Mass production factories, such as two- and four-wheeler parts manufacturers common in Indonesia, have multiple manufacturing processes. In such cases, processing costs are calculated for each process, and the method of aggregating these costs into the product is called process costing. In this approach, labor costs and manufacturing overheads are recorded at the end of the month by the accounting department, transferred to inventory assets, and then allocated accordingly.

On the other hand, in factories producing custom-made items under individual order production, job order costing is used, where costs are aggregated by order number or project number. In this case, labor costs and manufacturing overheads are calculated by multiplying pre-determined wage rates or allocation rates by the hours worked.

The operating rate of production facilities in Indonesia’s manufacturing industry fluctuates. When the operating rate decreases, fixed costs such as labor and equipment expenses are heavily allocated to the lower production output, causing product costs to rise. Therefore, a cost calculation system that reflects fluctuations in production plans and actual results, along with a mechanism to calculate profits, becomes necessary. This requires accurate real-time data collection using IoT and a system capable of setting allocation rules that align with reality.

However, the fundamental issue is that no matter how precisely costs are tracked, profits won’t increase. To concretely improve profitability, variance analysis of costs and budget-versus-actual analysis for management decisions are essential. This necessitates setting departmental targets, monthly monitoring, and creating a system that highlights the most effective targets for profit improvement.

This blog features articles on cost management systems aimed at helping those in Indonesia’s manufacturing industry who feel the need to systematize cost management operations but are unsure where to start, offering insights into what a manufacturing system suited to Indonesia might look like.

Differences in Cost Calculation Methods Adopted by Production Management Systems

Production management packages commonly implemented in Indonesia, such as Microsoft Dynamics or Sage Accpac, adopt actual cost calculation based on the perpetual inventory method. This method performs real-time cost calculation and generates accounting entries with every inventory receipt or issuance, covering the sequence of material procurement, material input (material cost incurrence), manufacturing (transfer of material costs to products), shipping (revenue recognition), and cost of goods sold (transfer of product costs to cost of sales). As a result, no transfer entries from beginning inventory balances to ending inventory balances for cost of sales are generated. Differences in Cost Calculation Methods Adopted by Production Management Systems The differences in cost calculation methods between a system adopting the perpetual inventory method, where journal entries are generated with each receipt or issuance, synchronizing the inventory asset valuation between accounting and inventory management, and a system adopting the periodic inventory method (inventory calculation method), which calculates manufacturing costs by subtracting the ending inventory from the beginning inventory and the expenses incurred during the month, will be explained by separating variable costs and fixed costs. 続きを見る

Systems using the three-way method adopt actual cost calculation executed in batches after the accounting month-end closing, as well as standard cost calculation performed as part of managerial accounting based on next period’s production plans and fixed cost budgets.

Rolling Costing: Adding Process Costs to Preceding Process Costs to Determine Manufacturing Costs

In cases with multiple manufacturing processes, process costs are calculated for each process. There are two methods to aggregate these costs into product costs: rolling costing and non-rolling costing.

- Rolling Costing

The finished goods of each process carry the costs of the preceding process plus the current process costs as they are transferred to the next process (commonly referred to as “rolling calculation” = Rolling Costing). - Non-Rolling Costing

A method where costs of each process are calculated without including preceding process costs, and these are directly summed to determine product costs.

Since monthly fixed costs remain constant while production volumes adjust to market changes, calculating manufacturing costs based solely on actual production volumes leads to short-sighted cost management. Therefore, a standardized cost leveled across the year is determined before preparing the next period’s budget, forming the basis for sales and procurement plans. The Cumulative Method of Calculating Manufacturing Costs by Adding The Costs of The Current Process to The Costs of The Previous Process. For items that have beginning inventory but no input performance in the current month, they remain recorded as assets on the B/S and are not expensed as manufacturing costs for the current month. Assuming there is no input-yet-to-be-completed (in-process inventory), the essence of actual cost calculation lies in calculating the manufacturing costs of input items by accumulating them by cost element using the total average unit price and allocating the processing costs of the current process by item. 続きを見る

Cost variance represents how much the monthly manufacturing cost deviates from this unchanging annual standard cost. Cost variance analysis breaks this down into factors such as material purchase prices, purchase quantities, and operating hours.

Cost variance indicates the degree to which the current month’s manufacturing cost deviates from the standard cost (the baseline). Naturally, inventory accumulated at the beginning of the month bears no responsibility for this cost variance. However, when shipped, both the beginning inventory and the current month’s production are lumped together and evaluated at a total average, ultimately bearing joint responsibility as the unit cost of goods sold.

The total average unit cost existing during manufacturing cost calculation is the total average unit cost of work-in-progress, while the total average unit cost of finished goods is calculated based on “beginning product inventory + current month’s product manufacturing cost,” corresponding to the unit cost of goods sold calculated after manufacturing costs.

Variance Analysis Between Actual Cost Calculation and Standard Cost Calculation

Both actual and standard costs can be analyzed for variances by treating fixed costs like variable costs using the concepts of wage rates (allocation rates) and hours worked (efficiency).

- Direct Material Cost (Materials) = Unit Price x Quantity (KG per product)

- Direct Labor Cost (Labor) = Wage Rate (Amount per minute) x Efficiency (Hours per product)

- Manufacturing Overhead (Machinery) = Allocation Rate (Amount per minute) x Operating Rate (Minutes per product) ← Allocated by working hours

- Manufacturing Overhead (Shared Machinery) = Allocation Rate (Amount per product) ← Allocated by production volume

Variance Analysis Between Actual and Standard Costs of Products

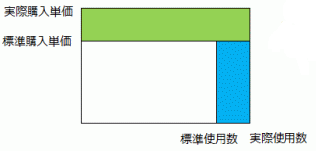

■ Direct Material Cost Price Variance = (Actual Material Unit Price – Standard Material Unit Price) x Actual Usage

■ Direct Material Cost Quantity Variance = (Actual Usage – Standard Usage) x Standard Material Unit Price

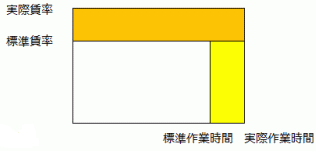

■ Direct Labor Cost Wage Rate Variance = (Actual Wage Rate – Standard Wage Rate) x Actual Hours

Actual Wage Rate = Actual Direct Labor Cost ÷ Actual Working Hours

■ Direct Labor Cost Working Hours Variance = (Actual Hours – Standard Hours) x Standard Wage Rate

■ Manufacturing Overhead Variance

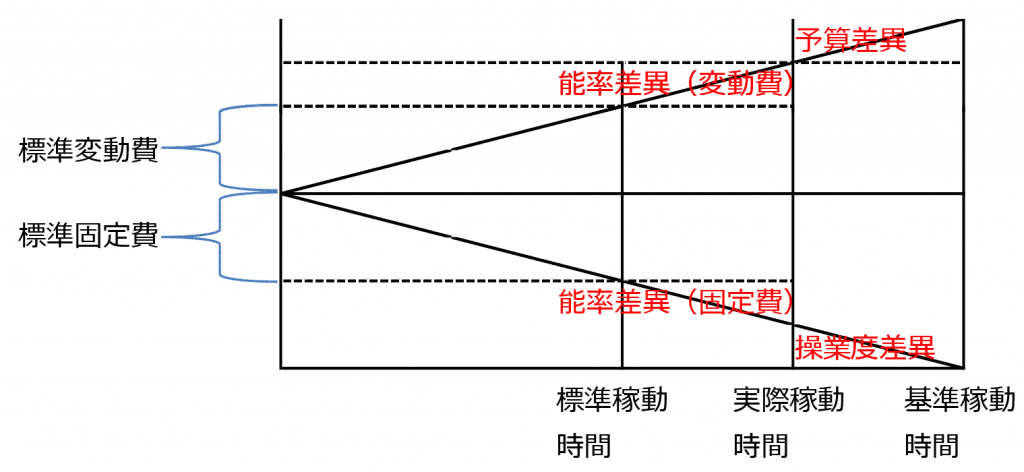

Using a Schlatter diagram, fixed costs are treated similarly to variable costs (allocation rate x operating hours) based on standard operating hours (target), actual operating hours, and baseline operating hours (plan), within which actual manufacturing overheads are incurred.

Allocation Rate x Actual Operating Hours = Actual Variable Costs + Actual Fixed Costs

Allocation Rate x Baseline Operating Hours = Baseline Variable Costs + Baseline Fixed Costs

- Efficiency Variance (Difference on XY Graph)

Efficiency Variance (Variable Cost Portion) = Actual Variable Costs – Standard Variable Costs

Efficiency Variance (Fixed Cost Portion) = Actual Fixed Costs – Standard Fixed Costs - Budget Variance

Actual Variable Costs – Theoretical Actual Variable Costs (based on actual operating hours), representing the excess of actual manufacturing overheads over theoretical manufacturing overheads (allocation rate x actual operating hours) due to rising material costs or wage rates (variable cost allocation rates).

- Capacity Variance (Difference on XY Graph)

Baseline Fixed Costs – Actual Fixed Costs, representing the loss due to the difference between baseline operating hours (full capacity) and actual operating hours

Costs Incurred Based on Production Results vs. Input Results in Cost Management Systems

Non-rolling costing can be considered as costs incurred in the current month based on production volume, while rolling costing is based on input volume. Costs incurred based on the preceding process’s production results become the input volume-based costs for the current process. Thus, material costs incurred become input volume-based costs for work-in-progress, and production volume-based costs for work-in-progress become input volume-based costs for finished goods. Costs Incurred Based on Production Results and Input Results in a Cost Management System Even if materials are received, if they are not used, the current month’s incurred costs are 0. In this sense, the current month’s incurred costs can be expressed as “the cost of materials used in the current month = incurred costs based on input.” If there is no manufacturing, the manufacturing cost is also 0, meaning the manufacturing cost can be expressed as “the cost of items completed in the current month = incurred costs based on production results.” If there are no sales, the cost of goods sold is also 0, meaning the cost of goods sold can be expressed as “the cost of items sold in the current month = incurred costs based on shipment results.” 続きを見る

The total material costs incurred for shared materials can be calculated using the three-way method by subtracting ending material inventory from the sum of beginning material inventory and current month’s material purchases. However, item-specific material costs cannot be calculated using the three-way method unless the usage (e.g., kilograms per product) is tracked, so they are calculated based on the parent-child relationship of input results.

Handling Fixed Costs in Indonesia When Production Results Span Months or When There’s No Production

Materials are not recognized as costs at the time of purchase but at the time of input, remaining as work-in-progress inventory until production results are recorded. They become manufacturing costs when production results are recorded and cost of goods sold when shipped. Handling Fixed Costs in Indonesia When Production Results Span Across Months and in Months Without Production The costs incurred based on input results are direct material costs, the costs incurred based on production volume are manufacturing costs, and the costs incurred based on shipment are the cost of goods sold. When input results and production results span across months, the input results for the current month remain as ending work-in-process inventory, and if production results are not recorded by the end of the following month, the work-in-process remains without any costs incurred. 続きを見る

When input results and production results span across months, costs incurred inevitably remain in the current month’s ending work-in-progress. If production results are still not recorded by the next month’s end, work-in-progress remains without incurred costs.

Manufacturing costs represent the costs of items manufactured in the current month (based on production results), so if production is zero, manufacturing costs are also zero. Similarly, cost of goods sold represents the costs of items sold in the current month (based on shipping results), so if sales are zero, cost of goods sold is also zero.

Regardless of production, depreciation expenses for machinery are incurred. Ideally, the portion attributable to the current month’s products should become part of manufacturing costs, but this creates a contradiction when there’s no production yet manufacturing costs exist. For tax purposes, since depreciation must be recorded monthly, it is transferred to selling, general, and administrative expenses or work-in-progress.

Understanding Standard Cost Calculation and Actual Cost Calculation Within the Same Framework

Allocation rate refers to aggregating costs to a unit (process, line, or product group) that sums items without bias toward “the value of working hours or production volume,” then dividing by total working hours to calculate a wage rate (amount per minute) or by total production volume to calculate an allocation rate (amount per unit).

In standard cost calculation, the planned production volume (sales volume) of products is used in a quantity breakdown calculation (required quantity) to determine the planned production volume of work-in-progress and planned purchase volume of materials, calculating direct material costs per product.

Additionally, a time breakdown calculation (required quantity x efficiency) determines planned direct working hours, calculating the primary allocation ratio for apportioning shared equipment depreciation to cost centers.

Budgets for direct labor costs and manufacturing overheads aggregated to cost centers are apportioned based on production volume ratios or direct working hour ratios to calculate wage rates (allocation rates), determining direct labor costs and manufacturing overheads per product.

In actual cost calculation, actual allocation rates are calculated using total average unit costs and allocation calculations.

- Standard Allocation Rate (Planned Allocation Rate): Calculated from budget costs by item and planned data by account or department

- Actual Allocation Rate: Calculated from actual incurred costs and actual data

The allocation ratio for apportioning total average unit costs (for calculating variable costs in actual cost calculation) or actual incurred amounts (for calculating fixed costs) to cost centers and then by item is the actual allocation rate. In standard cost calculation, the allocation ratio for apportioning standard unit prices (variable costs from a unit price master) or budgets (for calculating fixed costs) to cost centers and then by item is the standard allocation rate. How to Understand Standard Costing and Actual Costing as the Same Mechanism If a production management system can manage receipt and disbursement results according to the account linkage chart, a cost management system can calculate the total average unit price of direct materials. Furthermore, by accumulating processing costs (direct labor costs and manufacturing overhead) for each process using the cumulative method, the material costs incurred this month, manufacturing costs this month, and cost of goods sold this month—necessary for P/L preparation—can be calculated. 続きを見る

The Concept of Cost Management Through Wage Rates (Allocation Rates) and Hours Worked

The concept of cost management involves calculating fixed costs like labor costs using wage rate x efficiency (hours worked), similar to material costs (unit price x quantity). Originally, this was used to estimate processing fees based on hours worked (unit price x man-days).

■ Wage Rate Calculation for Cost Centers (Direct Departments)

- Total direct working hours are aggregated by cost center by subtracting indirect working hours (time not directly related to manufacturing) from attendance data (exit time – entry time) in daily work reports.

【Direct Working Hours by Product = Total Direct Working Hours by Cost Center x {(Standard Hours x Production Volume) / SUM(Standard Hours x Production Volume)}】

This calculates direct working hours (direct hours worked) by product. Using only production volume to apportion total direct working hours to products with varying hours worked is imprecise, so standard hours x production volume is used.

■ Increasing Direct Working Hour Ratio Is the Foundation of Factory Management

- Direct work generates results, and sales, administration, accounting, and management all support enhancing direct work productivity.

Since “wage rate = total cost / operating hours,” a higher direct working hour ratio yields greater results at the same wage rate, while a higher indirect working hour ratio yields smaller results. - Wage rate is a time cost, and in sewing, direct personnel must account for at least 70% to keep wage rates down and increase processing output.

-

-

The Concept of Cost Management by Calculating Costs from Wage Rate (Allocation Rate) and Labor Hours

The relationship between labor hours (minutes per unit) and wage rate (cost per hour) was once applied to calculate the payment processing fee (standard labor hours × standard wage rate) under an agreement between the ordering party and the subcontractor. However, in standard costing, labor hours are treated as efficiency, and the wage rate as an allocation rate, adopted for formulating the next fiscal year’s budget.

続きを見る

Correcting Errors in Actual Input in Production Management Systems

When using Excel for cost calculation in Indonesia’s manufacturing industry, if current month manufacturing costs are calculated by subtracting ending inventory from the sum of beginning inventory and current month incurred costs, input errors in production or input results can be addressed with adjusting accounting entries. However, with a cost management system calculating current month manufacturing costs from total average unit costs and actual quantities, corrections to actual data and recalculation of costs are required. How to Correct Errors in Actual Input in a Production Management System To correct an input error in actual results, it’s ideal to go back to the production results and make the correction. However, if the product has already been shipped and sales have been recorded, rolling back everything is a significant hassle. In such cases, it’s common to adjust the quantity through inventory adjustments and correct the manufacturing costs via accounting journal entries. 続きを見る

Differences Between Manufacturing Costs, Cost of Goods Sold, and Selling, General, and Administrative Expenses

Manufacturing costs are the costs of products entering the product warehouse in the current month. Variable costs include the portion of beginning material inventory and current month purchased materials that were input and turned into products in the current month. Fixed costs include the portion of current month direct labor costs and manufacturing overheads attributable to products.

Cost of goods sold is the cost of products shipped in the current month from beginning product inventory and products entering the warehouse in the current month. Operating profit is calculated by deducting selling, general, and administrative expenses (period costs) incurred up to shipping from the gross profit, which is sales minus cost of goods sold.

- Beginning Material Inventory + Current Month Purchased Materials – Ending Material Inventory = Current Month Material Costs

- Beginning Work-in-Progress Inventory + Current Month Material Costs + Current Month Processing Costs – Ending Work-in-Progress Costs = Manufacturing Costs

- Beginning Product Inventory + Manufacturing Costs – Ending Product Inventory = Cost of Goods Sold

- Sales – Cost of Goods Sold = Gross Profit

- Gross Profit – SG&A Expenses = Operating Profit

-

-

The Relationship Between Manufacturing Cost, Cost of Sales, and Selling and Administrative Expenses Representing the Framework of Corporate Accounting

Material costs and processing costs incurred at the manufacturing site are the current month’s incurred costs. The costs incurred to produce the products themselves are manufacturing costs (incurred costs based on production quantity), while the costs incurred to produce the products sold are the cost of sales (incurred costs based on shipped quantity). Selling and administrative expenses incurred for sales are deducted from gross profit.

続きを見る

Budget Costs in Cost Management Systems vs. Budget Management in Accounting Systems

A budget means “pre” = beforehand, and “calculation” = estimating, calculating the next period’s projected sales and expense amounts to forecast profits. Budgeted Cost in a Cost Management System and Budget Management in an Accounting System In standard costing, planned production quantities are calculated from the product production plan and BOM, planned direct labor time is calculated from the planned production quantities and the standard cost efficiency master, allocation rates are calculated from the manufacturing overhead budget and planned production quantities, and wage rates are calculated from the direct labor cost budget and planned direct labor time. 続きを見る

Key tasks in accounting include finalizing accounts and budgeting. Finalizing accounts occurs after a company completes a year of operations, while budgeting is done before starting a year of operations.

Real Story! Learning Marginal Profit and Break-Even Point from Boutique Management Experience in Bali

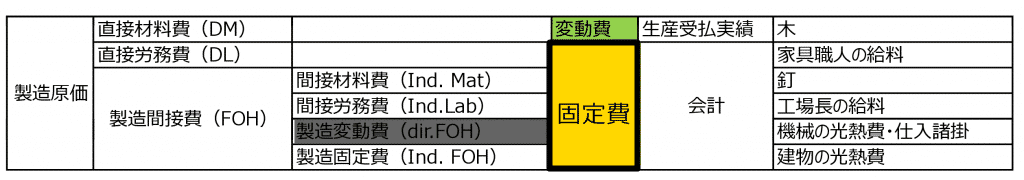

Manufacturing costs can be classified either as variable costs (amount proportional to quantity/unit price constant) and fixed costs (amount fixed/unit price inversely proportional to quantity) or by cost items (direct material costs, direct labor costs, manufacturing overheads). Direct material costs and subcontracting costs linked from production management system receipts and issuances are variable costs, while fixed costs are linked from the accounting system and apportioned based on allocation rules by working hours.

■ Classifying Manufacturing Costs as Variable or Fixed Costs

Variable costs are primarily direct material costs and subcontracting costs obtained from production management system receipt and issuance records, while fixed costs are expenses obtained from the accounting system.

■ Classifying Manufacturing Costs as Direct or Indirect Costs

Direct material costs, direct labor costs, manufacturing overheads

The same expenses as manufacturing overheads also occur as selling, general, and administrative expenses.

- Since Cost = Variable Costs + Fixed Costs, Unit Price = Variable Unit Price + Fixed Unit Price also holds. Variable unit price remains constant regardless of sales, but fixed unit price decreases inversely with sales.

- Recovering Fixed Costs with Gross Profit

Buying at 6 (variable cost) and selling at 10 means a cost of 60% of the manufacturer’s suggested retail price, or a profit margin of 0.4. To cover rent and labor costs of 30 (fixed costs), how much sales are needed? In this retail perspective, a profit margin of 0.4 (gross profit/sales) is the marginal profit rate (gross margin). Sales – Purchase (variable cost) = 4 is the marginal profit, and Fixed Costs 30 / Marginal Profit Rate 0.4 calculates the break-even sales of 75.

-

-

True Story! Learning About Marginal Profit and Break-Even Point from My Boutique Management Experience in Bali

Costs can be divided into variable costs and fixed costs. The break-even point sales, which recover fixed costs, are determined by the marginal profit rate—the ratio of the purchase price (variable cost) to sales. In other words, direct costing calculates how many clothes need to be sold to achieve the break-even point sales, considering only variable costs as the original cost.

続きを見る