Difference between physical inventory quantity and theoretical value

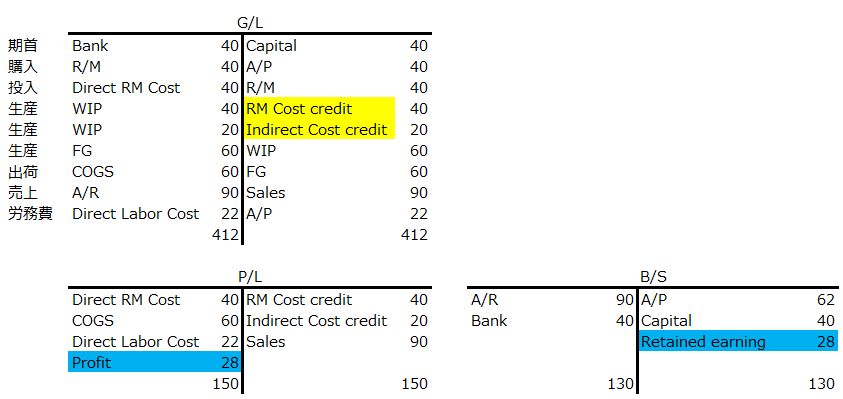

In a so-called continuous method system that generates accounting journal entries by receiving and paying for inventory, inventory is added when materials or parts are purchased or work in progress or products are recorded, and inventory is minus when materials or work in progress are put in or products are shipped.

- Dr. Material 40 Cr.A/P 40

In this case, the inventory valuation and the accounting inventory balance are synchronized in real time, so you can see the progress of the income statement (P/L) and balance sheet (B/S) during the month.

In this type of system, the unit cost of materials is updated in real time using the moving average method, and for other processing costs, the standard unit cost is usually set in the bill of materials (BOM).

In this case, the cost of materials can be recorded as a negative expense in the contra account (in this case, the R/M Cost Credit account) for the payment of materials, allowing a breakdown of production costs on the P/L without directly offsetting the material cost account balance.

- Dr. Direct material cost 40 Cr. Material 40

- Dr. WIP(Direct material)40 Cr. R/M Cost Credit 40

At the time of production volume accounting, the processing cost is calculated from the standard unit price of the BOM, and once recorded as a minus expense in the contra account (in this case, the indirect cost credit account), the breakdown of the production cost can be stated as a processing cost on the P/L.

- Dr. WIP(FOH)20 Cr. Indirect Cost Credit 20

- Dr. FG 60 Cr. WIP(Direct material+FOH)60

Finally, the product is shipped and becomes cost of sales.

- Dr. COGS 60 Cr. FG 60

- Dr. A/R 90 Cr. Sales 90

Since the cost of sales includes processing costs, the difference is adjusted when the actual amount of processing costs is determined.

The method in which the difference between the work-in-progress output and the amount of material input is recorded as a processing cost is called the scheduled allocation of actual costing to realize speed accounting. In other words, if the actual input is wrong, not only the inventory quantity but also the accounting figures will be wrong.

Usually, the mistake is often found at the time of physical stocktaking, and the correct way to deal with it is to correct the production performance during the month after the end of the month's stocktaking. However, in general, the lot of production performance recorded by mistake is already consumed in the post-process, and if the lead time is short, it may be already shipped or invoiced.

However, in the normal system, when a shipment or invoice is cancelled, the invoice number or shipping slip number is newly assigned to the customer or customer's document management as a result of the cancellation.

The impact on accounting when adjusting for shelf differences in inventory management

If the physical inventory quantity is less than the theoretical value, this difference can be expensed or capitalized.

If the difference between the shelves is caused by the input failure of NG, it should be included in the cost of production as spoilage fee and the original gross profit (gross profit) will be smaller than the actual gross profit.

- Gross written-off price = increase in janitorial activity at the beginning of the month (difference in current month's manufacturing price) - increase in depreciation at the end of the month

- Gross profit = gross sales-earnings

When entering into cost of sales as inventory consumables in the month-end adjustment journalization

- Gross operating price = high janitorial value at the beginning of the month + current month manufacturing price - (high disposals - difference at the end of the month)

- Gross profit = sales - cost of sales

Recording of extraordinary losses as non-operating expenses

- Cost of sales = Cost of sales carried forward at the beginning of the month + Cost of production in the current month - Inventory at the end of the month

- Gross profit = sales - cost of sales

- Operating income = Gross profit - Difference

In the end, no matter where it is recorded, some cost will be recorded and profits will be compressed, and I don't think it is an argument that the system where production receipts and payments are directly related to the accounting is different from the actual profit structure of the company.

I think that the problem should be "the fact that the delivery to the customer is done without any problem despite the fact that the input of the results is not enough". I think that we should pursue the factors that create the gap between the shelves, such as the fact that the system does not reflect the amount manufactured by red slips, or the fact that only good products are inputted despite the large number of defective products.

Systemization isn't always right.

If a business system is to be introduced in an Indonesian factory, we think the most practical system would be one in which only the quantity is managed in the production control receipts and disbursements, the inventory valuation is calculated in batches at the end of the month after inventory adjustment in the system, and the cost of production and cost of sales are calculated using the periodic method.

In this case, the following data interfaces are required between production control, cost control and accounting

- Interface to accounting for receivables A/R and debts A/P of the production management system

- Interface the fixed costs of the accounting system to the cost management system

- Interface to the accounting system as a journalization of cost control system calculation results

However, you don't necessarily have to build the interface in the system, but you can do it with manual or double input.

Even if the interface is systemized, it is still the work of human beings to check and correct the data in order from upstream to downstream.

Accounting is definitely more efficient when it is systemized, but production management is not necessarily more efficient when it is systemized. The people who work on the system are like, "I'm done saying that," but in Indonesia, I feel this is especially true.

In the past I thought it was a good idea to introduce a system directly related to inventory receipt and payment and accounting work can be manualized as follows, but I think this is how to deal with the case where the processing is complicated by the systemization, and the basis of the output figures can no longer be traced by humans.

1. Purchase materials are managed by the moving average unit price of the system as before.

- Dr. RM Cr. A/P

2. Management of material payout quantities in Excel

No journalization.

3. Management of work-in-progress production volume in Excel

No journalization.

4. Product manufacturing results are managed by the system and product inventory valuation is managed by the system's standard unit price.

- Dr. FG Cr. COGS

5. Material quantity and amount are debited from the system at the moving average unit price of the system based on the actual shelf.

- Dr. COGS Cr. R/M

6. The valuation of inventory of work in progress is determined by the standard unit price of Excel based on the actual shelf and an accounting journal is made.

-

- Dr. WIP Cr. COGS

U.S. President Nixon's "honorable withdrawal" as a slogan to end the Vietnam War was supported by troops and public opinion on the front lines, where prolonged war and pessimism were rampant.

In some cases, "manualization of the system" may improve morale and work efficiency in the field, if the field operators are exhausted by a system that is supposed to make their work easier.