The direct method calculates cash inflows and outflows and the cash/bank balance by aggregating the pluses and minuses of cash/bank transactions (gross presentation) on a per-transaction basis. Therefore, among unrealized foreign exchange gains and losses, the journal entries related to cash/bank foreign exchange gains and losses need to be adjusted. Accounting System in Indonesia The cloudification of accounting systems is advancing in Indonesia, with the three major local cloud systemsAccurate, Zahir, and Jurnalleading the market. However, in reality, it is said that fewer than 8% of domestic companies have implemented accounting systems. This is why new cloud-based accounting systems continue to be launched in what might seem like an already saturated Indonesian market. It suggests that both domestic and international IT startups see significant potential for cloud accounting systems to expand their market share locally. In Indonesia, automated journal entries due to the widespread use of accounting systems have become commonplace, and over the ... 続きを見る

Differences Between the Direct Method and Indirect Method from an Accounting System Perspective

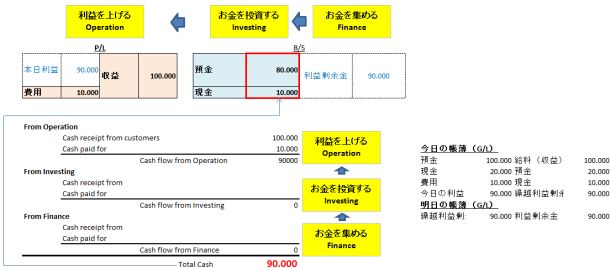

In companies using cash-basis accounting, profit and loss are recognized when cash moves, regardless of when the transaction occurs, so the P/L aligns with cash inflows and outflows.

However, most companies use accrual-basis accounting, where profit and loss are recognized when a transaction occurs, regardless of cash movement. This creates a discrepancy between the profit on the P/L and cash inflows/outflows at month-end, necessitating a separate Cash Flow Statement (C/F) to manage cash flows.

The "Cash Flow from Operating Activities" section of the C/F, under the direct method, calculates cash inflows/outflows and the cash/bank balance by aggregating the pluses and minuses of cash/bank (Cash/Bank) on a per-transaction basis (referred to as gross presentation).

In contrast, the indirect method starts with the accrual-basis net profit from operating activities (gross profit → operating profit → ordinary profit → net profit), adjusts for items not yet reflected as cash outflows or inflows, and converts it to a cash-basis figure to similarly calculate cash inflows/outflows and the cash/bank balance.

- (+) Receipts from A/R settlement ⇒ Add C/F code to A/R settlement entry

- (-) Payments for direct material costs ⇒ Add C/F code to direct material payment entry

- (-) Payments for manufacturing overhead ⇒ Add C/F code to indirect labor/expense payment entry

- (-) Payments for SG&A expenses ⇒ Add C/F code to SG&A payment entry

Indirect Method: Cash Flow from Operating Activities by calculating the pure cash/bank portion from Net Profit

- (+) Net Profit ⇒ Accrual-basis net profit for the period

- (+) Depreciation expense ⇒ Amount that reduced Net Profit on an accrual-basis P/L

- (-) Increase in A/R ⇒ Amount not yet received as Cash/Bank

- (+) Increase in A/P ⇒ Amount not yet paid as Cash/Bank

From an accounting system perspective, with the direct method, a cash flow code is assigned during the input of transactions involving cash/bank movements, and these are aggregated into the corresponding sections of the C/F.

With the indirect method, no cash flow code is required; it is generated from the account balances (subject balances).

Realized and Unrealized Gains/Losses in the Cash Flow Statement

When creating a C/F from an accounting system, the direct method aggregates transactions by cash flow code for each accounting month, while the indirect method aggregates the General Ledger (G/L) by accounting month, calculating the opening carryover and ending balance.

Regardless of the method used, if the foreign exchange revaluation of the cash/bank account balance at month-end is not adjusted on the C/F, the C/F balance will not match the actual cash/bank balance.

Foreign exchange gains and losses are broadly divided into two types:

- Realized foreign exchange gains/losses at settlement (Forex Gain-Realized)

⇒ Gains/losses related to receivables (A/R) and payables (A/P) are not included in the C/F (not cash/bank). - Unrealized foreign exchange gains/losses from month-end revaluation (Forex Gain-Unrealized)

⇒ All gains/losses related to cash/bank are included in the C/F (because it is cash/bank), but gains/losses related to A/R and A/P are not included (not cash/bank).

The issue with the indirect method is that when A/R and A/P include both operating activity-related and non-operating investment activity-related items, it becomes difficult to calculate the foreign exchange gains/losses to be presented on the C/F after adjusting the accrual-basis net profit on the P/L for cash/bank movements.

Direct Method Cash Flow Statement

The direct method Cash Flow Statement (C/F) is created based on the G/L. Roughly speaking, it is a vertical breakdown of the cash and bank accounts from the G/L, categorized into three sections by offsetting accounts.

Thus, when entering journal entries, it is necessary to select a cash flow code as an indicator of which section and subsection of the C/F the transaction should appear in.

Generally, the direct method C/F is considered more burdensome to prepare than the indirect method. However, when using an accounting system, it is actually easier to create compared to the indirect method.

That said, for analyzing the cash backing behind the net profit on the P/L, the indirect method C/F is more suitable.

The three sections represent the cash inflows and outflows from a company’s business activities: "raising money (B/S credit side)," "investing in something (B/S debit side)," and "generating profit (P/L)."

- Financing = Balance Sheet credit side (right side = in Europe, Creditor is the upper position)

Liabilities are the names of those who lend money - Investing = Balance Sheet debit side (left side = in Europe, Debtor is the lower position)

- Profit = Profit and Loss Statement

Cash refers to cash and cash equivalents, including cash, savings accounts, and checking accounts:

- How money was raised (Financing Activities = Finance)

- How money was invested (Investing Activities = Investing)

- How profit was generated (Operating Activities = Operation)

These explain how cash moved across the three company activities.

In the direct method, based on the cash flow codes in the journal entries, the offsets for cash/bank accounts were applied to the detailed IN and OUT sections of operating, investing, and financing activities. In the indirect method, the operating activities section is prepared to show how much of the profit/loss recorded on the P/L translated into cash inflows/outflows.

For the investing and financing activities sections, since the offsets for liabilities, equity, and assets are generally cash/bank, they remain the same as in the direct method Cash Flow Statement.

Ways to Increase Cash

It is almost never the case that transactions between Japanese companies in Indonesia are conducted solely in cash with zero receivables/payables balances.

In the indirect method Cash Flow Statement, unsettled receivables balances are adjusted as a negative to operating cash flow, and unsettled payables balances as a positive, from the accrual-basis net profit on the P/L.

A common saying in corporate accounting is that there are really only three ways to increase cash:

- Increase deductible expenses to reduce taxable income (tax savings).

- Shorten the payment terms for receivables from sales and delay the payment terms for payables from cost of sales.

- Increase non-operating cash inflows and reduce non-operating cash outflows.

Even though there are no bill transactions in intercompany dealings in Indonesia, when sales (revenue) are recognized on the P/L based on shipment, the period until receivables are recorded upon invoice arrival after inspection is treated as temporary receivables.

Thus, temporary receivables not yet recorded as receivables must also be adjusted as a negative to operating cash flow (similarly for temporary payables not yet recorded as payables).

- Shipment Date

(Debit) A/R Accrued 100 (Credit) Sales 100 - Invoice Arrival Date

(Debit) A/R 110 (Credit) A/R Accrued 100

(Credit) VAT Out-Payable 10

Tax Savings on Corporate Income Tax Through Depreciation

Since depreciation expenses included in manufacturing costs and SG&A expenses do not involve invoices, they are "expenses that do not involve cash outflows." This is why "depreciation affects cash flow." However, if the profit before tax is negative and taxable income is zero, depreciation cannot be used to save on corporate income tax.

In reality, recording depreciation expenses for fixed assets does not directly increase cash or recover funds. It might be more accurate to say that you’re simply pleased to realize the actual cash is higher than the net profit on the P/L by the amount of depreciation.

- January

Service sales generating 12 million yen in revenue- (Debit) Cash 1,200 (Credit) Sales 1,200

P/L shows a profit of 12 million yen.

C/F (Operating Section) shows a plus of 12 million yen. - February

Purchased a molding machine for 12 million yen in cash- (Debit) Machine 1,200 (Credit) Cash 1,200

No impact on P/L.

C/F (Investing Section) shows a minus of 12 million yen. - March

Recorded 100,000 yen in depreciation expense- (Debit) Depreciation 10 (Credit) Accumulated Depreciation 10

P/L shows a loss of 100,000 yen.

No impact on C/F (Operating Section).

Conversely, increasing non-deductible expenditures does not contribute to tax savings. Investing in land (real estate) without depreciation does not provide tax savings, but renting it out can generate rental income (income gain), or selling it years later at a higher value can produce non-operating cash gains (capital gain).