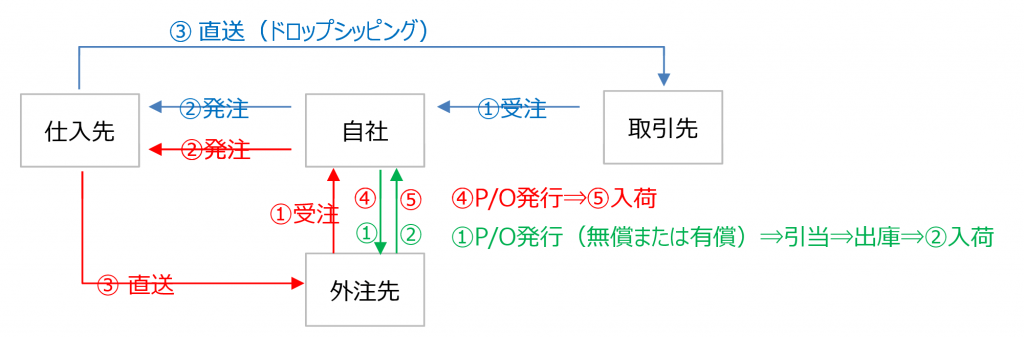

Paid supply involves selling materials to a subcontractor and purchasing the processed work-in-progress (WIP) afterward, whereas free supply involves issuing a purchase order (P/O) for subcontracted WIP, recording material allocation and issuance based on issuance instructions, logging usage performance of supplied materials at the subcontractor, and recording the receipt performance of the WIP. Accounting System in Indonesia The cloudification of accounting systems is advancing in Indonesia, with the three major local cloud systemsAccurate, Zahir, and Jurnalleading the market. However, in reality, it is said that fewer than 8% of domestic companies have implemented accounting systems. This is why new cloud-based accounting systems continue to be launched in what might seem like an already saturated Indonesian market. It suggests that both domestic and international IT startups see significant potential for cloud accounting systems to expand their market share locally. In Indonesia, automated journal entries due to the widespread use of accounting systems have become commonplace, and over the ... 続きを見る

Dropshipping and Direct Supplier Shipping

From 2001 to 2007, while running a furniture export business in Bali, I frequently received inquiries from people in Japan looking to start an online business:

Back then, I felt repulsed by the idea of opening an online shop with zero risk and no inventory, but now dropshipping has matured into a solid affiliate business model.

In business systems, dropshipping corresponds to the direct supplier shipping function. Registering an order from Customer A automatically generates a purchase order to Supplier B, with receipt performance recorded at Customer A’s location, not the company’s warehouse.

Imagine a scenario where Japan HQ receives an order from its U.S. branch, Japan HQ places an order with the Indonesia factory, and the Indonesia factory ships directly to the U.S. branch—a trilateral transaction makes it easier to understand.

In an ERP system where order management and accounting are integrated, registering a direct supplier shipment after order and purchase registration triggers:

- Receipt

- Purchase (Materials/Payables)

- Shipment

- Sales (Receivables/Materials)

These four processes are executed together. If a return occurs from the customer, you must perform:

- Sales Return

- Purchase Return

If only a sales return is processed, inventory remains in the virtual warehouse for direct shipping, which should have no residual stock.

Supplying from Your Own Warehouse

The process flow for paid supply and free supply is the same, but the P/O price issued to the subcontractor includes material costs + processing fees for paid supply, and only processing fees for free supply.

For revenue recognition in paid supply, upon receiving a material order from the subcontractor, a purchase order for materials is registered with the supplier. The materials may either arrive at your warehouse or be shipped directly to the subcontractor.

- Order for materials from the subcontractor (for paid supply)

- Purchase order for materials to the supplier

When materials arrive at your warehouse, the flow—issuing a subcontract P/O, reserving materials and issuing them to the subcontractor, and recording receipt after processing—is identical for both paid and free supply:

- Your company issues a subcontract purchase order (P/O) to the subcontractor

- Reserve materials in your warehouse

- Issue material issuance instructions to the subcontractor

- Record material issuance performance to the subcontractor

- Record usage performance of supplied materials at the subcontractor

- Record receipt performance of subcontracted WIP from the subcontractor

From a receipt-and-issue perspective, the difference between in-house production and subcontracting is:

- In-house: Input performance ⇒ Production performance

- Subcontracting: Supply performance ⇒ (Input performance ⇒) Purchase performance

Paid Supply

In Indonesia, free supply often leads to vague revenue management, so tax authorities require paid supply with a profit margin.

However, with paid supply, you must avoid double-counting sales (a “double slap”)—recording sales when supplying materials and again when selling the processed product to the customer.

- Sale of materials to the subcontractor

(Debit) A/R 120 (Credit) Sales 120 - Sale of product to the customer

(Debit) A/R 200 (Credit) Sales 200

Sales get double-counted.

Thus, at the supply stage (material sale), record it as accrued revenue (receivables) rather than Sales (revenue plus), deducting materials. When buying back the processed item, transfer the accrued revenue to subcontracting costs:

- Material purchase

(Debit) Materials 100 (Credit) A/P 100 - Sale of materials to the subcontractor (your profit: 20)

(Debit) Accrued Revenue 120 (Credit) Materials 100

(Credit) Material Supply Gain 20 - Subcontracting completed (subcontractor’s profit: 50)

(Debit) Subcontracting Costs 170 (Credit) A/P 50

(Credit) Accrued Revenue 120 - Sale of product to the customer (your profit: 30)

(Debit) A/R 200 (Credit) Sales 200

Free Supply

Subcontracting like plating or pressing is a service purchase (toll processing), and a subcontract purchase order (P/O) is issued to the subcontractor for the service:

- Material purchase

(Debit) Materials 100 (Credit) A/P 100 - Material handover to the subcontractor

No journal entry - Subcontracting completed (subcontractor’s profit: 50)

(Debit) Subcontracting Costs 50 (Credit) A/P 50 - Sale of product to the customer (your profit: 50)

(Debit) A/R 200 (Credit) Sales 200