rates), following the ‘foreign currency ⇒ functional currency ⇒ presentation currency’ process.

The difference between the rate at A/P recognition upon invoice arrival and the rate at A/P settlement is a confirmed realized profit (Forex Gain-Realized), while foreign exchange gains/losses from revaluing A/P at month-end rates are unrealized profits (Forex Gain-Unrealized), representing potential valuation gains at a specific point.

During month-end revaluation of receivables/payables, if the month-over-month gain/loss of assets is critical, the separation method updates the invoice price to the latest valuation. If the gain/loss compared to acquisition is critical, the reversal method reverses it to the acquisition valuation at the beginning of the next month.

■ Separation Method (Separating Acquisition Cost)

Month-end revaluation entry:

- (Debit) Unrealized Loss 10 (Credit) A/R 10

Next month-end revaluation entry:

- (Debit) Unrealized Loss 2 (Credit) A/R 2

This updates the P/L valuation gain/loss compared to the previous month-end as the fair value of A/R on the B/S each month-end.

■ Reversal Method (Maintaining Acquisition Cost)

Month-end revaluation entry:

- (Debit) Unrealized Loss 10 (Credit) A/R 10

Reversal entry at the beginning of the next month to restore A/R to acquisition valuation:

- (Debit) A/R 10 (Credit) Unrealized Loss 10

Next month-end revaluation entry records the gain/loss on the P/L against the acquisition A/R price:

- (Debit) Unrealized Loss 12 (Credit) A/R 12

When using the previous month-end rate as the flat rate for the current month’s foreign currency transactions, no realized foreign exchange gains/losses occur at settlement, but unrealized foreign exchange gains/losses arise during month-end revaluation. In this case, since the previous month-end rate is set as the transaction rate in the exchange rate master, a separate revaluation rate must be set in addition to the transaction rate and TAX rate. Change of Functional Currency Due to the Rupiahization of Domestic Transactions in Indonesia When revaluing foreign exchange for receivables and payables at month-end, if the gain or loss compared to the previous month’s assets is significant, the separation method updates the invoice price to the latest valuation amount. If the gain or loss compared to the acquisition cost is significant, the reversal method reverses the valuation to the acquisition cost at the beginning of the following month. 続きを見る

When offsetting entries to correct foreign currency transaction entries, failing to input the transaction rate results in a residual balance in the functional currency despite zeroing out in the transaction currency, requiring caution. In accounting systems allowing different currencies for debit and credit accounts, balancing in the functional currency is mandatory.

Revenue-Expense Approach (Income Method) vs. Asset-Liability Approach (Balance Sheet Method)

Revenue-Expense Approach Based on Income Method vs. Asset-Liability Approach Based on Balance Sheet Method

- Profit for the month under the income method is “month-end revenue - month-end expenses,” while under the balance sheet method, it is the increase in equity: “(beginning assets - beginning liabilities) - (ending assets - ending liabilities),” both yielding the same amount.

- The profit as the difference between Expense and Revenue in the income method becomes the increase in Equities in the balance sheet method, establishing the trial balance equation: Asset + Expense = Liabilities + Equities + Revenue.

Japan adopts a revenue-expense approach, preparing the P/L first and supplementarily recording assets, liabilities, and equity items sources of future revenue and expenses in the B/S. Tax law valuation amounts are used as accounting valuations, with depreciation completed and processed as extraordinary gains/losses, reflecting a strong income method perspective.

- With full adoption of IFRS and fair value accounting, country-specific tax law depreciation and recording residual value as valuation losses would no longer be possible.

Under IFRS, the asset-liability approach emphasizes fair value evaluation of fixed assets (impairment loss and reversal), marketable financial assets, etc., to accurately prepare the B/S and clarify whether assets can generate future cash flows, reflecting a strong balance sheet method perspective.

System compliance with IFRS involves the timing of journal entries:

- Accrual-basis revenue recognition (shipment or inspection basis in the automotive industry)

- Fair value evaluation of fixed assets (impairment and reversal)

-

-

Profit & Loss Method and Property Method

The monthly profit under the Profit and Loss Method is calculated as "Revenue at the end of the month – Expenses at the end of the month," whereas the monthly profit under the Property Method is the increase in capital expressed as "(Assets at the beginning of the month – Liabilities at the beginning of the month) – (Assets at the end of the month – Liabilities at the end of the month)," and both methods yield the same amount.

続きを見る

Handling Prepayments and Advances Received in Accounting Systems

Advances received from customers (Deferred Revenue) are processed as Down Payments without recognizing Sales, transferred to Sales upon obtaining the Surah Terima Berita Acara (proof of receipt).

■ Upon receiving Down Payment

- (Debit) A/R 50 (Credit) Down Payment 50

■ Upon receiving Surah Terima Berita Acara for 50% of Down Payment

Percentage of Completion Basis:

- (Debit) Down Payment 25 (Credit) Sales 25

Completion Basis:

- No entry

■ Upon receiving Surah Terima Berita Acara for remaining Down Payment

Percentage of Completion Basis:

- (Debit) Down Payment 25 (Credit) Sales 25

Completion Basis:

- (Debit) Down Payment 50 (Credit) Sales 50

■ Upon receiving Surah Terima Berita Acara for the entire order amount

- (Debit) A/R 50 (Credit) Sales 50

Since Down Payments are processed, Sales recognition may span months. Between shipment (service provision) and invoice issuance, comparing A/R balances with accounting G/L Sales on a monthly basis shows excess A/R, causing discrepancies.

Prepayments to suppliers (Deferred Expense) are processed as Advanced Payments without recognizing Purchases, transferred to Purchases upon confirmation.

- (Debit) Advanced Payment 100 (Credit) A/P 100

- (Debit) Purchase 100 (Credit) Advanced Payment 100

-

-

Handling of Advance Payments and Down Payments in an Accounting System

Advance payments from customers are recorded in the Down Payment account at the time of invoice issuance and are transferred to Sales upon receipt of the customer's Surah Terima Berita Acara (certificate of acceptance). As a result, a mismatch occurs between the invoice amount issued for the month (A/R recorded amount) and the accounting Sales figure.

続きを見る

Accrual Basis Processing with Shipment and Receipt Criteria

In the accounting practices of Indonesia’s automotive parts industry, the principle of simultaneous shipment and sales recognition often involves recording temporary receivables (A/R Accrued) and sales, as well as purchases and temporary payables (A/P Accrued), in the transaction occurrence month to prepare the current month’s P/L and B/S. Invoices are merely units for aging management of billing and payments, not units of cash movement.

■ Recording unrealized receivables and sales on October 5 shipment date

- (Debit) A/R Accrued 100 (Credit) Sales 100

■ Recording unrealized receivables and sales on October 10 shipment date

- (Debit) A/R Accrued 100 (Credit) Sales 100

■ Transferring to receivables upon invoice issuance on November 5

- (Debit) A/R 200 (Credit) A/R Accrued 200

For imports via sea freight, discrepancies between invoice dates and delivery dates occur. Upon invoice arrival, entries are recorded as Goods In Transit, transferred to the Purchase account upon cargo arrival, managing them as on-board inventory.

■ Invoice arrival

- (Debit) Goods In Transit 300 (Credit) A/P 300

■ Cargo arrival

- (Debit) Purchase 300 (Credit) Goods In Transit 300

The reason for recognizing sales on the B/L (Bill of Lading) date under FOB (Free On Board) exports is that, under trade terms where “the seller bears costs and risks until loading onto the ship, and the buyer assumes costs and risks thereafter,” the B/L date marks the goods’ handover date. Processing Methods Based on the Shipment Basis and Receipt Basis Under the Accrual Principle Accrual accounting recognizes revenue and expenses at the time a transaction occurs, regardless of cash flow, so sales (revenue) and purchases (expenses) are recognized at the point of shipment or receipt. In contrast, realization accounting recognizes them when the transfer of goods or provision of services is complete and consideration is established, meaning sales (revenue) and purchases (expenses) are recognized at the point of invoice issuance or arrival. 続きを見る

Managing On-Board Inventory and Unarrived Invoice Inventory in Accounting Systems

■ Construction In Progress

A temporary account to manage construction costs, material costs, labor costs, and expenses prepaid or advanced until construction completion or building handover. Equipment imported from Japan under FOB terms becomes company assets upon departure but is recorded in Construction In Progress until CIF costs are finalized, rather than being incorporated into fixed assets.

- Freight Charge

- PIB (Pemberitahuan Impor Barang - Import Declaration)

- SPPB (Surat Persetujuan Pengeluaran Barang - Customs Clearance Permit)

Construction In Progress is a temporary storage for non-depreciable assets and becomes subject to audit if it remains unusually long.

■ Work In Process or Cost of Uncompleted Contracts

Buildings under construction for sale are distinguished as Cost of Uncompleted Contracts or Work In Process.

■ Goods In Transit

Imported materials’ on-board inventory is recorded as Goods In Transit. CIF costs incidental to purchases are expensed as purchase incidentals if small but transferred to Purchases and turned into COGS if significant.

Common Incoterms heard in trade between Japan and Indonesia include:

- EXW (Ex Works)

- FOB (Free On Board)

- CIF (Cost, Insurance, and Freight)

Equipment becomes Construction In Progress once it is on-board inventory, is capitalized as a fixed asset upon factory delivery and start of use (date put into service), and depreciated based on its useful life. Methods for Managing On-Board Inventory and Inventory with Unarrived Invoices in an Accounting System When managing on-board inventory or inventory with invoices yet to arrive in a business system, assets are recorded under the Goods in Transit account when the ship departs from the exporting country. For goods shipped for consignment sales, they are recorded in the Consigned Goods account. In Indonesia, all such items are treated as Goods in Transit, and liabilities are recorded in a temporary payables account. 続きを見る

Direct and Indirect Cash Flow Statements Output from Accounting Systems

In Cash Basis accounting, profit/loss is recognized when cash moves, regardless of transaction timing, aligning P/L with cash flow. However, most companies use Accrual Basis accounting, recognizing profit/loss when transactions occur, regardless of cash movement, causing discrepancies between P/L and cash flow at month-end. A separate Cash Flow Statement (C/F) is needed to manage cash flow.

Whether cash/bank is used for operations, investments, or financing can only be determined at transaction occurrence, so it cannot be grouped into account categories on a master and pasted into a C/F format like B/S or P/L. Thus, a cash flow code must be selected during journal entry to indicate where it should appear on the C/F form.

IFRS mandates C/F preparation using the direct method, aggregating Cash/Bank pluses and minuses from G/L, displayed as totals, and categorized vertically by counterparty accounts.

- Operations: Operation (P/L)

- Receipt of sales proceeds and payment of purchase costs

- Investments: Investment (B/S Debit)

- Sale and purchase of assets, issuance or collection of receivables

- Financing: Finance (B/S Credit)

- Borrowing or repayment of debts

For the operating section of C/F, the direct method aggregating transaction amounts from G/L based on cash flow codes is easier to prepare in an accounting system. However, the indirect method, analyzing cash backing for P/L net profit, requires no cash flow codes and can be generated from Account Balances.

- Direct Method: Cash flow from operating activities aggregated from pluses and minuses of cash/bank per transaction (total display)

- (+) Receipts from A/R settlement ⇒ Add C/F code to A/R settlement entry

- (-) Payments for direct material costs ⇒ Add C/F code to direct material payment entry

- (-) Payments for manufacturing overheads ⇒ Add C/F code to indirect labor/expense payment entry

- (-) Payments for SG&A expenses ⇒ Add C/F code to SG&A payment entry

- Indirect Method: Adjusts accrual-basis Net Profit (revenue-expense difference) to cash-basis Net Profit (Cash/Bank difference)

- (+) Net Profit ⇒ Accrual-basis current period profit

- (+) Depreciation Expense ⇒ Amount subtracted from Net Profit in accrual-basis P/L (no Cash/Bank movement)

- (-) A/R Increase ⇒ Amount not yet received as Cash/Bank

- (+) A/P Increase ⇒ Amount not yet paid as Cash/Bank

- The direct and indirect methods differ only in the operating section; the investment and financing sections are the same, with the previous month-end cash balance carried over to the current month.

Unrealized foreign exchange gains/losses from month-end revaluation of foreign currency deposits are reflected in the cash flow statement.

- Realized gains/losses (Forex Gain-Realized) at A/R and A/P settlement are not Cash/Bank, so they are not included in C/F.

- Unrealized gains/losses (Forex Gain-Unrealized) from revaluing foreign currency Cash/Bank balances must be adjusted on the C/F statement, or the C/F balance won’t match actual cash/bank balances. Foreign exchange gains/losses related to A/R and A/P, which are not Cash/Bank, are not included in C/F.

In cash transactions, “profit = cash,” but in accrual accounting, “profit + liabilities + depreciation - receivables = cash.” In the indirect cash flow statement, unsettled receivable balances are adjusted as a negative to operating cash, while unsettled payable balances and depreciation are adjusted as positives.

The benefit of depreciation is not that it physically increases cash.

- It provides a tax-saving effect by being expensed as a deductible item, classified as non-taxable income.

- It makes you feel happier knowing actual cash inflows exceed P/L profits by the depreciation amount.

Expenses like land (real estate) that don’t qualify for depreciation don’t contribute to tax savings, but appreciation could generate cash as non-operating gains upon sale.

Both fixed assets and supplies are initially recorded as assets and gradually expensed (expense deferral). “Recovering past investment funds through depreciation” means indirectly recovering investment funds through tax savings by expensing it as a deductible item.

■ May: Service sales generating 12 million yen in revenue

P/L: 12 million yen profit. C/F (Operating Section): +12 million yen.

- (Debit) Cash 1,200 (Credit) Sales 1,200

■ June: Purchased molding machine for 12 million yen cash

P/L: 0 yen profit. C/F (Investment Section): -12 million yen.

- (Debit) Machine 1,200 (Credit) Cash 1,200

■ July: Recorded 100,000 yen depreciation expense

P/L: 100,000 yen loss. C/F (Operating Section): 0 yen.

- (Debit) Depreciation 10 (Credit) Accumulated Depreciation 10

-

-

Cash Flow Statements Using the Direct Method and Indirect Method

The direct method calculates cash inflows and outflows and the cash/bank balance by aggregating the pluses and minuses of cash/bank transactions (gross presentation) on a per-transaction basis. Therefore, among unrealized foreign exchange gains and losses, the journal entries related to cash/bank foreign exchange gains and losses need to be adjusted.

続きを見る

Understanding the Flow of Goods and Money in Production Management Systems from an Accounting Perspective

Accrual basis accounting (recognition of revenue/expenses without cash movement) requires adjustments to a cash basis (settlement) for cash flow statements.

■ Credit transactions (A/R, A/P) recognize only settled amounts, excluding unsettled A/R balances. Even when sales (revenue) are recognized on the P/L under the shipment basis, temporary receivables are pooled until the invoice arrival date (when receivables are recorded). Unrecorded temporary receivables must be adjusted as a negative to operating cash (similarly for unrecorded temporary payables).

Shipment Date

- (Debit) A/R Accrued 100 (Credit) Sales 100

Invoice Arrival Date

- (Debit) A/R 110 (Credit) A/R Accrued 100

- (Credit) VAT Out-Payable 10

■ Revenue/expenses processed as accruals (deferred expense, deferred revenue, accrued expense, accrued revenue). Flow of Goods and Money in a Production Management System from an Accounting Perspective Against the accrual-basis performance on the P/L, unsettled receivables are subtracted, and depreciation expenses, which do not involve cash movement, are added to convert it to a cash basis. When preparing a cash flow statement, it is necessary to be mindful of this conversion from accrual basis to cash basis. 続きを見る

■ Depreciation of fixed assets

The complexity of corporate accounting stems from recording revenue/expenses on an accrual basis. If recorded on a cash basis, it would be simpler. A company’s profitability is reflected in P/L profits, but adjusting for unsettled expenses, revenue, and depreciation in a cash flow statement provides cash-basis management information for near-term settlements.

Key Points for Implementing a Fixed Asset Management System in Indonesia

■ Basic Functions

- Acquisition

- (Debit) Fixed Assets 1000 (Credit) Liabilities 1000

- Depreciation

- (Debit) Depreciation Expense 100 (Credit) Accumulated Depreciation 100

- Transfer

- No expense arises from Transfer, but when managing profit/loss by department, line, or machine in the accounting system, transfer entries are generated for reassignment.

- (Debit) Fixed Assets - Sales (Credit) Fixed Assets - Production

■ Extraordinary Loss Management

- Impairment Loss

- Impairment loss is conducted in the acquisition currency, requiring a currency code in the acquisition entry. Transferring assets to expenses can easily lead to P/L profit manipulation and should be done cautiously. While Japan does not allow reversal of impaired fixed assets, IFRS permits it.

- (Debit) Impairment Loss 20 (Credit) Fixed Assets 20

- (Debit) Fixed Assets 15 (Credit) Reversal Gain 15

- Retirement

- (Debit) Accumulated Depreciation 100 (Credit) Fixed Assets 1000

- (Debit) Supplies 500

- (Debit) Retirement Loss 400

- Disposal

- Disposal is recorded as a disposal loss without valuation. If the sale price exceeds the remaining value, it is recorded as a profit on sales.

- (Debit) Accumulated Depreciation 100 (Credit) Fixed Assets 1000

- (Debit) Disposal Loss 900

- Sale

- (Debit) Accumulated Depreciation 100 (Credit) Fixed Assets 1000

- (Debit) Receivables 800

- (Debit) Sale Loss 100

■ Mold Depreciation Management

- Molds are recorded in Construction In Progress when mold materials are purchased and processing begins, transferred to Fixed Assets upon completion as finished molds, initiating accounting depreciation.

- The distinction between current and fixed assets is based on whether they can be converted to cash within a year. Molds, even with a useful life under one year, are classified as Category 1 fixed assets due to their significant acquisition cost.

- Small-cost auxiliary molds may be expensed as supplies upon acquisition or grouped with molds as fixed assets.

- As fixed assets, entries are made indirectly as negative assets, listing accumulated amounts under B/S fixed asset purchase costs for “how much has been depreciated” and “how much loss has been recorded.”

-

-

Points to Implement a Fixed Asset Management System in Indonesia

In fixed asset depreciation, the straight-line method suppresses initial expense burdens to generate profit quickly, while the declining balance method accelerates expense recognition to suppress profit and achieve tax savings.

続きを見る

Capital Lease Contracts Depreciated as Lease Assets

■ Operating leases are essentially rentals of assets owned by the leasing company.

■ Capital leases (finance leases from the lessor’s perspective) or sale-and-leaseback involve owned lease assets, incurring depreciation expenses, and are transferred to main assets upon lease term completion.

- The past issue of double VAT taxation involved buying an asset (PPN-In arises from asset transfer via sales contract), selling it to a leasing company (PPN-Out arises from asset transfer via sales contract), having the leasing company settle the debt on behalf, leasing it back long-term with interest, and returning it to company assets at lease inception (PPN-In arises from asset transfer via sales contract), resulting in two VAT incidences in one leaseback transaction.

- Buying and selling to a leasing company could offset VAT, but depreciation would no longer be deductible.

- In the sale-and-leaseback method, an asset is bought (PPN-In arises from asset transfer via sales contract), contracted with the leasing company (non-taxable financial transaction with no asset transfer), and transferred from lease assets to fixed assets at lease end.

- The advantage of sale-and-leaseback is transferring to lease assets without selling, allowing long-term reduction of lease liabilities rather than settling short-term debts (A/P), suppressing large equipment purchase expenditures without generating PPN-Out from selling to the leasing company.

Equipment Purchase

PPN-In 11% is excluded from the lease contract amount.

- (Debit) Plant & Machinery 1,000,000 (Credit) Lease A/P 1,000,000

- (Debit) PPN-In 110,000 (Credit) A/P 110,000

Lease Contract Amount

No sale, so no PPN-Out 11% arises.

- (Debit) Lease Asset 1,000,000 (Credit) Plant & Machinery 1,000,000

Monthly Lease Payments

Lease payment: 1,000,000 ÷ 3 ÷ 12

Depreciation expense: 1,000,000 ÷ 10 ÷ 12

- (Debit) Lease A/P 27,777 (Credit) Bank 27,777

- (Debit) Depreciation 8,333 (Credit) Accumulated Depreciation 8,333

Conversion to Fixed Assets After Lease Term

No purchase, so no PPN-In 11% arises.

- (Debit) Plant & Machinery 1,000,000 (Credit) Lease Asset 1,000,000

Monthly Payments

Depreciation expense: 1,000,000 ÷ 10 ÷ 12

- (Debit) Depreciation 8,333 (Credit) Accumulated Depreciation 8,333

-

-

Capital lease agreements that are depreciated as leased assets

An operating lease is essentially the same as renting an asset from a leasing company, while a capital lease (from the leasing company’s perspective, a finance lease) or sale-and-leaseback involves your own lease asset, incurring depreciation expenses, and is transferred to the main asset after the lease term ends.

続きを見る

Key Points for Implementing Accounting Systems in Indonesia

Ledger Method vs. Invoice Method

Indonesia adopts the invoice method rather than the ledger method, calculating VAT based on Tax Invoices. Japan, with the introduction of reduced tax rates, decided to adopt the invoice method starting in 2021.

In the ledger method, tax amounts like consumption tax are calculated from the tax-inclusive amounts recorded in the ledger. In the invoice method, tax amounts listed on invoices are aggregated, making calculations easier even with varying tax rates by item or service.

Account Design Method

- Cash/Bank accounts (Cash, Checking, Time Deposits) are subdivided with sub-accounts.

Cash is divided by currency (IDR, USD, JPY, etc.), and checking accounts by bank and currency (SMBC-IDR, BOTM-USD, etc.). - G/L includes department codes, counterparty codes (employee codes), and currency codes, so A/R and A/P accounts don’t need subdivision by department, counterparty, or currency. They are grouped by counterparty nature (e.g., intra-group, domestic, international).

- Accounting systems have RDLC templates for management reports aggregating revenue/expense accounts horizontally by department or counterparty from the P/L menu. To aggregate amounts vertically by row, accounts must be subdivided by department or counterparty.

-

-

Key Points for Implementing an Accounting System in Indonesia

Key points to consider when implementing an accounting system in Indonesia include distinguishing between the Tax Rate (tax rate) and BI Rate (central bank transaction rate), preparing Faktur Pajak (Tax Invoice) for VAT declaration, and the timing of revenue and expense recognition under the accrual basis.

続きを見る

Basic Tax Knowledge to Understand When Implementing Accounting Systems in Indonesia

In Indonesia, the equivalent of Japan’s consumption tax is PPN (VAT = Value Added Tax). Unlike the ledger method (determining tax amounts based on ledger records, as with consumption tax), Indonesia uses the invoice method (determining tax amounts based on Tax Invoices). PPN payments or refunds are calculated based on Faktur Pajak (Tax Invoices). Essential Tax Knowledge to Understand When Implementing an Accounting System in Indonesia In the case of Indonesia, PPN (Pajak Penambahan Nilai = VAT = Value Added Tax) is the equivalent of Japan's consumption tax, but Indonesia uses the invoice method (tax invoice is used to determine the tax amount) instead of the book method (which determines the tax amount based on the book, just like the calculation of consumption tax), so the amount of PPN payment or refund is calculated based on the tax invoice. 続きを見る

The Fun and Difficulty of Accounting Conceived in Indonesia

The Difficulty of Introducing Time Concepts to Transactions Not Occurring in Reality

- Accruals

- Accrued Expense: A/P Accrued (Liability)

- Accrued Revenue: A/R Accrued (Asset)

- Deferred Expense: VAT-IN Prepaid or Advanced Payment (Asset)

- Deferred Revenue: VAT-OUT Payable or Down Payment (Liability)

These four types are B/S accounts to handle transactions where revenue or expense recognition shifts over time, misaligning with cash inflows/outflows.

- Development costs or experimental research expenses, as deferred assets, are expenditures that should burden future periods. Instead of expensing them solely in the current period, they are temporarily treated as assets and deferred, allocated over the period their effects are expected.

- Prepaid expenses, deferred assets, supplies, and fixed assets defer expensing (deferred = postpone) by initially recording them as assets.

Interpreting Events from an Accounting Perspective

Interpreting events from an accounting perspective means seeing the flow of monetary amounts (numbers) and cash (cash and checking accounts) behind corporate activities. Studying for the Japanese bookkeeping certification aids not only in practical work but also in understanding the context of everyday situations.

Economic news labeled “inappropriate accounting” typically involves tax evasion, embezzlement (personal misuse), or window dressing, all leading to false statements in securities reports (documents submitted annually to the government and stock exchanges summarizing company performance for investors’ decisions). This distorts P/L and B/S figures, ultimately harming shareholders the most.

Examples of Inappropriate Accounting

- 【Off-Book Transactions】: Selling at a “friend price” reduces taxable income, raising suspicions of off-book back margins.

- 【Circular Transactions】: Toshiba’s double-counting of sales by providing LCD manufacturing to subcontractors on a paid basis is “circular trading.”

- 【Transfer Pricing】: Selling cheaply to a low-tax-rate overseas branch reduces taxable income in Japan, increasing it locally, boosting consolidated profits.

- 【Loss Hiding】: Transferring bad debts with unrealized losses to non-consolidated affiliates at book value to hide losses.

- 【Reassignment (Impression Management)】: Reassigning financial trading losses to M&A losses from acquiring a paper company to improve the loss’s perception.

Royalty/Commission

- Accounts used by Japanese headquarters to recover investments from Indonesian subsidiaries are classified as Production Royalty (manufacturing expense), Sales Commission (SG&A expense), or Dividends Payable (liability), but tax authorities often deny them as transfer pricing.

- Even if successfully expensed as legitimate royalties to the Japanese headquarters, transfer pricing rules may recalculate the royalty amount, subjecting it to a 20% PPH26 withholding tax on overseas services.

- Dividends are the preferred form of investment recovery, but without consecutive years of operating profit, recording them as dividends is difficult. Thus, royalties are expensed at applicable rates per item upon Sales recognition.

-

-

The Fun and Challenges of Accounting Conceived in Indonesia

Accounting is a puzzle-like mechanism where a single transaction is recorded on two sides—debit and credit—incorporating the difference between expenses and revenues into net assets, balancing the equation "Assets = Liabilities + Net Assets." Cash flow management involves adjusting accrual-based transaction entries to a cash basis to track the movement of cash and deposits.

続きを見る

Meaning of Deducting from Manufacturing Costs or Cost of Goods Sold via Transfer to Other Accounts

Once a product is completed, manufacturing costs are finalized, leaving deduction from cost of goods sold as the only option.

If materials become defective before being input into the manufacturing process, it becomes an inventory shrinkage expense.

Defective work-in-process costs are transferred within manufacturing costs.

- Manufacturing Cost = Beginning WIP + Current Month Manufacturing Expenses (Material Costs + Processing Costs) - Ending WIP

- Assuming material costs are input in the initial process and processing costs accumulate per process, defective costs are extra expenses within current month manufacturing expenses (material costs + processing costs) due to defects, distinguished as a separate expense from material or processing costs.

- On the P/L, they are indirectly deducted from total manufacturing expenses using transfer to other accounts.

Prototypes of products are deducted from cost of goods sold.

- Cost of Goods Sold = Beginning Products + Current Period Manufacturing Cost - Ending Products

- Items that should have become ending products but didn’t are transferred from cost of goods sold to SG&A.

Transfer to other accounts indirectly transfers work-in-process (or manufacturing expenses like material/processing costs) to other accounts without directly reducing them when material defects or work-in-process defects occur (similar to depreciation or bad debt provisions).

Deduction means “subtracting the over-recorded portion of manufacturing costs or cost of goods sold.” Using Transfer to Other Accounts (WIP) deducts from manufacturing costs, while Transfer to Other Accounts (Finished Goods) deducts from cost of goods sold.

Transfer to Other Accounts WIP deducts from manufacturing costs, Transfer to Other Accounts F/G deducts from SG&A.

- Allowance for Doubtful Accounts and Accumulated Depreciation are negative asset contra accounts (liabilities), expensing the used portion monthly like supplies.

Indirectly reducing assets allows tracking the net amount on the B/S while maintaining the fixed asset acquisition cost.- (Debit) Depreciation Expense (Credit) Accumulated Depreciation (Liability Account)

- (Debit) Bad Debt Expense (Credit) Allowance for Doubtful Accounts (Liability Account)

- Input costs are recorded as negative expenses (R/M Cost Credit), indirectly transferred to manufacturing output assets (F/G), and expensed as positives (COGS) upon sale, with the remainder as ending product assets (the crux of accounting and costing).

- Production results pair input and manufacturing entries:

- Input Results

- (Debit) Direct R/M Cost (Credit) R/M

- Manufacturing Results

- (Debit) F/G (Credit) R/M Cost Credit

- (Credit) Direct Labor Cost Credit

- Labor Cost Confirmation

- (Debit) Direct Labor Cost (Credit) A/P

- Sale

- (Debit) COGS (Credit) F/G

- (Debit) A/R (Credit) Sales

Expense contra (negative expenses) is included in products (F/G), expensed as COGS upon sale, correctly calculating current period Profit.

- Closing Process

- Sales - COGS = Profit

- Input Results

- Transferring Beginning Inventory (Opening Stock) to positive expenses and Ending Inventory (Closing Stock) to negative expenses deducts the portion remaining in ending inventory from the full amount expensed at purchase, finalizing profit/loss (the crux of accounting and costing).

- When recording monthly purchases as expenses (debit), at month-end, the P/L contra account Opening Stock (debit) eliminates beginning inventory, replaced by Closing Stock (credit) for ending inventory, synchronizing inventory with accounting and creating the B/S.

- Using expense contra accounts Opening Stock and Closing Stock calculates Total Revenue - Total Expenses = Gross Profit, but completing the P/L requires COGS, so the difference “Opening Stock + COGM - Closing Stock” is transferred to COGS.

- Rearranging expenses within total expenses using transfer to other accounts contra merely reallocates defective costs within manufacturing costs or removes them from cost of goods sold.

- Inventory shrinkage in the material warehouse is transferred to SG&A via Transfer to Other Accounts (WIP), input losses or defective costs in the manufacturing process are transferred within manufacturing costs via Transfer to Other Accounts (WIP), and prototypes in the product warehouse are transferred to SG&A via Transfer to Other Accounts (F/G).

-

-

Deducting from Manufacturing Costs or Cost Of Goods Sold via Inter-Account Transfer

When defective materials or spoilage (spoilage after becoming work-in-progress) occur, rather than directly reducing work-in-progress (or manufacturing costs like material costs or processing costs), transferring them indirectly to other accounts through inter-account transfers is the same as with depreciation or allowance for doubtful accounts.

続きを見る

Data Discrepancies Common at Month-End in Indonesian Business Systems

Examples of A/P and A/R balances not matching G/L account balances:

- B/S A/R beginning balance not matching the previous month-end A/R Aging balance due to direct A/R entries (Credit Note/Debit Note) from G/L.

- Monthly A/R list not matching G/L Sales because some A/R is processed as Down Payments, with Sales not yet recorded. Down Payments are transferred to Sales based on progress.

- Inability to segment A/R and A/P by department at recognition, preventing inter-departmental profit/loss management in accounting.

- Post-closing G/L data adjustments (discounts, tax, forex) causing discrepancies between the monthly A/R list total and G/L current month A/R total.

- Since forex revaluation targets current A/R balances, entering current month settlements before completing last month’s revaluation results in revaluing an incorrect G/L balance (e.g., A/R previous month-end balance is 100, but G/L revalues 98), generating erroneous unrealized forex gain/loss entries.

- G/L A/R lacks department codes, preventing comparison with A/R department-wise totals.

B/S accounts, not subject to profit/loss management, may lack department codes or use a representative department in G/L.

For G/L department-wise aggregation, inherit the sales department from order registration to A/R, or input it at A/R recognition, carrying department codes to A/R settlement and G/L, and carrying forward department- and currency-specific balances to the next month’s beginning balance.

-

-

Data Discrepancies Prone to Occur at Month-End in Indonesian Business Systems

At Japanese manufacturing companies in Indonesia, data discrepancies arising during the operation of business systems are typically mismatches between accounts receivable/payable balances and general ledger (GL) balances, discrepancies between accounts receivable listings and sales, or issues related to functional integration within the business system.

続きを見る

Relationship Between Corporate Accounting Retained Earnings and International Balance of Payments Financial Account

■ Cutoff

To reset and restart a system while carrying over past data, complete all unshipped (unreceived) sales/purchase data, reset inventory impact factors, issue all inventory data to empty it, then re-enter the previous period-end physical inventory balance.

In accounting systems, monthly profits are displayed as Net Profit on the B/S for balancing, but at year-end closing, accumulated Profit is automatically transferred to Retained Earnings.

■ Four Patterns for Mid-Period Cutoff in Accounting Systems

- Method to output annual monthly A/P, A/R aging, and monthly P/L and B/S transitions

- Period Start: Import Trial Balance T/B residuals, A/P, A/R balances

- Monthly: Import G/L and A/P, A/R occurrences; input A/P, A/R settlements; perform closing

- Method to output annual monthly P/L and B/S transitions

- Period Start: Import Trial Balance T/B residuals

- Monthly: Import G/L and A/P, A/R occurrences; clear A/P, A/R settlements from prior months via G/L; input A/P, A/R settlements from current period; perform closing

- Method to track annual profit and monthly P/L and B/S transitions from the current month onward (prior months as balances only)

- Current Month: Input all previous month-end Trial Balance T/B accounts via transfer vouchers

- Method to track profits and monthly P/L and B/S transitions from the current month onward only

- Input only B/S accounts from Trial Balance T/B via transfer vouchers, balancing the difference with Retained Earnings.

■ Tasks When Changing the System’s Functional Currency

- Prepare a rupiah-based system environment and database

- Migrate masters

- Investigate impacts on existing forms and vouchers

- Prepare beginning balances in rupiah (A/P, A/R required per invoice for settlement)

- Perform initial closing in rupiah

-

-

The Relationship Between Retained Earnings in Corporate Accounting and the Financial Account in the Balance of Payments

Transferring the current period's profit to retained earnings for profit appropriation means resetting the P/L account balances to zero. The system cutoff, to avoid the burden of transferring P/L account balances like depreciation expenses, is typically performed at fiscal year-end.

続きを見る

Systemization and Manualization Both Aim for Process Improvement

Four methods for handling inventory differences:

- Expense Recognition

(Debit) Expense (Credit) Work In Process - Temporary Account Retreat

(Debit) Temporary Account (Credit) Work In Process - Offset by Increasing Fixed Asset Valuation

(Debit) Fixed Asset Valuation Increase (Credit) Work In Process - Offset with Retained Earnings or Legal Reserve

(Debit) Retained Earnings (Credit) Work In Process

■ If input omissions occur due to defects, correcting manufacturing results becomes “Defective Cost/Work In Process,” incorporated into manufacturing costs as “Manufacturing Cost = Beginning WIP + (Current Month Expenses + Defective Cost) - (Ending WIP - Additional Difference),” compressing gross profit (Sales - COGS). Both Systemization and Manualization Aim for Operational Improvement. Recording month-end inventory discrepancies as spoilage costs and including them in manufacturing costs reduces gross profit. Recording them as inventory shrinkage costs in cost of goods sold (COGS) also reduces gross profit, while recording them as extraordinary losses under non-operating expenses reduces operating profit. 続きを見る

■ When incorporated into COGS as defective costs via month-end adjusting entries, “COGS = Beginning Products + Manufacturing Cost - (Ending Products - Additional Difference),” compressing gross profit (Sales - COGS).

■ When recorded as extraordinary losses under non-operating expenses, “Operating Profit = Gross Profit - Additional Difference,” compressing operating profit. Ultimately, recording anywhere compresses some form of profit.

U.S. President Nixon proposed “honorable withdrawal” as a slogan for ending the Vietnam War. If a system meant to ease work exhausts on-site operators, “manualization of the system” might boost morale and efficiency in some cases.

Why Understanding Operations Remains Necessary Even When Promoting DX in Indonesia

IT automation enhances accuracy and efficiency, but conceiving complex ideas or innovations requires a systematic understanding of operations ingrained in one’s mind. Reasons for Believing That Understanding Operations Is Necessary Even When Promoting DX in Indonesia Regarding the concern, “Does advancing IT eliminate the need to spend time understanding the essence of operations?” I would answer that understanding operational mechanisms is beneficial because it enables one to imagine how the world works. If you understand bookkeeping, you can envision the movement of goods, amounts, and cash, as well as the mechanisms of company management. 続きを見る

Similar to the debate over whether English learning becomes obsolete with real-time translators, while translators handle on-the-spot reading/writing, ideas generated within the Japanese-English conversion framework are limited.

No matter how much can be searched in this era, there’s a difference in thinking depth between internalized knowledge and none. Knowledge not instantly recallable in necessary moments is as good as unknown.

Knowledge memorized as dots in the mind serves as hooks, connecting to new knowledge or experiences, forming lines that become a cultured understanding of operations.

Revenue and Process Improvement Toward Post-COVID in Indonesia

In accounting, “creating cash with profit and depreciation” means cash sources are profits and depreciation. Depreciation is an expense without cash outflow, a numerical game where actual cash exceeds P/L profit by the depreciation amount. Physically, it doesn’t generate cash; rather, deducting depreciation from profit reduces taxable income by that amount, lowering tax burden = increasing cash. Improving Profitability and Operations for the Factory in Indonesia We examine ways to improve profitability from an accounting perspective and a supply chain perspective, and consider ways to improve business operations with IT infrastructure. If we try to change the way we work to improve business efficiency, we need to change the flow and structure of business data, and systematization is inevitable. 続きを見る

During the 2020-2021 COVID-19 pandemic, lower operating rates caused fixed costs like labor and equipment to heavily burden the cost of low-output products, raising costs and squeezing revenue. Fundamental solutions include just-in-time production (starting manufacturing upon material arrival and shipping upon completion), multi-skilling, and externalizing internal setup processes.

Assets as Debit and Liabilities as Credit Concept

Debit is your money, credit is borrowed money. Based on the payment source, debit is assets (debit side), and credit is liabilities (credit side).

Amount adjustments without receipts/issuances are handled with Debit Notes (DN)/Credit Notes (CN).

- Overpayment claims are issued to the counterparty via Debit Note (some companies call invoices Debit Notes).

“Debit Noteで請求させていただきます。” (We will bill via Debit Note.) - Over-received payment obligations are communicated to the counterparty via Credit Note, indicating it’s okay to claim.

A photo credit (credit side) clarifies “this photo isn’t mine but borrowed” (incurring a liability). A software license reduction (asset decrease) is a credit. The Concept That Assets Are Debits and Liabilities Are Credits When considering the source of payment, a debit represents an asset (debit side), while a credit represents a liability (credit side). A debit can also be seen as the right to claim, and a credit as the obligation to be claimed, implying that it grants the other party the right to issue a debit note. 続きを見る

Paid and Free Provision to Subcontractors in Indonesia

In dropshipping-like direct supplier shipments, “receipt results + purchase registration + shipment results + sales registration” are executed together upon receipt. Returns from customers require both sales returns and purchase returns. If only sales returns are processed, inventory remains in the virtual direct shipment warehouse, which should have no balance. Paid Supply and Free Supply to Subcontractors in Indonesia Paid supply involves selling materials to a subcontractor and purchasing the processed work-in-progress (WIP) afterward, whereas free supply involves issuing a purchase order (P/O) for subcontracted WIP, recording material allocation and issuance based on issuance instructions, logging usage performance of supplied materials at the subcontractor, and recording the receipt performance of the WIP. 続きを見る

Free provision is a material movement without entries. Paid provision sells materials to subcontractors and buys back products, but to avoid double-counting Sales (round-trip slap), Sales aren’t recorded to subcontractors; material negatives are recorded as receivables (assets).

In paid provision, materials provided to subcontractors become their assets upon sale. When buying back processed products at “material cost + processing fee,” receivables are transferred to subcontracting costs.

Paid provision mirrors regular sales transactions, differing from direct supplier shipments in whether subcontractors order materials or customers order products, from an entry perspective.

Development of Attendance and Payroll Systems in Indonesia

In Indonesia, the mainstream method involves stamping a time card (kartu absensi) with a “gatchan” (called “absen”) to record entry/exit times. Some devices simultaneously write data to internal memory, extractable via USB in CSV format. Development of Attendance Management and Payroll System in Indonesia In developing an attendance management and payroll system in Indonesia, it is necessary to calculate and deduct individual income tax (PPh21) and health insurance (BPJS) from the total payment amount, which consists of basic salary and allowances. 続きを見る

In Indonesia, weekday overtime is 1.5x or 2x base pay, and holiday overtime is 2x, 3x, or 4x, creating a staggering burden. Even with increased orders and busyness, profits don’t rise, and the break-even point keeps escaping despite pursuit. I’ve heard cases of being busy without profitability.