We will consider revenue improvement methods from an accounting perspective and a supply chain perspective, and explore ways to enhance operations through IT infrastructure. Changing work methods to improve operational efficiency inevitably requires altering the flow or structure of operational data, making systemization unavoidable. Accounting System in Indonesia The cloudification of accounting systems is advancing in Indonesia, with the three major local cloud systemsAccurate, Zahir, and Jurnalleading the market. However, in reality, it is said that fewer than 8% of domestic companies have implemented accounting systems. This is why new cloud-based accounting systems continue to be launched in what might seem like an already saturated Indonesian market. It suggests that both domestic and international IT startups see significant potential for cloud accounting systems to expand their market share locally. In Indonesia, automated journal entries due to the widespread use of accounting systems have become commonplace, and over the ... 続きを見る

Revenue Improvement from an Accounting Perspective

In the accounting world, it’s often said, “Profit and depreciation create cash,” meaning a company’s cash sources are profit and depreciation. Depreciation is an expense without cash outflow, so while it’s just a numbers game where actual cash exceeds the P/L’s net profit by the depreciation amount, physically generating cash isn’t the point. Rather, depreciation reduces profit, lowering taxable income by that amount, which reduces tax burden = increases cash.

Thus, amid declining sales due to the COVID-19 pandemic, the following four options are roughly what can be done to increase cash:

- Increase deductible expenses to reduce taxable income (tax savings).

- Shorten payment terms for receivables from sales and delay payment terms for payables from COGS.

- Reduce COGS and SG&A to increase core business profit (operating profit).

- Increase non-operating cash inflows (e.g., selling land/buildings) and reduce non-operating cash outflows (e.g., canceling internal events).

Profit is “sales – expenses.” With core sales not increasing, boosting profit means cutting expenses. In Jakarta, moves to reduce fixed costs—employee layoffs, terminating outsourcing contracts, salary cuts, and canceling office leases—are evident. Across Indonesia, layoffs (PHK: Pemutusan Hubungan Kerja) reportedly reached 7 million by April, slowing office relocations and expansions. As a result, occupancy rates for new office buildings in Jakarta are said to be around 70%.

Revenue Improvement from a Supply Chain Perspective

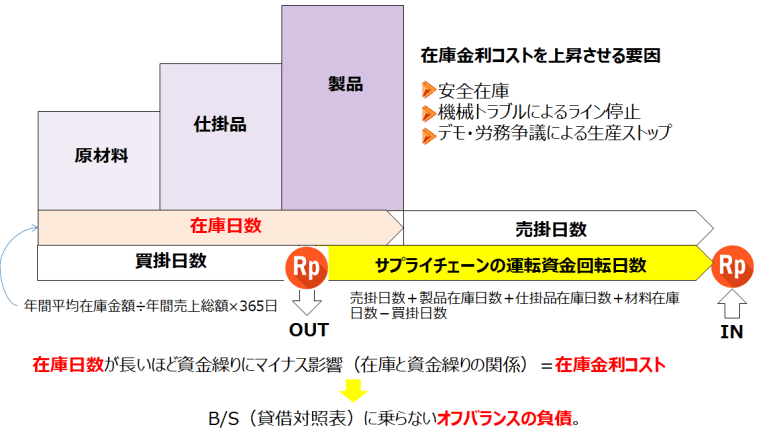

Raw materials, work-in-progress (WIP), and finished goods—future cash—sit in warehouses as inventory assets, negatively impacting cash flow, causing opportunity losses from interest on bank deposits, and incurring borrowing costs for raw material procurement, all of which compress revenue.

There are two reasons to hold inventory despite these interest costs: 1) The “order lead time” (from receiving an order to shipping) is shorter than the “manufacturing lead time” (from start to completion), so inventory acts as a buffer to bridge this gap; 2) It serves as buffer stock to prevent stopping bottleneck processes that determine factory-wide productivity.

Amid U.S.-China trade tensions and COVID-19, reevaluating high-risk imports from China and shifting to local procurement to order and receive goods just in time is tough during production peaks. However, with production down due to the pandemic, this could be a prime opportunity for operational improvement.

Just-in-time production—starting manufacturing when materials arrive and shipping upon completion—along with multi-skilling and converting internal setup to external setup (preparing in advance to avoid stopping machines), can enhance production efficiency with fewer workers post-reduction, contributing to revenue improvement.

Operational Improvement from an IT Infrastructure Perspective

Building IT infrastructure involves understanding current workflows and content, identifying improvement areas, and implementing them in systems. Even as IT investments are deferred due to the pandemic, operational analysis and improvement can be tackled in-house without significant cost.

Operational analysis requires roughly two things:

- Workflow: Needed to oversee the overall process.

- Task Details: Needed to grasp the specifics of tasks composing the workflow that can’t be fully captured in it.

For operational improvement, the classic ECRS (Eliminate, Combine, Rearrange, Simplify) principles guide restructuring workflows to maximize results with minimal effort, creating a Standard Operating Procedure (SOP).

Changing workers’ methods inevitably alters data flows or structures. While Excel may suffice temporarily, systemization is unavoidable for efficiency improvements to survive the pandemic.

Post-COVID, workplaces will likely advance paperless and IoT solutions to minimize physical contact and shared items, reducing virus exposure, alongside a push for IT adoption to review and enhance existing operations.

Shifting from Cost Center to Profit Center Mindset

Monthly production cost calculations (actual cost accounting) are rarely systemized in Indonesia. Detailed calculations are time-consuming, while rough estimates obscure desired insights. With time freed up by the pandemic, now is an ideal moment to rethink cost accounting from a revenue improvement perspective.

However, since revenue (profit) is “sales – expenses,” focusing solely on expenses can mislead. A department seeming cost-heavy might drive significant sales. For revenue improvement, revising cost accounting should include not just manufacturing costs but also COGS (shipment-based) and SG&A, subtracted from sales to reveal operating profit—a key management accounting element.

- Manufacturing Costs = Beginning WIP Inventory + Current Month Manufacturing Expenses – Ending WIP Inventory

- COGS = Beginning Product Inventory + Current Month Manufacturing Costs – Ending Product Inventory

- Gross Profit (Margin) = Sales – COGS

- Operating Profit = Gross Profit – SG&A

Revenue improvement via cost accounting requires elevating thinking from manufacturing costs to COGS, gross profit to operating profit, and cost centers to profit centers.

In Indonesia, beyond the unabating COVID-19 spread, volatile exchange/interest rates, annually rising minimum wages (UMK), procurement challenges due to supply chain power dynamics, opaque customs procedures, and tax risks inflate costs. Conversely, a demographic bonus—where the working-age population exceeds dependents by over double until 2030—offers sales growth potential.

In this high-risk, high-return environment, where sales and expenses are determined by market-driven flows of goods, money, and information in the supply chain, sustaining revenue is tough. Post-COVID revenue improvement strategies should go beyond cost-cutting to accurately grasp costs, concentrate capital in high-value businesses, and transform business structures for productivity gains.

Rethinking Cost Accounting

Unlike order-based cost accounting (job costing), mass production cost accounting (process costing) uses cost centers—typically departments, processes, machines, or product groups—as the lowest aggregation level from a revenue improvement perspective (e.g., business units).

To understand current cost accounting workflows and content, start with these three points:

- What unit price for variable costs (direct materials)?

⇒ Purchase price (job-specific)

⇒ Standard unit price

⇒ Total average unit price (process) - How to calculate fixed costs (labor, overhead)?

⇒ Standard unit price

⇒ Aggregate actual costs to cost centers and allocate: Requires labor/operation hour tracking. - Basis for cost accounting?

⇒ Input quantity: Requires linking actual inputs (child) to recipients (parent).

⇒ Production quantity: BOM standard usage × standard unit price

For fixed costs using standard unit prices, labor requires a wage rate (cost per minute) × efficiency, and overhead needs an allocation rate (cost per unit), both calculated separately in advance.

The criterion for restructuring workflows is “maximum results with minimal effort.” However, whether to use time-consuming actual costs for variable and fixed cost calculations hinges solely on “Can it serve as a revenue improvement metric?” If not, pre-prepared standard unit prices should be maximized in actual cost accounting.