In 2013, customs mandated the introduction of an IT Inventory system for bonded factories to track the movement of quantities such as materials, work-in-progress, products, and scrap. However, starting in December 2019, it has also become mandatory to install an accounting system to report the connection between these quantity movements and their corresponding monetary values in accounting. Production Control System in Indonesia It’s not limited to Indonesia, but it’s often said that the ultimate goals of the manufacturing industry are twofold: "cost reduction through productivity improvement" and "delivering products on time without delays." From a management perspective, business plans are crafted to maximize growth based on market supply and demand adjustments. However, even if sales increase due to low pricing, it only reduces gross profit, leading to losses from selling and administrative expenses or non-operating costs. On the other hand, raising unit prices isn’t straightforward due to market price considerations. Therefore, process management based on production plans aimed at reducing costs through ... 続きを見る

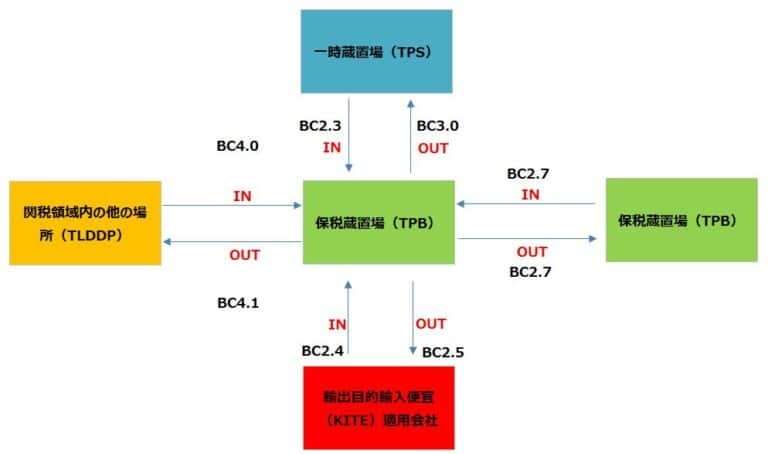

BC Forms Required for Entry and Exit at Bonded Storage Facilities (TPB)

Bonded status refers to "the temporary suspension of customs duty collection." In Indonesia, bonded zones are called Kawasan Berikat (KB or Kaber), while areas outside bonded zones are referred to as Daerah Pabean Indonesia Lainnya (DPIL).

However, to define a more specific location as "a structure, place, or area meeting specific requirements, used for storing goods for a particular purpose under a customs duty suspension," the concept of a Bonded Storage Facility (Tempat Penimbunan Berikat = TPB) within a bonded zone (KB) is used. Other locations within the customs territory not designated as TPB (i.e., areas subject to customs duties outside TPB) are called Tempat Lain Dalam Daerah Pabean (TLDDP).

At bonded storage facilities, tax reporting using the following BC forms is required for incoming and outgoing goods:

| BC Form | Description (Indonesian) | Description (Japanese) |

| BC2.0 | Pemberitahuan Impor Barang(PIB) | Import Declaration |

| BC3.0 | Pemberitahuan Ekspor Barang(PEB) | Export Declaration |

| BC1.0 | Rencana Kedatangan Sarana Pengangkut/Jadwal Kedatangan Sarana Pengangkut(RKSP/JKSP) | Arrival Schedule Notification: Information and arrival schedule of the transport vessel for scheduled cargo |

| BC1.1 | Pemberitahuan Inward Manifes/Outward Manifes | Inward/Outward Manifest Notification: |

| BC2.3 | Pemberitahuan Impor Barang Untuk Ditimbun Di Tempat Penimbunan Berikat(TPB)dari Tempat Penimbunan Sementara(TPS) | Bonded Transport Declaration: Import declaration for storage at a Bonded Storage Facility (a structure, place, or area meeting specific requirements, used for storing goods for a specific purpose under a customs duty suspension) from a Temporary Storage Facility (TPS, e.g., port) |

| BC2.4 | Pemberitahuan Ekspor Barang dari perusahaan penerima fasilitas KITE(KEMUDAHAN IMPORT TUJUAN EKSPOR)ke Tempat Penimbunan Berikat(TPB) | Export Declaration from a company benefiting from KITE (Ease of Import for Export Purposes) to a Bonded Storage Facility (export for the KITE beneficiary company). |

| BC2.5 | Pemberitahuan Impor Barang Dari Tempat Penimbunan Berikat(TPB)ke perusahaan penerima fasilitas KITE(KEMUDAHAN IMPORT TUJUAN EKSPOR) | Import Declaration from a Bonded Storage Facility to a company benefiting from KITE (Ease of Import for Export Purposes). |

| BC2.6.1 | Pemberitahuan Pengeluaran Barang Dari Tempat Penimbunan Berikat(TPB) Dengan Jaminan | Release Declaration with Guarantee from a Bonded Storage Facility to other locations within the customs territory (non-TPB areas). ⇒ Declaration for releasing outsourced items, loaned items, repair items, etc. |

| BC2.6.2 | Pemberitahuan Pmasukan Kembali Barang Yang Dikeluarkan Dari Tempat Penimbunan Berikat(TPB) Dengan Jaminan | Return Entry Declaration with Guarantee for goods previously released from a Bonded Storage Facility to other locations within the customs territory (non-TPB areas). ⇒ Declaration for returning outsourced items, loaned items, repair items, etc. |

| BC2.7 | Pemberitahuan Pengeluaran Barang Dari Tempat Penimbunan Berikat(TPB) Ke Tempat Penimbunan Berikat Lainnya. | Release Declaration from one Bonded Storage Facility to another Bonded Storage Facility |

| BC4.0 | Pemberitahuan Pemasukan Barang Asal Tempat Lain Dalam Daerah Pabean(TLDDP) Ke Tempat Penimbunan Berikat(TPB) | Entry Declaration to a Bonded Storage Facility: Declaration for goods entering from other locations within the customs territory (non-TPB areas) to a Bonded Storage Facility. ⇒ Declaration for receiving purchased goods, outsourced items, loaned items, or repair items. |

| BC4.1 | Pemberitahuan Pengeluaran Barang Asal Tempat Lain Dalam Daerah Pabean Dari Tempat Penimbunan Berikat | Release Declaration from a Bonded Storage Facility to other locations within the customs territory (non-TPB areas). ⇒ Declaration for shipping sales, outsourced items, loaned items, or repair items. |

| BC1.6 | Pemberitahuan Impor Barang Untuk Ditimbun Di Pusat Logistik Berikat(PLB) | Import Declaration for storage at a Bonded Logistics Center (a TPB used to store goods from the customs territory and/or other locations within it, to be re-exported within a specific period) |

| BC2.8 | Pemberitahuan Impor Barang Dari Pusat Logistik Berikat | Import Declaration from a Bonded Logistics Center |

Customs’ Inventory Management Oversight and CCTV Monitoring for Bonded Factories

In 2011, the Minister of Finance (Menteri Keuangan) and Indonesian Customs (Bea Cukai) issued a regulation, effective from January 2013, mandating bonded factories (Pengusaha Kawasan Berikat) to implement an online system (IT Inventory) allowing customs to monitor inventory management status. As of May 2019, this should have been implemented in all bonded factories.

Additionally, bonded factories are required to submit printed records of the receipt/payment history and inventory status of raw materials, work-in-progress, products, scrap, etc., every four months by the 10th of the following month.

What customs most wants to know is the linkage between the BC number assigned to the delivery note (Surat Jalan) upon raw material receipt and the new BC number assigned to the shipping note (Surat Jalan) upon product shipment. This ensures that raw materials imported with tax exemptions are properly processed into products within the bonded factory and appropriately shipped.

- Receipt Information (BC number, item, quantity, unit price, etc.)

⇒BC2.6.2, BC2.3, BC2.4, BC2.7, BC4.0 - Shipping Information (BC number, item, quantity, amount, BC number from raw material receipt, raw material amount, etc.)

⇒BC2.6.1, BC2.7, BC3.0, BC4.1, BC2.5

⇒Registration with the Customs-Excise Information System and Automation (CEISA) is required for shipping to obtain an approval number. - Information on entry, release, inventory adjustments, and current inventory of products, work-in-progress, raw materials, and scrap (item, quantity, etc.)

When registering shipping information in CEISA, the unit price must be retrieved by referencing the corresponding receipt BC number to calculate the raw material cost used in the product. However, maintaining a perfect linkage from raw materials to products is challenging, so referencing BC numbers using the FIFO (First-In, First-Out) method might be the best achievable approach.

Moreover, this information must be viewable by customs over the internet, alongside online streaming of CCTV footage from two locations—warehouse entrances/exits and container loading areas. This is what’s known as the IT Inventory system.

Whether these documents can be submitted by the 10th of the following month determines how customs categorizes bonded factories into hijau (green), kuning (yellow), or merah (red).

For imports into Indonesia, companies categorized as red undergo thorough, time-consuming checks of both documents and physical goods for their imported raw materials. This can lead to production line stoppages, delays in manufacturing, and missed delivery deadlines to clients, causing significant adverse business impacts.

The management of BC numbers related to the entry and exit operations of KB (bonded factories) may feel quite complex, but understanding it becomes possible by grasping the following key points:

- What customs wants to know is simply which items (mainly raw materials) are used in the items (mainly products) a KB releases externally. The BC number is the key to managing this linkage, and customs requires the connection between the BC number upon release and the BC number upon entry to be demonstrated.

- The entity releasing the goods issues the BC number, which is obtained only after registering the transaction in CEISA and receiving customs approval.

- If a KB’s transaction partner is non-KB, the KB must obtain the BC number since the non-KB party hasn’t implemented CEISA.

- When a KB (our company) receives raw materials from a KB supplier, the supplier registers in CEISA and obtains BC2.7 (as the releasing party), so our company doesn’t need to register in CEISA. However, if returning raw materials, our KB company registers in CEISA and obtains BC2.7 (as the releasing party).

- When a KB (our company) receives raw materials from a non-KB supplier, our company registers in CEISA (since non-KB hasn’t implemented CEISA) and obtains BC4.0. For returns, our company also registers in CEISA and obtains BC4.1 (since non-KB hasn’t implemented CEISA).

- When a KB (our company) ships products to a KB customer, our company registers in CEISA (as the releasing party) and obtains BC2.7. For product returns, the customer obtains BC2.7 (as the releasing party), so our company doesn’t need to register in CEISA.

- When a KB (our company) ships to a non-KB customer, our company registers in CEISA (as the releasing party) and obtains BC4.1. For product returns, our company registers in CEISA and obtains BC4.0 (since non-KB hasn’t implemented CEISA).

The IT Inventory system, accessible online by customs officers, must provide the following seven reports:

- Laporan Pemasukan Barang (Entry Report)

- Laporan Pengeluaran Barang (Release Report)

- Laporan Posisi WIP (Work-in-Progress Position Report)

- Laporan Penganggung jawaban mutasi bahan baku/bahan penolong (Raw Material/Purchased Goods Movement Responsibility Report)

- Laporan pertanggung jawaban mutasi barang jadi (Finished Goods Movement Responsibility Report)

- Laporan pertanggung jawaban mutasi mesin dan peralatan (Machinery/Fixture Movement Responsibility Report)

- Laporan pertanggung jawaban mutasi reject dan scrap (Reject/Scrap Movement Responsibility Report)

Mandatory Integration of IT Inventory and Accounting Systems for Bonded Factories

Since 2013, the IT Inventory system, enabling customs to monitor inventory management status, has been mandatory to track the movement of quantities such as raw materials, work-in-progress, products, and scrap. Starting in December 2019, installing an online accounting system to report how these quantity movements connect to monetary values in accounting has also become mandatory.

Specifically, customs investigates whether a bonded factory’s (Pengusaha Kawasan Berikat) IT Inventory system is a subsystem of its accounting system (apakah IT Inventory perusahaan merupakan sub sistem dari sistem pencatatan perusahaan). Factories are categorized into four groups, with Category 1 passing, Category 2 receiving guidance, and Categories 3 and 4 failing:

- Perusahaan KB hanya menggunakan 1 (satu) aplikasi sistem pencatatan pembukuan dan IT Inventory merupakan bagian dari sistem pencatatan tersebut.

⇒IT Inventory and the accounting system are linked within the same application - Perusahaan KB menggunakan 2 (dua) aplikasi, di mana yang pertama adalah aplikasi sistem pencatatan pembukuan utama dan yang kedua adalah IT Inventory, di mana keduanya saling terintegrasi dan menggunakan sumber data yang sama dalam pencatatan keluar masuk barang (termasuk di dalamnya IT Inventory sebagai interface).

⇒IT Inventory and the accounting system are separate applications but linked via an interface - Perusahaan KB menggunakan 2 (dua) aplikasi, di mana yang pertama adalah aplikasi sistem pencatatan pembukuan utama dan yang kedua adalah IT Inventory, tetapi keduanya berdiri sendiri dan tidak saling terintegrasi, masingmasing menggunakan sumber data yang berbeda dalam pencatatan keluar masuk barang.

⇒IT Inventory and the accounting system are separate applications and not linked (IT Inventory’s receipt/payment data isn’t linked to the accounting system’s receivables/payables data). - Perusahaan KB hanya menggunakan IT Inventory dalam pencatatan keluar masuk barang, dan pencatatan lainnya masih dilakukan secara manual atau berbantuan komputer, misal hanya menggunakan MS Excel.

⇒No accounting system is implemented, and management is done in Excel.

Since bonded factories should already have an IT Inventory system, achieving a Category 1 rating might involve the following options:

- Add an accounting module to the existing IT Inventory system.

- Develop an additional accounting module.

- Replace it with a new system that integrates IT Inventory and accounting.

Each option places a significant burden on bonded factories, so an alternative might be to introduce a separate accounting system linked to the current IT Inventory system via an interface to aim for a Category 2 rating.

Customs’ policies are expected to become clearer moving forward, but the accounting system required as a subsystem here is likely a separate “for customs display” accounting system, distinct from the core system already in use at bonded factories, with its scope limited to showing a list of receivables and payables.

An overview can be found in Japanese on the following JETRO site: