Two ways to classify production costs

In Indonesian, the word mutasi means to "move" such as movement or change, which is an alien word from the English word mutation, and this mutasi can be broadly divided into Goods Receive, Goods Issue, Movement, and Inventory Transfer. (Transfer).

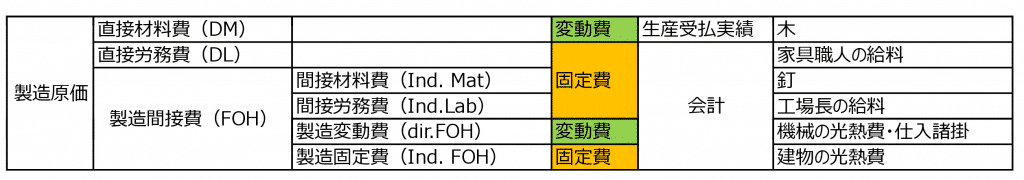

Manufacturing overhead is divided into subgroups: indirect material costs, indirect labor costs and expenses. Variable costs are direct material costs derived from the actual receipt and payment of production, while fixed costs are costs derived from accounting and can be divided into two types: indirect and direct.

Although there are variable costs in addition to direct material costs such as overtime and charge, most of the variable costs are made up of direct material costs and subcontracted processing costs.

Actual allocation of fixed costs under the Continuing Records Act

The Perpetual Pethod, one of the inventory valuation methods, is a method of constantly monitoring the movement of inventory amounts in the asset accounts (materials, work in progress, and products) in accounting as receipts and payments are made, but in the case of a system that integrates accounting and production control, direct material costs can be kept at unit prices in FIFO (First-in First-out) or Unit costs are updated using the moving average method, and direct labor and manufacturing costs are allocated on a scheduled basis by setting a standard allocation rate in the bill of materials (BOM).

However, even if the unit price of direct materials is evaluated by FIFO or moving average method in real time and the journal entry is made by continuous recording method, in case of allocating direct labor cost or manufacturing cost to an item, the journal entry must be generated in a batch processing at the end of each month, based on the actual amount incurred.

The journal entry for accrual of debt at the time of material purchase.

- (Dr) Material (Cr) AP

Materials are put into work-in-process, but no manufacturing overhead is charged to work-in-process.

- (Dr) WIP (Cr) Material

The current month's electricity bill arrives from the utility company PLN (at this stage it is recorded as an operating expense)

- (Dr) utility cost (Cr)AP

Utility costs were transferred to manufacturing overhead costs.

- (Dr) Overhead (Cr) utility cost

Assessing manufacturing overhead costs on products

(Dr) FG (Cr) WIP

(Cr) Overhead

In Indonesia, there is no obligation to levy manufacturing overhead on work-in-process products for tax purposes, so the mainstream idea is to levy only on products like this example rather than going through a complicated process.

In addition, under the assumption that there is no change in the purchase price of materials within the same month, the inventory movement (mutasi) of materials in FIFO is recorded on a monthly basis, so the cost of materials is recorded by the continuous recording method to calculate the valuation of payment (material input) by the material code and the month of purchase, as in "the cost of materials purchased in X month is Y yen". The two are managed as keys.

Treatment of fixed costs for months with no production

Regardless of production, as long as you are a factory, you will incur depreciation on your machinery, and essentially the amount of that depreciation that is made into a product of the month is part of the current month's production cost.

- Work in progress at the beginning of the month (Rp.0) + manufacturing cost for the month (Rp.100) - work in progress at the end of the month (Rp.0) = manufacturing cost for the month (Rp.100)

In the fixed asset management system, there is a function to suspend the depreciation of machinery in the month when there is no production, but there is no other way except transferring the depreciation to SG&A expenses as long as it is required to be depreciated every month, regardless of the straight-line method or the declining balance method.

When you transfer this depreciation cost related to production to SG&A expenses, it is necessary to transfer it indirectly through other account transfer account to clarify the amount incurred.

However, if there is no work-in-process inventory in the warehouse even though the work-in-process account is enlarged in a normal factory, the auditor will report to the company's auditor that there is no work-in-process inventory in the warehouse.

- Why is it recorded as work-in-process if there is no work-in-process inventory?

It may be pointed out that

Generally, in project accounting or construction accounting, the amount is recorded in the work-in-process account or the work-in-progress account and finally transferred to the product.