Attendance system

In Indonesia, the most common type of time card (kartu absensi) is the one that is stamped with the time of arrival and departure by pushing the time card (called "absen"), but there is also a type that data is written into the memory with a click and can be exported as a CSV file via USB.

However, many models have a small memory capacity of 2-4MB, so if you don't make sure to size up the daily attendance data required per person (how many bytes per record), the number of employees, the data storage period in the memory, and the amount of space required for the master in advance, the attendance data that you thought was left in the memory may be overwritten when a problem occurs after the start of operation.

There are three other methods used to prevent the use of substitute imprinting and reduce the workload of collecting attendance data: employee card, fingerprint authentication (finger print), and hand punch (hand punch), or a combination of the three (e.g., a set of employee card and fingerprint authentication).

Inexpensive fingerprint machines are available from about 30,000 yen, while hand vein authentication machines are more expensive at over 200,000 yen.

The more machines you purchase, the more you have to wait in line for, and the more machines you have to buy, the more money you have to spend.

Fingerprint and hand vein authentication are pre-registered to create a matching table with the employee code, which is then stored in the machine's memory.

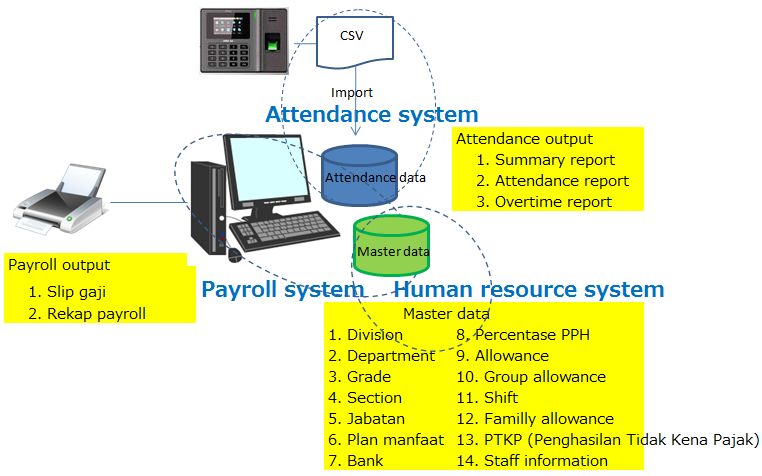

The attendance data is also stored in the machine's memory and is downloaded to the PC via the supplied utility software in CSV format or AccessDB. This is usually a manual process (data importing) and not automatic, so HRD personnel will periodically download the data.

The downloaded data will be categorized into absenteeism (absen), keterlambatan (keterlambatan), Ijin (Ijin), and overtime (overtime), etc., and then payroll will be calculated.

Overtime and leave requests are usually requested in advance (Overtime request, Leave request), and the amount is determined by comparing the information on the overtime request with the attendance data.

Human resource management system

In order to calculate payroll based on attendance data, a master data system is required to manage the data necessary for the calculation of allowances (such as employee's year of employment, position, address, family structure, etc.).

There is a system called HR Management System that can register non-essential data separately from the payroll system, but it is essentially inseparable from the payroll system.

Payroll system

Master data shown in the above figure is the master information required in Indonesian payroll system. These will be reflected in the payroll as numerical parameters such as tax rate, burden rate, and overtime coefficient, and the pay slips will be issued at the end of the month.

Incidentally, as of August 2013, as a result of repeated worker demonstrations, the coefficient for overtime pay has increased significantly.

Overtime on weekdays is now 1.5 or 2 times the basic hourly wage, and overtime on holidays is now 2, 3 or 4 times the basic hourly wage, so that even though orders are increasing and the company is busy, there is no profit at all. We often hear about

PPH21

In Indonesia, it is said that income tax is paid by the company in principle, but isn't it just a matter of withholding tax like in Japan, and then taking action at the time of hiring based on the after-tax net amount?

If you don't apply for Bukti potong PPH21 from your company at the end of March every year, it is considered that you haven't fulfilled your tax obligation.

By the way, although most of Indonesian companies' fiscal year is from January to December, they file their tax returns at the end of March like in Japan.

So, as mentioned above, employees bring the withholding tax certificate to the tax office at the end of March, and the financial statements and vouchers are checked by auditors in March.

Therefore, after the provisional closing at the end of December, as a result of the audit, an adjusting journal entry is made in the 13th month, which is a complicated process. At the end of December, we are busy with the closing process at the end of the year, so we will move it by three months so that you can finish the audit and do it calmly and accurately.

Jamsostek(Discontinued as of 2014)⇒BPJS

It's like social insurance in Indonesia, it's a set of worker's compensation insurance (JKK), death insurance (JKM), pension (JHT), and health insurance (JPK), and just like in Japan, full-time employees are required to have it. This was run by a state-owned company called Jamsostek.

The system is largely the same as that of social insurance for salaried employees in Japan (health insurance and welfare pension), and Jamsostek's contribution differs depending on the amount of salary and number of dependents.

By the way, there is no national health insurance (National Health Insurance) and national pension for self-employed people in Japan in Indonesia. However, tax obligations arise whether you are a company employee or self-employed, and you must obtain an NPWP (taxpayer identification number), including your spouse.

As of January 2015, it is recommended to join the BPJS Kesehatan (Badan Penyelenggara Jaminan Sosial), which replaces Jamsostek, which is a combination of pension (JHT) and health insurance (JPK).

Family Composition

The reason why the family composition information is required is that the amount of deductions (Penghasilan Tidak Kena Pajak) varies according to marital status, number of children, etc., in addition to the basic deductions from payroll calculation, the amount of deductions (Penghasilan Tidak Kena Pajak) depends on the number of children, etc. PTKP is the non-taxable portion of income, and the calculation of the monthly withholding tax (PPH21), and the amount of the taxable income. This has an impact on year-end adjustments and tax returns for the year.

Employee Information

This is general information such as education, religion, job title, years of service, etc., and the impact of this information on payroll depends on the company's policies. Some companies apply a rather tricky calculation method, so a certain amount of customization is often necessary when implementing a payroll system.

Allowance Master

This master sets up the THR (Tunjangan Hari Raya), which is the rebalance allowance, and the type of bonus and the coefficients needed to calculate it.

Salary Structure

The term Upah Minimum Propinsi (UMP) / Upah Minimum Kabupaten (UMK), in short, is the minimum wage that always appears during the season of worker demonstrations.

- Gaji pokok(basic salary)

- Tunjangan tetap(fixed allowance)

- Tunjangan transport(Transport allowance)

- Potongan transport(transport deduction)

- Potongan Absensi(Absence deduction)

- Uang makan(Meal allowance)

- Uang lembur(Overtime)

- Tunjangan lain lain(Others allowance)

- Potongan lain lain(Others deduction)

- Tunjangan pengobatan(Medical allowance)

- Tunjangan Asuransi(Insurance Insentive)

- Tunjangan Premi Jamsostek(Jamsostek premi allowance)

- Potongan premi Jamsostek(Charge of Jamsostek premi)

- Bonus(Bonus)

- Tunjangan Hari Raya.

- Tunjangan Pajak(Tax allowance)

- Potongan pajak(tax cuts)