Key points to consider when implementing an accounting system in Indonesia include distinguishing between the Tax Rate (tax rate) and BI Rate (central bank transaction rate), preparing Faktur Pajak (Tax Invoice) for VAT declaration, and the timing of revenue and expense recognition under the accrual basis. Accounting System in Indonesia The cloudification of accounting systems is advancing in Indonesia, with the three major local cloud systemsAccurate, Zahir, and Jurnalleading the market. However, in reality, it is said that fewer than 8% of domestic companies have implemented accounting systems. This is why new cloud-based accounting systems continue to be launched in what might seem like an already saturated Indonesian market. It suggests that both domestic and international IT startups see significant potential for cloud accounting systems to expand their market share locally. In Indonesia, automated journal entries due to the widespread use of accounting systems have become commonplace, and over the ... 続きを見る

Tax Rate (Tax Rate) and BI Rate (Transaction Rate)

For calculating tax amounts related to foreign currency transactions, it is mandatory to use the Tax Rate published by the tax office (Kantor Pajak) every Wednesday. Therefore, the accounting system’s exchange rate master must include both the BI (Bank Indonesia) Rate and the Tax Rate.

Similar to rates published by private banks, the BI Rate includes TTS (selling), TTB (buying), and TTM (mid-rate), but there are no cases where TTS and TTB are separately set for selling and buying transactions.

Taking rupiah transactions as an example for a company with rupiah as its functional currency, when an A/P Entry (payables input) is made and A/P Approval (payables approval) is completed, VAT at 11% is automatically calculated, and the following journal entry is generated as a Transfer Voucher:

- (Debit) Purchase Rp. 900,000 (Credit) A/P Rp. 900,000

- (Debit) Prepaid VAT Input Rp. 99,000 (Credit) A/P Rp. 99,000

Since VAT entries are processed in rupiah, no currency conversion occurs for rupiah transactions regardless of whether the functional currency is rupiah or dollars. However, for foreign currency transactions like dollars, the VAT portion always requires conversion using the Tax Rate.

If the Tax Rate is $1 = Rp.10,500, then $100 × 11% × 10,500 = Rp.115,500 becomes the VAT entry for both the transaction currency and functional currency. For the transaction portion, if the BI Rate is $1 = Rp.10,000, it would be as follows:

- (Debit) Purchase $100 (Credit) A/P $100

- (Debit) Purchase Rp.100,000 (Credit) A/P Rp.100,000 ← BI Rate $1 = Rp.10,000

- (Debit) Prepaid VAT Input Rp.115,500 (Credit) A/P Rp.115,500 ← Tax Rate $1 = Rp.10,500

In this case, the payables input screen must retrieve both the BI Rate and Tax Rate from the exchange rate master. If this is difficult within the system, the following three operational methods can be used:

Manual VAT Calculation

The system automatically calculates both the transaction and VAT portions using the BI Rate from the exchange rate master, but the VAT portion is manually recalculated using the Tax Rate, corrected, and the Tax Rate is noted in the applicable field.

Separate Input for Transaction and VAT Portions

In this case, the A/P Voucher No for the transaction entry and the Transfer Voucher No for the VAT entry differ, requiring management of their linkage using the Invoice Number as the key.

Batch VAT Adjustment at Month-End

At the time of transaction, the VAT portion is generated automatically in the original currency alongside the transaction portion, with a batch adjustment performed at month-end.

- (Debit) Purchase $100 (Credit) A/P $110

- (Debit) VAT Clearing $10

The Faktur Pajak (Tax Invoice) amounts are aggregated monthly and adjusted in bulk:

- (Debit) Prepaid VAT Input Rp.105,000 (Credit) VAT Clearing $10

Faktur Pajak (Tax Invoice) for VAT (PPN) Declaration

Indonesia has historically adopted the invoice method rather than the ledger method, calculating VAT amounts based on the Tax Invoice. Japan began using the invoice method with the introduction of reduced tax rates in 2021.

Until 2024, Indonesia’s PPN rate was 11%, increasing to 12% from January 2025. However, the 12% rate applies directly only to certain luxury goods. For regular transactions, the taxable base amount (DPP: Dasar Pengenaan Pajak) is multiplied by 11/12 to calculate the DPP nilai lain for applying the 12% PPN rate, resulting in an effective tax amount equivalent to 11%.

The ledger method calculates tax amounts like consumption tax from the tax-inclusive amounts recorded in the books, while the invoice method aggregates tax amounts listed on invoices, making calculations easier even when tax rates differ by item or service.

A Faktur Pajak (Tax Invoice) is always required alongside invoices for tax payments or refund claims. However, the form changes irregularly, requiring adjustments each time.

Faktur Pajak is broadly divided into two types:

Faktur Pajak Standard

A standard Faktur Pajak issued for each Delivery OrderFaktur Pajak Gabungan

A single Faktur Pajak issued at month-end consolidating a month’s D/O, requiring the relevant Invoice No to be specified.Faktur Pajak Sederhana

Now discontinued. Used for small tax payments or tax payments by individuals or organizations other than PKP (Pengusaha Kena Pajak).

For claims in foreign currencies like US$, a form with a field to specify the foreign currency name is required.

Incidentally, Faktur Pajak was issued via the e-Faktur system until 2024, and from 2025 onward, it will be issued through the online coretax system, eliminating the need to develop a dedicated form in the accounting system.

International Financial Reporting Standards (IFRS) Compliance in Accounting Systems

Japanese accounting standards emphasize the Profit and Loss Statement (P/L), rooted in the high-growth era’s assumption of a steadily rising economy, where future predictions could easily be made based solely on the current period’s profit/loss.

In essence, the approach is to create the P/L first, then supplementarily record assets, liabilities, and equity items—the sources of future revenue and expenses—in the Balance Sheet (B/S). Rather than verifying and revaluing B/S items to reflect reality, there’s a strong tendency to use tax law valuations as accounting valuations, processing them as extraordinary gains/losses upon depreciation completion. This is called the revenue-expense approach.

In contrast, IFRS aims to provide investors and creditors with information necessary for evaluating enterprise value. It emphasizes the B/S by revaluing fixed assets for impairment, revaluation, and marketable financial assets at fair value to accurately prepare the B/S, making it clear whether the asset situation can generate future cash flows. This is called the asset-liability approach.

While consolidated financial reporting must comply with IFRS, tax reporting continues to require financial statements based on each country’s unique standards.

As a global standard, all rules are defined in English without considering local tax requirements, focusing on a global perspective. While IFRS compliance is mandatory for investors and creditors in accounting, tax authorities may not always accommodate it. Ideally, accounting systems should implement a multi-standard ledger function.

IFRS compliance in systems can involve either system modifications or operational changes. The following are typical proposals made to clients during system implementation:

Revenue Recognition on a Realization Basis

Revenue is recognized based on shipment or acceptance criteria, with receivable recognition varying by invoice issuance timing. Below is an example of entry generation for the acceptance criterion:

Tripartite Method:

- No entry

- (Debit) A/R 100,000 (Credit) Sales 100,000

Perpetual Recording Method:

- (Debit) A/R Accrued 60,000 (Credit) Inventories 60,000

- (Debit) COGS 60,000 (Credit) A/R Accrued 60,000

- (Debit) A/R 100,000 (Credit) Sales 100,000

If defects (NG) are discovered during customer inspection after invoice dispatch or during production input, methods to correct the issued invoice (recognized A/R) include:

- Adjust inventory by issuing replacements and receiving returns without changing the invoice (Tukar guling).

- Cancel and reissue an invoice for only the OK portion.

- Issue a corrected invoice after return processing, then register a new order for the NG portion.

- Issue a negative invoice and process return order after month-end closing.

If the customer disposes of the NG portion and only the invoice amount is adjusted, the company issues a Credit Note (indicating a payable obligation), and the customer issues a Debit Note (indicating a receivable right) for correction.

In the perpetual recording method, which reduces inventory assets in real-time with shipment, cost of sales can be recognized simultaneously with shipment. However, if invoice issuance occurs later, accrued revenue (A/R Accrued) can be used to maintain synchronization between inventory and accounting (transferring the inventory reduction to current assets) from shipment to acceptance.

Uniform Inventory Valuation Method

Inventory valuation methods must be standardized across consolidated companies, typically aligning with the Japanese headquarters’ method. IFRS permits FIFO, moving average, standard cost (standard unit price), and weighted average methods, but not LIFO.

Separate Management of Physical and Accounting Inventory

Cost of sales is finalized by month-end inventory counts. During the month, despite inventory reductions due to shipments, accounting retains the beginning balance, and this mismatch is managed as unrealized sales (accrued revenue) in subsidiary ledgers.

In this case, inventory transaction entries are not recorded at shipment. Instead, a batch process at month-end swaps beginning and ending balances to finalize inventory assets, calculating cost of sales using the tripartite method (beginning inventory + purchases – ending inventory) to determine current-period profit.

Revaluation of Tangible Fixed Assets (Manual Handling)

IFRS requires revaluation of tangible fixed assets each fiscal year, reviewing depreciation methods and useful lives. For example, when calculating vehicle value during asset inheritance, tax standards may list it as 0 yen, while market value is 200,000 yen. In Japan, tax standards are often adopted for accounting without regular revaluation, but periodic revaluation reduces such cases. This is more an operational issue than a system correction.

Mandatory Cash Flow Statement (Direct Method)

Cash flow statements are not mandatory in Indonesia and are often not prepared. When generated from a system, the direct method—retrieving data from the GL using cash flow codes set during transaction input—is easily implemented.

Multi-Standard Ledger

Tax reporting follows each country’s unique standards, while consolidated financial statements require IFRS compliance (B/S emphasis). Accounting must comply with IFRS for investors and creditors, but tax authorities may not accommodate this.

Ideally, accounting systems should implement a multi-standard ledger function, specifically managing accounting entry data separately and allowing optional aggregation during output.

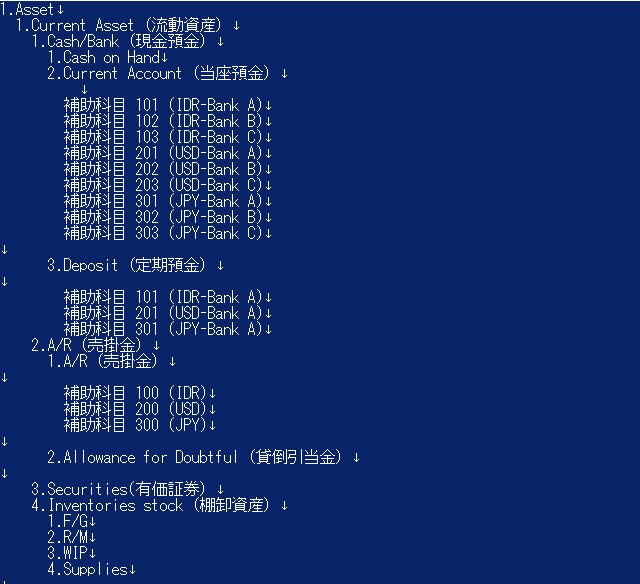

Subdivision of Accounts

When implementing an accounting system, a Chart of Accounts (COA) is essential above all else.

For companies that outsourced bookkeeping to accounting consultants, this is a good opportunity to rethink their code structure. However, without clear mapping between old and new codes, setting opening balances or comparing Trial Balances (T/B) can lead to struggles with account balance discrepancies.

Accounting consultants, handling bookkeeping for many clients, adopt a greatest-common-denominator approach for efficiency. For example, even if materials imported from Japan under FOB (Free On Board) terms are managed as Goods-In-Transit (GIT) in inventory, the consultant’s bookkeeping may not reflect this accurately.

The COA typically combines a 3-4 digit main account with a 3-digit sub-account. For Cash/Bank, it’s almost standard to divide sub-accounts by currency for cash and by “bank + currency” for deposits.

The General Ledger (G/L) includes department codes, counterparty codes, and currency codes. Thus, there’s no need to subdivide A/R and A/P accounts by department, currency, or counterparty; they are often grouped by counterparty characteristics like intra-group, external, domestic, or foreign.

However, if the accounting system’s P/L menu provides department-specific management report templates but can only retrieve amounts from expense accounts for cost reports, it may be necessary to subdivide revenue accounts (e.g., sales) by counterparty.

Accounting software is often said to be similar, but such functional limitations are what distinguish packaged solutions.

Balance Between Balance Sheet (B/S) and Profit and Loss Statement (P/L)

A slight digression: accounting entries begin at the company’s inception. When personal funds are invested, they become company assets and are recorded on the B/S.

This is the moment personal money becomes a company asset.

For example, when a foreigner invests 60 juta in personal funds to establish a PT (limited company) in Indonesia, with an Indonesian director (Direktur) and auditor (Komisaris) as shareholders, the asset becomes the company’s once the shareholder ratio is registered in the Company Establishment Deed (AKTA Pendirian Perseroan Terbatas), incorporated into the opening Balance Sheet (B/S = Nuraca) as capital.

- (Debit) Bank 60,000,000 (Credit) Capital 60,000,000

Capital is the legal capital paid by shareholders, and together with legal capital surplus and retained earnings (earned surplus), it forms net assets.

Naturally, liabilities have repayment obligations, while net assets do not. Liabilities are divided into current liabilities (repayable within 1 year) and fixed liabilities.

- Assets = Liabilities + Net Assets

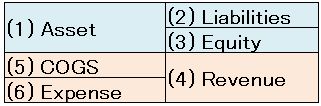

At inception, the B/S only includes assets and net assets. As expenses arise and the first sale occurs, P/L accounts become necessary, balancing with the following equation:

- Assets + Expenses = Liabilities + Net Assets + Revenue

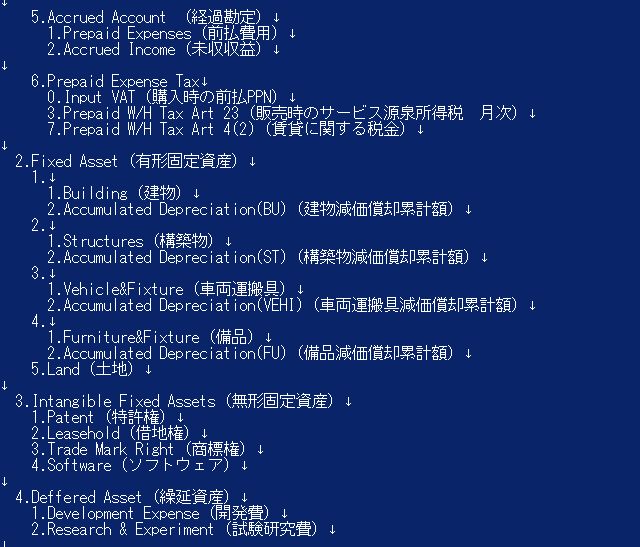

Finalizing the Chart of Accounts

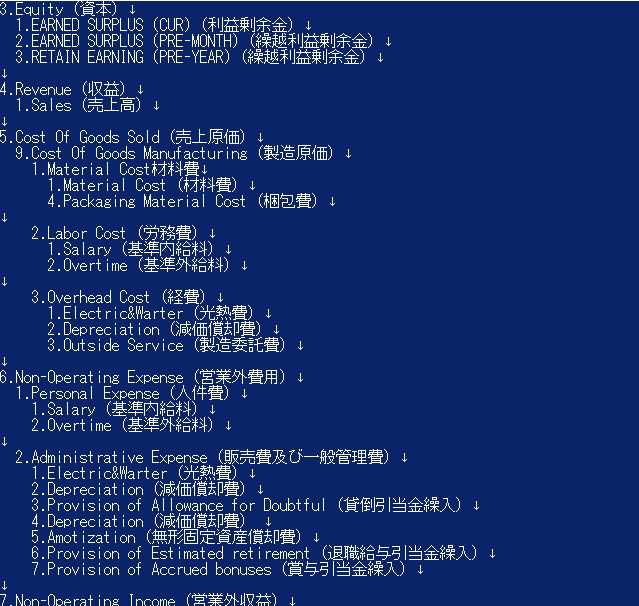

The account code structure typically starts with assets (prefix 1), liabilities (prefix 2), and net assets (prefix 3), followed by revenue (prefix 4), and then expenses (prefix 5 onwards), subdivided into direct manufacturing costs, indirect manufacturing costs, and SG&A.

1. Allowance for Doubtful Accounts

A account for amortizing current asset losses, recorded as a negative asset (prefix 1) in closing entries using the indirect method, listed under A/R on the B/S, and as a positive expense (prefix 6) under SG&A on the P/L as Provision for Allowance for Doubtful Accounts.

- (Debit) Provision for Allowance for Doubtful Accounts (Positive Expense) (Credit) Allowance for Doubtful Accounts (Negative Asset)

2. Depreciation

A account for depreciating tangible fixed assets, recorded as a negative asset (prefix 1) in closing entries using the indirect method, listed under tangible fixed assets (excluding land) on the B/S as Accumulated Depreciation, and as a positive expense (prefix 6) under SG&A on the P/L.

- (Debit) Equipment Depreciation Expense (Positive Expense) (Credit) Accumulated Depreciation for Equipment (Negative Asset)

3. Amortization of Intangible Fixed Assets

A account for amortizing intangible fixed assets, recorded using the direct method in closing entries by reducing the asset, and as a positive expense (prefix 6) under SG&A on the P/L as Amortization of Intangible Fixed Assets.

- (Debit) Amortization of Intangible Fixed Assets (Positive Expense) (Credit) Software (Asset)

4. Estimated Retirement Benefits

Manages provisions for retirement benefits expected in the future, estimating the current period’s burden and recording it as an expense. Recorded as a positive liability (prefix 2) under Allowances on the B/S in closing entries, and as a positive expense (prefix 6) under SG&A on the P/L as Provision for Retirement Benefits.

- (Debit) Provision for Retirement Benefits (Positive Expense) (Credit) Estimated Retirement Benefits (Positive Liability)

5. Deferred Assets (Development Costs, R&D Costs)

Among expenses incurred, amounts attributable to future periods are deferred as assets rather than expensed solely in the current period, allocated over the period their effects are expected.

Since results arise in future periods, they are temporarily placed under assets on the B/S.

6. Accruals (Accrued Revenue, Accrued Expenses)

For ongoing provision or receipt of services where revenue or expenses accrue over time, if the timing of cash flows differs from P/L recognition, these are managed with accrual accounts (B/S items).

Accrued Revenue (non-product credit) is placed under B/S assets, and Accrued Expenses under B/S liabilities.

7. Manufacturing Costs and SG&A

Cost accounting targets only manufacturing costs (prefix 5), while SG&A (prefix 6) lists similar expense items but is excluded from cost accounting. Material and outsourcing costs are calculated monthly using the weighted average from production management module data. Labor and overhead costs are allocated based on actual work hours, and depreciation is allocated based on output.

8. Taxes

VAT (PPN) and withholding tax on domestic service revenue (PPh23) have both In (asset) and Out (liability) components, while personal income tax (PPh21) is only a liability.

PPN (Input-VAT-Prepaid as Asset, Output-VAT Payable as Liability)

At Purchase (In):

- (Debit) Purchase 100 (Credit) A/P 110

- (Debit) Input-VAT Prepaid (Asset) 10

- (Debit) A/R 110 (Credit) Sales 100

- (Credit) Output-VAT Payable (Liability) 10

PPh23 (PPh23 Prepaid as Asset, PPh23 Payable as Liability)

- (Debit) Bank 108 (Credit) A/R 110

- (Debit) PPh23 Prepaid (Asset) 2

- (Debit) A/P 110 (Credit) Bank 108

- (Credit) PPh23 Payable (Liability) 2

PPh21 (W/H Tax21 as Liability)

- (Debit) Salary (Base Wage) (Credit) Bank

- (Credit) PPh21 Payable (Liability)

9. Supplies

Office consumables are expensed as SG&A during month-end inventory counts.

- (Debit) Supplies (Supplies) (Credit) Cash

- (Debit) Supplies Expense (Consumables Expense) (Credit) Supplies (Supplies)

Purpose of Closing Procedures (Closing Entries and Profit Calculation)

1. Correction of Amounts for Accounts Without Counterparties

- Depreciation (Indirect Method)

Converting Fixed Assets to negative assets (accumulated amount) and to cost of sales (manufacturing) or SG&A (office equipment) - Amortization (Direct Method)

Converting Intangible Fixed Assets to SG&A - Allowance for Doubtful Accounts

Converting A/R to negative assets and SG&A (provision amount) - Estimated Retirement Benefits

Converting A/R to negative assets and SG&A (provision amount) - Supplies Stock Taking (Expensing Supplies)

Converting used supplies to Supplies Expense (SG&A)

2. Calculation of Cost of Goods Sold (COGS)

In the tripartite method using the purchase account (expense) for mid-month inventory receipts, COGS (expense) is calculated at month-end as “beginning inventory + purchases – ending inventory.”

Replace beginning and ending product inventory using contra accounts:

- (Debit) Beginning Product Inventory 50 (Credit) Products 50

- (Debit) Products 30 (Credit) Ending Product Inventory 30

Transfer to the COGS account along with Cost of Goods Manufactured (COGM) to calculate current-period COGS:

- (Debit) COGS 50 (Credit) Beginning Product Inventory 50

- (Debit) Ending Product Inventory 40 (Credit) COGS 40

- (Debit) COGS 30 (Credit) COGM 30

3. Transfer All P/L Accounts (Including COGS) to Income Summary to Calculate Net Income

The current period’s net income on the P/L (cumulative net income from the beginning of the period to the prior month) is transferred to Earned Surplus (Pre-Month) on the B/S, then to Retained Earnings (cumulative net income from the founding year to the prior year).

Before calculating net income, gross profit is calculated using the Net Income account. Gross profit from the Net Income account is reduced by SG&A on the P/L to become operating profit.

- Gross Profit > Operating Profit > Ordinary Profit > Pre-Tax Profit > After-Tax Profit (Net Income)

Profit/Loss Recognition on an Accrual Basis (Shipment vs. Acceptance Criteria)

From an IFRS perspective, expense recognition on an accrual basis is fundamental. Revenue recognition under the accrual basis includes shipment and acceptance criteria.

The method of recognizing profit/loss upon acquiring cash or cash equivalents (monetary assets like A/R or notes) is sometimes called the Realization Basis.

Perpetual Recording Method (Acceptance Criterion)

- (Debit) Inventories 100 (Credit) A/P Accrued 100

- (Debit) A/P Accrued 100 (Credit) A/P 100

- (Debit) Shipment Clearing 100 (Credit) Inventories 100

Revenue recognized after customer acceptance under the acceptance criterion:

- (Debit) A/R 120 (Credit) Sales 120

- (Debit) COGS 100 (Credit) Shipment Clearing 100

Perpetual Recording Method (Shipment Criterion)

- (Debit) Inventories 100 (Credit) A/P Accrued 100

- (Debit) A/P Accrued 100 (Credit) A/P 100

Revenue recognized at shipment under the realization basis:

- (Debit) A/R Accrued 120 (Credit) Sales 120

- (Debit) COGS 100 (Credit) Inventories 100

- (Debit) A/R 120 (Credit) A/R Accrued 120