To correct an input error in actual results, it’s ideal to go back to the production results and make the correction. However, if the product has already been shipped and sales have been recorded, rolling back everything is a significant hassle. In such cases, it’s common to adjust the quantity through inventory adjustments and correct the manufacturing costs via accounting journal entries. Cost Management in Indonesia Mass production factories, such as two- and four-wheeler parts manufacturers common in Indonesia, have multiple manufacturing processes. In such cases, processing costs are calculated for each process, and the method of aggregating these costs into the product is called process costing. In this approach, labor costs and manufacturing overheads are recorded at the end of the month by the accounting department, transferred to inventory assets, and then allocated accordingly. On the other hand, in factories producing custom-made items under individual order production, job order costing is used, where costs are aggregated by order number or project number. In this case, ... 続きを見る

Differences Between the Total Average Method and the Three-Way Method in Cost Accounting

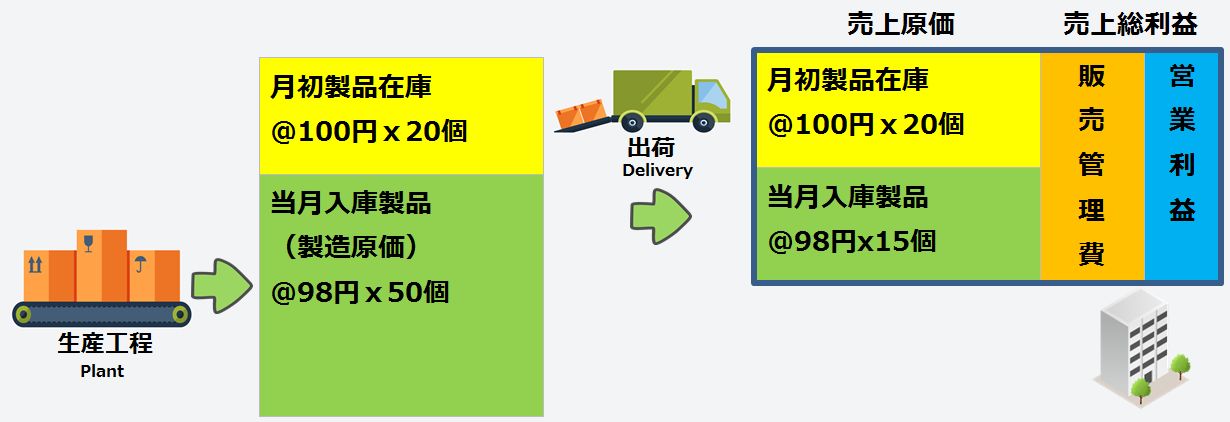

The difference between manufacturing costs and cost of goods sold lies in whether it’s the cost of products completed this month or the cost of products shipped this month.

The cost of goods sold doesn’t include additional expenses beyond manufacturing costs, so the unit price of the cost of goods sold is either the unit price of products shipped from the beginning inventory or the unit price of products manufactured this month.

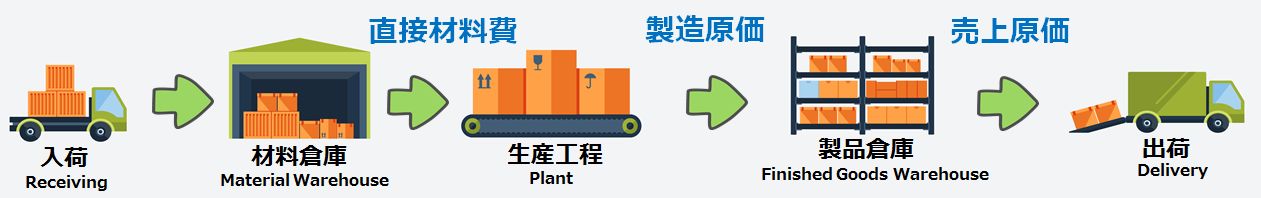

Once materials are input, processing costs accumulate in the manufacturing process, and anything less than a finished product is collectively referred to as work-in-process.

- Input-Based Costs Incurred = Direct Material Costs

⇒ Total Average Unit Price of Materials × Input Quantity - Production-Based Costs Incurred = Manufacturing Costs

⇒ Total Average Unit Price of Input Items × Input Quantity + Processing Costs = Total Average Unit Price of Products × Production Quantity - Shipment-Based Costs Incurred = Cost of Goods Sold

⇒ Total Average Unit Price of Products × Shipment Quantity

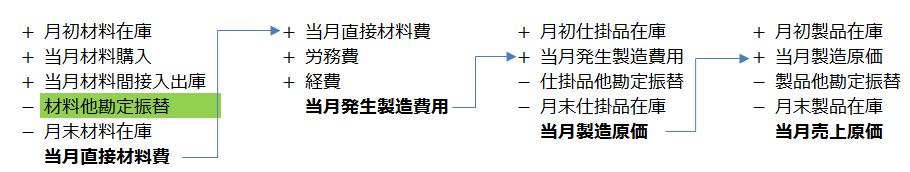

The direct material costs, manufacturing costs, and cost of goods sold for the month can also be calculated using the three-way method, which involves “deducting from the beginning inventory and costs incurred this month by accounting for the ending inventory,” as follows:

The direct material costs, manufacturing costs, and cost of goods sold for the month can also be calculated using the three-way method, which involves “deducting from the beginning inventory and costs incurred this month by accounting for the ending inventory,” as follows:

- Direct Material Costs = Beginning Material Inventory Amount + Material Purchase Amount This Month - Ending Material Inventory Amount

- Manufacturing Costs = Beginning Work-in-Process Inventory Amount + (Direct Material Costs + Processing Costs) - Ending Work-in-Process Amount

- Cost of Goods Sold = Beginning Product Inventory Amount + Manufacturing Costs - Ending Inventory Amount

If Actual Input Is Entered Incorrectly, Costs Based on the Total Average Method Won’t Be Calculated Correctly

If it’s discovered at the end of the month that the input material quantity was entered incorrectly during production result input, an inventory adjustment (indirect disbursement) is used to forcibly align the numbers. However, unless the production results are canceled and the input results corrected, the direct material costs will be overstated (or understated), leaving the product’s manufacturing costs incorrect.

- The input result quantity was supposed to be 1 unit but was mistakenly entered as 10 units, a digit too many.

- As a result, the system inventory became significantly lower than the actual physical inventory.

- The manufactured product has already passed the inspection process, and after a sequential serial number-managed pass label has been attached, correcting the input results is no longer possible.

- With no other choice, an inventory adjustment (indirect receipt) was performed to correct the system inventory numbers.

In this case, since the theoretical system value is 9 units less than the actual physical count, receiving 9 units indirectly corrects the inventory quantity.

If the unit price at the time of this receipt is evaluated at the total average unit price before the indirect receipt, the total average unit price before and after the inventory adjustment remains nearly the same, and consequently, the manufacturing costs remain nearly unchanged.

- Correct Total Average Unit Price and Manufacturing Costs for Materials

- Total Average Unit Price of Materials = (Beginning Inventory @100 × 10 units + Purchase @140 × 5 units) / (10 units + 5 units) = @113.33

- Manufacturing Costs = @113.33 × 1 unit + Processing Costs 0 = 113.3

- Total Average Unit Price and Manufacturing Costs When Input Results Were Entered Incorrectly

- Total Average Unit Price of Materials = (Beginning Inventory @100 × 10 units + Purchase @140 × 5 units) / (10 units + 5 units) = @113.33

- Manufacturing Costs = @113.33 × 10 units + Processing Costs 0 = 1133.3 ← Costs Overstated

- When the Material Unit Price at Receipt Is Set to the Total Average Unit Price Before Receipt

- Total Average Unit Price of Materials = (Beginning Inventory @100 × 10 units + Purchase @140 × 5 units + Inventory Adjustment @113.33 × 9 units) / (10 units + 5 units + 9 units) = @113.32

- Manufacturing Costs = @113.32 × 10 units + Processing Costs 0 = 1133.2

- When the Material Unit Price at Receipt Is Set to 0

- Total Average Unit Price of Materials = (Beginning Inventory @100 × 10 units + Purchase @140 × 5 units + Inventory Adjustment @0 × 9 units) / (10 units + 5 units + 9 units) = @70.83

- Manufacturing Costs = @70.83 × 10 units + Processing Costs 0 = 708.3

Whether the unit price for the indirect material receipt is set to the total average unit price at that point (No. 3) or to 0 (No. 4), the product’s manufacturing costs remain incorrect. Unless the input results in the production management system are corrected, the manufacturing costs of the product in the cost management system will not be accurately adjusted.

Adjustment Journal Entries from the Accounting Side Based on the Three-Way Method

While it’s not possible to correctly adjust the product’s manufacturing costs in management accounting based on the total average method, in financial accounting based on the three-way method, the overstated direct material costs for 9 units can be transferred to SG&A expenses.

-

- Total Average Unit Price of Materials = (Beginning Inventory @100 × 10 units + Purchase @140 × 5 units + Inventory Adjustment @113.33 × 9 units) / (10 units + 5 units + 9 units) = @113.32

- Manufacturing Costs = @113.32 × Input Quantity 10 units + Processing Costs 0 - Inventory Adjustment @113.32 × 9 units = 113.32

When input results are overstated, the system processes a receipt for the material shortfall compared to the physical count, subtracting the overstated direct material costs and deducting them from the manufacturing costs. The reduction in direct material costs is indirectly transferred to materials through an “other account transfer” account.

- (Debit) Materials 1019.88 (Credit) Materials Other Account Transfer 1019.88

When input results are understated, the insufficient material quantity is reduced, and the unconsumed direct material costs are increased through an “other account transfer” account. This is the same processing method as for supplementary materials or secondary materials, which are expensed only for the amount used and recorded as direct costs in the accounting system without going through the production management system.

When input results are understated, the insufficient material quantity is reduced, and the unconsumed direct material costs are increased through an “other account transfer” account. This is the same processing method as for supplementary materials or secondary materials, which are expensed only for the amount used and recorded as direct costs in the accounting system without going through the production management system.

- (Debit) Materials Other Account Transfer 1019.88 (Credit) Materials 1019.88

The three-way method inductively calculates costs incurred this month from the result (ending inventory). When correcting input errors in production results via inventory adjustments, the following points should be noted:

- An error in input results, even if adjusted to match the physical count through inventory adjustments, will leave the direct material costs in manufacturing costs incorrect unless the input results themselves are corrected.

- The total average unit price is unaffected by disbursement results; only the ending inventory decreases by the disbursed amount, so neither direct material costs nor manufacturing costs change.

- The total average unit price is affected by receipt results, but when the receipt amount is evaluated at the total average unit price before adjustment, the total average unit price after adjustment barely changes.

- The overstated input result portion is deducted from manufacturing costs as direct material costs through accounting journal entries via an “other account transfer.”