In job order costing, where costs are aggregated by order unit, manufacturing costs can be calculated based on actual results. However, adopting this in a mass production (continuous large-scale production) forecast production factory is challenging. Therefore, IFRS (International Financial Reporting Standards) recognizes four inventory valuation methods: First-In-First-Out (FIFO), Moving Average, Standard Costing, and Total Average Costing. Cost Management in Indonesia Mass production factories, such as two- and four-wheeler parts manufacturers common in Indonesia, have multiple manufacturing processes. In such cases, processing costs are calculated for each process, and the method of aggregating these costs into the product is called process costing. In this approach, labor costs and manufacturing overheads are recorded at the end of the month by the accounting department, transferred to inventory assets, and then allocated accordingly. On the other hand, in factories producing custom-made items under individual order production, job order costing is used, where costs are aggregated by order number or project number. In this case, ... 続きを見る

Similarities in Business Flows Between Trading Companies (Sales Companies) and Job Order Production Factories

I once spent about six months commuting to a high-rise building in Central Jakarta to build a business system. Normally, I visit factories filled with the sounds of presses and molding machines, so riding the high-speed elevators of an intelligent building housing offices of globally renowned companies and Japan’s four major trading firms felt incredibly out of place—I was totally like a country bumpkin in the big city.

Being a trading company, the star of the show was, of course, the sales team. Japanese expatriates were assigned to business units dealing with Japanese companies in Indonesia, while sharp Indonesian managers oversaw units handling local companies. Every visit to their sophisticated offices made me think, “Working at a big company like this might be nice just once” (though I doubt they’d hire me, haha).

The trading company offered two types of services: selling stocked goods they procured and managing projects where they received orders for entire equipment sets and billed based on the percentage-of-completion method. After receiving an order, they issued purchase orders for necessary materials, and all costs incurred during the project period were tied to the order number and recorded as work-in-process.

While supporting system operations, an internal issue I noticed was the personality clash between the sales and accounting departments. The Japanese expatriates, eager to quickly process work and rack up sales results, clashed with the Indonesian accounting manager, who obsessed over precise figures to ensure proper tax-related accounting.

The Japanese expatriates would casually tell the accounting department, “Hey, issue this invoice, YO,” but without linking it to a specific order number or shipment (task), the Indonesian accounting manager would grumble repeatedly, “Japan tells us to calculate profit and loss by business unit and order number from the Indonesia side, but the Japanese expatriates don’t provide any basis for the invoices, YO.”

These little anecdotes aren’t particularly important, but a key feature of a trading company’s (sales company’s) operations is that the entire flow—from order receipt to procurement, tasks, and accounting—is tied to an order number.

A job order production (Make-to-Order) factory follows a similar business flow with the following characteristics:

- Flow from order receipt to design, procurement, manufacturing, shipment, and sales:

Purchase orders and task results are managed by order number. The design department redraws blueprints based on customer-provided designs. - Material costs are based on order unit prices, while labor costs and manufacturing overhead are accumulated by multiplying actual labor hours by wage rates and allocation rates.

- Inventory management is roughly divided into materials, work-in-process, and products, without tracking work-in-process quantities by process.

- Comparison between the budget at the time of quotation and actual results is necessary.

- Frequent custom orders are common, but common items become inventory-managed items.

In one-of-a-kind production, costs vary by order number, necessitating such cost aggregation. Conversely, this kind of serial number management can be handled manually in Excel precisely because the number of orders isn’t too high and manufacturing lead times aren’t excessively long.

In Indonesia, job order production factories often struggle with cost management. When tasked with systematizing production management operations, the focus is often less on the flow of goods via inventory receipt and disbursement and more on aggregating costs by order number. In many cases, “production management = cost management.”

The Ambiguity of the Term “Process Costing”

Most of our company’s clients in Indonesian manufacturing are two- and four-wheeler parts makers or electronic component manufacturers. To supply parts for consumer goods like cars, motorcycles, and printers downstream in the supply chain, they engage in mass continuous production (mass production) and maintain a certain inventory level through forecast production (Make-to-Stock).

In this case, with too many orders, trying to accumulate material costs, labor costs, and manufacturing overhead by order number as in job order production (Make-to-Order) would be impossible in terms of manpower and time. Moreover, since continuous production inherently incurs the same costs, calculating them individually by order number is pointless.

Generally, to understand manufacturing costs in a factory engaged in large-scale forecast production, “process costing” is said to be used, with a definition like this:

- Aggregate costs incurred over a certain period and divide by production quantity to calculate the manufacturing cost unit price per product.

I wonder how many people can read this and think “Got it,” but it’s as vague as describing Indonesian cuisine with the single word “spicy.”

The above definition is easier to visualize when applying the three-way method (inventory counting method), which calculates manufacturing costs by deducting from beginning inventory and costs incurred this month based on ending inventory:

- Beginning Material Inventory + Material Purchase Costs This Month - Ending Material Inventory = Material Costs Incurred (Input) This Month

- Beginning Work-in-Process Inventory + (Material Costs Incurred This Month + Labor Costs + Manufacturing Overhead) - Ending Work-in-Process Inventory = Manufacturing Costs

- Beginning Product Inventory + Manufacturing Costs This Month - Ending Product Inventory = Cost of Goods Sold

This way, calculating costs incurred over a certain period (typically one month) using the three-way method and dividing by production quantity yields the manufacturing cost unit price, but it assumes that a physical inventory count is conducted at month-end to determine the ending inventory amount.

- The three-way method presupposes determining the ending inventory amount through a physical inventory count.

So, does that mean manufacturing costs can’t be calculated without a month-end physical inventory count?

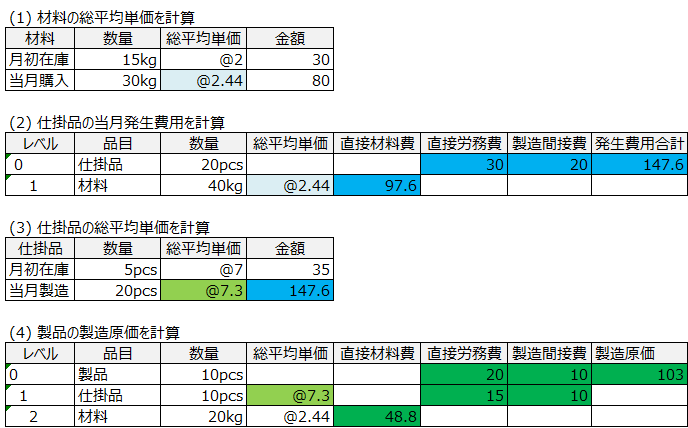

No. By implementing a cost management system, the Total Average Method (Average Cost) can be used. By applying the total average unit price of materials as the unit price of input results in the initial process and the total average unit price of work-in-process as the unit price of input results in the final process, the total average unit price of products (manufacturing cost unit price) can be calculated:

- (Beginning Material Inventory + Material Purchase Amount This Month + Indirect Material Receipt Amount This Month) / Total Quantity = Total Average Unit Price of Materials

- Total Average Unit Price of Materials × Input Quantity to Completed Work-in-Process = Direct Material Costs This Month (Work-in-Process)

- Direct Material Costs This Month + Labor Costs + Manufacturing Overhead = Work-in-Process Costs This Month

- (Beginning Work-in-Process Inventory + Work-in-Process Costs This Month) / Total Quantity = Total Average Unit Price of Work-in-Process

- Total Average Unit Price of Work-in-Process × Input Quantity to Completed Products = Previous Process (Products)

- Direct Material Costs This Month + Labor Costs + Manufacturing Overhead = Manufacturing Costs Incurred (Input) This Month (Final Process)

- (Beginning Product Inventory + Manufacturing Costs Incurred This Month) / Total Quantity = Total Average Unit Price of Products

- Total Average Unit Price of Products × Sales Quantity This Month = Cost of Goods Sold This Month

Key points of the Total Average Method in process costing are as follows:

- The total average unit price becomes the unit price of input results for work-in-process or products completed in the next process (input results based on production quantity).

- Input Result Quantity × Total Average Unit Price = Previous Process Costs (Direct Material Costs if it’s the initial process).

The above are examples of process costing using the three-way method and the total average method. However, without a cost management system, process costing via the total average method is practically impossible. As a result, most Japanese forecast production factories in Indonesia adopt Excel-based standard costing.

Four Cost Accounting Standards Recognized for Convenience Under International Financial Reporting Standards

Ideally, the most accurate cost accounting method is job order costing. However, in mass continuous production, where the number of orders is high but the costs incurred are fundamentally the same, IFRS (International Financial Reporting Standards) permits calculating costs and valuing inventory using four methods for convenience: First-In-First-Out (FIFO), Moving Average, Standard Costing, and Total Average Costing.

FIFO requires selecting the earliest received inventory each time a disbursement occurs, while the Moving Average method involves updating the average unit price at the time of receipt. These methods primarily aim to accurately evaluate inventory assets at disbursement and are seen in systems adopting the perpetual inventory method, which generates accounting journal entries with each inventory receipt and disbursement.

Even in Indonesian job order production factories, cost aggregation by order number is feasible precisely because the number of orders is low. However, as the number of orders increases, product specifications diversify and become more complex, and manufacturing lead times lengthen, the accuracy of cost accounting declines, affecting quotation amounts, which prompts consideration of systemization.