Why accounting systems are said to be more mission critical than production management systems

In the last two months, we have seen an increasing number of cases of Japanese companies in Indonesia where the server of their core system was infected with a ransomware called WannaCry and could not be accessed, so they had to format their hard disks and restore the DB backups to restore it.

If you want to decrypt the hard disk of the encrypted server, send $US300 to the designated bitcoin address (approximately 0.1 BTC). This $US300 is close to the estimated cost of having the infected PC formatted by the system company to recover the backup data, and depending on the urgency and importance of the data, you might send it in bitcoin.

When I was working on the restoration of the production management system's server that was infected by WannaCry the other day, I was impressed that the president of the company said, "It's a blessing in disguise that it wasn't the accounting system's server that was infected," but only a week later, it developed into a laughable case where the accounting system's server was infected by WannaCry.

Once the accounting system is paralyzed, it will not be able to produce the original data documents to produce P/L and B/S for the previous month to be submitted to the accounting consulting company, and as a result, it will not be able to make tax reports, which is the biggest concern of running a business in Indonesia.

Of course, it will be impossible to create financial and management documents for the Japanese head office, and the size of the damage the current law will cause to the company's image both externally and internally will be immeasurable, so I think it's a natural feeling that it's fortunate that it wasn't the accounting system's server that was infected.

In the case of the production management system, even if the worst case is that the system is infected by WannaCry and stops for two to three weeks, as long as you keep the inventory of raw materials and products at the site with a margin, even if there is a slight delay in preparation of delivery notes and other slips, it will not develop into a situation that delays the shipment of the actual product.

- Production control system down

Even though there is a risk of disrupting day-to-day operations, it is possible to make an effort not to stop the operations themselves by using Excel to handle them outside the system. - Accounting system down.

As long as the correct figures are ready at the end of the month, even if daily operations during the month are interrupted due to a system failure, there is no problem if they are entered after the fact.

The point is that in terms of corporate management, the priority of business systems :

- Accounting System > Production Management System

It is unavoidable that this is the case.

What is a production management system and an accounting system that work together?

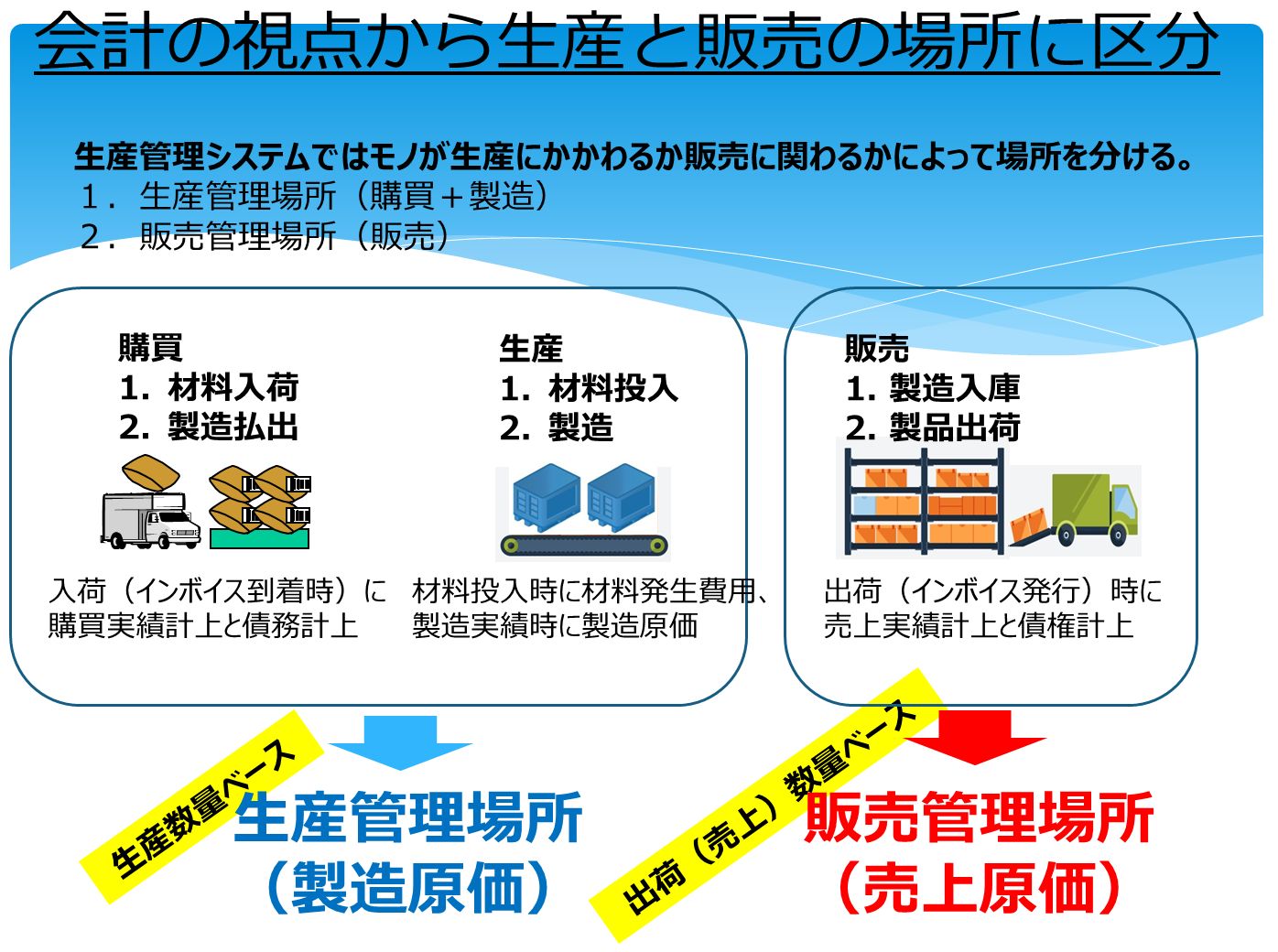

The production management system covers purchasing management, production management, and sales management, and when the purchase results are entered into purchasing management and sales results are entered into sales management, receivables and payables data is generated in the accounting system or automatically transcribed into the ledger (posting).

The fact that production control and accounting are interlocked means that the actual payment of inventory in the production control system generates an accounting journal, automatically updates the ledger balance of asset items, and the valuation amount for the quantity in inventory control is synchronized with the asset item balance in accounting.

The merit of this case is not only to maintain the consistency of the entire business system, but also to reduce the input load on the accounting system and to record the correct figures as long as the production control side input the correct results. On the other hand, if the wrong results are input, the wrong figures are also reflected in the accounting system.

The results of adjustments made to adjust the accounting figures will always remain in the production control side as a debt, so it is always necessary to adjust the balance in the following month or so, and as a result of repeatedly postponing the problem, we will have to deal with a large extraordinary loss at the end of the fiscal year.

Business systems are entered on an accrual basis

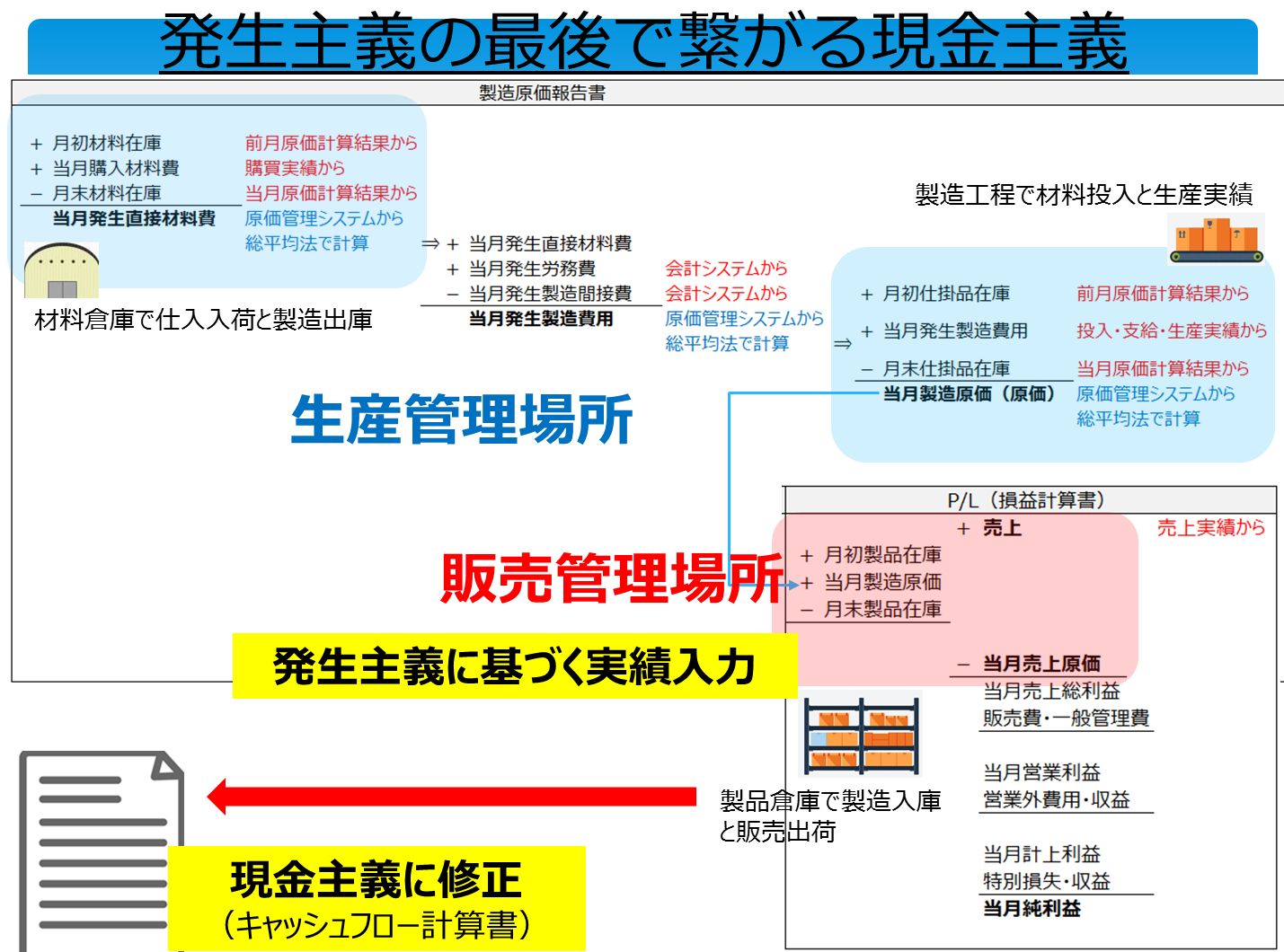

I don't think there is much point in linking the accounting system, which is OK as long as the correct T/B (trial balance) is completed at the end of the month, and the production management system, which supports the daily operations during the month of issuing slips based on performance input, with the production management system, but I think it is necessary to be aware of how and where things move in the two places, production management and sales management, to make them an expense in accounting.

In other words, when the inventory (goods) based on the actual input in the production control system is in the production control location, the outflow is an incurred expense and the inflow is recorded in the asset account as inventory in process, but when it is in the sales control location, the inflow is production cost and the outflow is recognized as cost of sales.

The ERP system links the inventory payment results to the current month's accruals in the accounting system and updates the inventory amount in real time using FIFO (first-in, first-out method) or moving average method, while the inventory at the end of the month is held down and the accruals are calculated by subtracting the purchases made at the beginning of the month and the current month.

Assuming this accrual-based performance input, cash flow management is a modification to the cash basis to figure out how much of the fresh water assets at hand, i.e., cash and deposits, are moving freely.

When a company makes a profit, it means that it is making a profit on a P/L basis.

- Accrued and unsettled expenses and income from receivables and payables

- Depreciation and amortization expenses

Cash flow statement provides management information to address the most recent settlement on a cash basis.