Transferring the current period's profit to retained earnings for profit appropriation means resetting the P/L account balances to zero. The system cutoff, to avoid the burden of transferring P/L account balances like depreciation expenses, is typically performed at fiscal year-end. Accounting System in Indonesia The cloudification of accounting systems is advancing in Indonesia, with the three major local cloud systemsAccurate, Zahir, and Jurnalleading the market. However, in reality, it is said that fewer than 8% of domestic companies have implemented accounting systems. This is why new cloud-based accounting systems continue to be launched in what might seem like an already saturated Indonesian market. It suggests that both domestic and international IT startups see significant potential for cloud accounting systems to expand their market share locally. In Indonesia, automated journal entries due to the widespread use of accounting systems have become commonplace, and over the ... 続きを見る

Handling Retained Earnings When Cutting Off Retroactively to the Beginning of the Period

Resetting a system and restarting it involves a process called cutoff to carry over past data. If this occurs at the start of the fiscal year, the sales, purchasing, and inventory systems can begin operation by promptly completing the following steps:

- Complete all unshipped (or unreceived) sales and purchasing data to reset factors affecting inventory.

- Issue all inventory data to reset it.

- Record the previous period-end inventory balance as an inbound entry.

For accounting processes, the worst-case scenario is meeting the month-end deadline, so:

- Complete all unsettled accounts receivable and payable data to reset factors affecting accounting.

- Reset the trial balance (T/B) balances using offsetting journal entries via transfer vouchers.

- Enter the previous period-end T/B balance sheet (B/S) accounts via transfer vouchers.

At this point, memo balance data can be set as needed, but since it’s cumbersome, it’s preferable to input sales/purchasing (or A/R and A/P) simultaneously with shipping/receiving (or settlement) timing. For now, focus on improving the accuracy of inventory and accounting data. In this case, the sales list and AR aging list will start aligning with data from the following month onward.

Even if the cutoff occurs mid-period, by entering the previous month-end T/B balance sheet (B/S) accounts via transfer vouchers and starting transaction entries from the current month, the system will automatically transfer cumulative profit to retained earnings during the year-end closing process.

Since the previous month-end retained earnings (a net asset account) already includes year-to-date (from period start to today) cumulative profit, the profit and loss (P/L) accounts only manage totals from this month to period-end. For example, the full-year cumulative transportation expenses won’t be visible.

To track P/L account totals for the full year, you’d need to input year-to-date P/L totals in addition to the previous month-end B/S balances. However, this requires deducting the year-to-date cumulative profit already included in retained earnings to balance it.

- Enter the cumulative P/L account totals from the period start to the previous month via transfer vouchers (this won’t balance).

- Enter the previous month-end T/B B/S accounts via transfer vouchers, but deduct the cumulative profit from retained earnings.

Furthermore, if a “by month for year” (monthly annual transition table) for P/L and B/S is needed, you’d have to input the month-end T/B balances via transfer vouchers and perform closing repeatedly for year-to-date. Normally, no one goes this far, though.

Corporate Accounting and Balance of Payments

Corporate accounting and balance of payments both use double-entry bookkeeping with the same principles, but they differ in that the latter reverses debit and credit presentation, distinguished by the term “double counting.”

Like a cash flow statement, it involves retrieving the offset account amounts from G/L based on cash flow codes, reversing the debit and credit display.

In corporate accounting, P/L is viewed from the perspective of profit/loss (asset movement), while the cash flow statement is viewed from the perspective of receipts and payments (cash movement). For example, when sales (revenue) are fully received in cash, the journal entry is:

- (Debit) Cash 100 (Credit) Sales 100

P/L and B/S are asset-based, with a standard rule that assets are written on the right and revenues on the left. This cash movement entry is reflected in the cash flow statement.

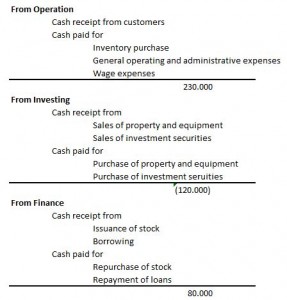

In the direct method, based on cash flow codes from the G/L (or journal entry table, usually the same), cash and deposit account offsets are applied to the details of inflows and outflows for operating, investing, and financing activities.

The indirect method, on the other hand, constructs the operating activities section to show how much of the profit/loss recorded on the P/L resulted in cash inflows/outflows. For investing and financing activities, since the offsets for liabilities, capital, and assets are typically cash/deposits, it matches the direct method’s cash flow statement.

Similarly, balance of payments entries follow the same logic as corporate accounting, calculated like a cash flow statement from the G/L cash/deposit account perspective.

- (Debit) Cash (Increase in Financial Assets) (Credit) Export (Revenue) Conventionally written with reversed debit/credit

- (Credit) Export (Revenue) (Debit) Cash (Increase in Financial Assets)

- (Debit) Import (Expenditure) (Credit) Cash (Decrease in Financial Assets) Conventionally written with reversed debit/credit

- (Credit) Cash (Decrease in Financial Assets) (Debit) Import (Expenditure)

A positive current account balance (trade and services) always corresponds to a positive financial account balance. Since the financial account’s debits and credits are nearly equal, the following equation roughly holds. A current account surplus means a financial account deficit, but a financial account deficit indicates a large amount of overseas assets.

- Current Account – Financial Account = 0

Just as current period profit (value added generated this period) is incorporated into retained earnings, the current account (value added from trade or overseas investment) converges into the financial account.

For a central bank (Bank Indonesia, BI) with a current account deficit and low foreign currency reserves, defending the exchange rate might involve high interest rates (e.g., 7.5% as of May 2015) to attract foreign capital inflows. However, the government prefers lower rates to stimulate the domestic economy.

While we’ve grown accustomed to 1 USD = Rp13,000, the rupiah’s psychological defense line has retreated from Rp9,000 → Rp10,000 → Rp12,000.

The root cause is the current account deficit—or more precisely, the inability to generate sufficient value added domestically to meet internal demand. With exports centered on primary commodities (natural rubber, palm oil), the value added is small, and as market-driven goods, they’re heavily impacted by the economic demand of export destinations.

Given Indonesia’s growth engine of domestic demand, creating value added domestically to satisfy it, reducing imports, and preventing financial asset outflows is the classic path to economic growth for developing nations.

Japanese manufacturing firms can play a significant role in improving the current account and boosting domestic investment, potentially contributing enough to raise Indonesia’s GDP.

When domestic economic conditions improve, as they have recently, import pressure increases, and the current account turns negative—unavoidable. However, with a thin domestic financial market and high interest rates weakening private borrowing demand, reliance on foreign capital persists. Without addressing this pattern, public investment from the government will keep growing, skewing capital distribution.

Yet, it’s puzzling that regulations hindering foreign capital inflows emerge despite this. Attention is on whether the much-discussed corporate tax cut from 25% to 18% will actually happen.