Work in progress appears as a month-end balance in the B/S, not the P/L.

When I first started studying costing, it took me a long time to understand that manufacturing cost is a manufacturing cost of a product.

And after I understood that manufacturing cost is "manufacturing cost of the product", I wondered "Why do we calculate incurred material cost, manufacturing cost and cost of sales by the trichotomy, but not the manufacturing cost of the in-process items in between? This was the case.

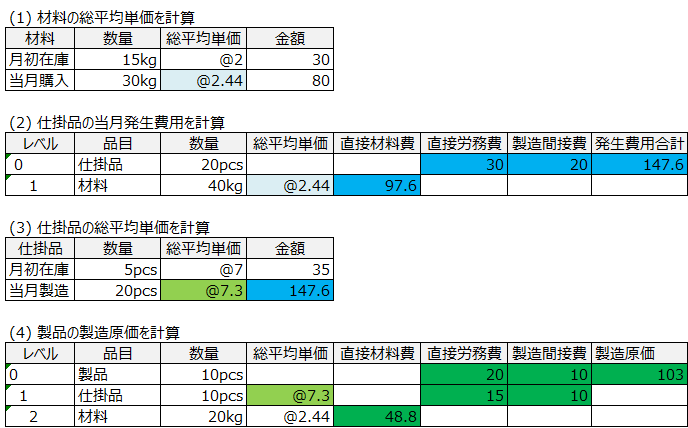

- Material in stock at the beginning of the month + Material purchased during the month - Material in stock at the end of the month = Material generated during the month.

- (Material cost + Processing cost) - Hanging goods in stock at the end of the month = Production price for the month.

- Beginning of month product inventory + current month's product manufacturing costs - end of month product inventory = current month product cost of sales

仕掛品がレベル0の集計費用は発生費用に該当する。

Since the purpose of financial accounting is to create P/L and B/S, it is sufficient to calculate incurred material cost, manufacturing cost, and cost of sales, and the processing cost can be established as P/L by allocating it to the product only, but only the material cost part will appear in the end-of-month balance of the work-in-process item that appears on the B/S.

For accounting purposes, the expenses incurred during the month are included in the cost of goods in progress.

In terms of assets, the state between materials and products is a work in progress.

In other words, when the material is input and expensed, it becomes a work-in-progress, and the processing cost is added to it.

Material cost in progress" is the same as "cost of the month", and this is equivalent to the cost of work in progress.

Material cost incurred in the current month + processing cost incurred in the current month" is the cost of work-in-process in the current month itself.

The cost of production calculated by "total average unit cost of work in progress x quantity + direct labor cost + manufacturing overhead cost" above is the same as the result calculated by "work in progress at the beginning of the month + expenses incurred in the month - work in progress at the end of the month" by subtracting the inventory at the end of the month.

- Material in stock at the beginning of the month + Material purchased during the month - Material in stock at the end of the month = Material generated during the month.

- Work-in-process inventory at the beginning of the month + work-in-process production cost for the month - work-in-process inventory at the end of the month = product production cost for the month

- Beginning of month product inventory + product manufacturing costs for the month - end of month product inventory = cost of product sales for the month

Calculating the balance of work in progress at the end of the month

Now, when it becomes necessary to allocate processing cost, which is currently allocated to products only, to work-in-progress, it is necessary to allocate it to those that became products and those that remain as work-in-progress.

While material costs can be allocated by the input quantity in the usual way, processing costs are allocated to different forms of products and work in progress, so the work to convert work in progress into products is required, which is quite difficult.

One of the purposes of introducing a cost control system is to calculate the end-of-month balance of the work in progress that is allocated processing cost, which is difficult to do by manual work.

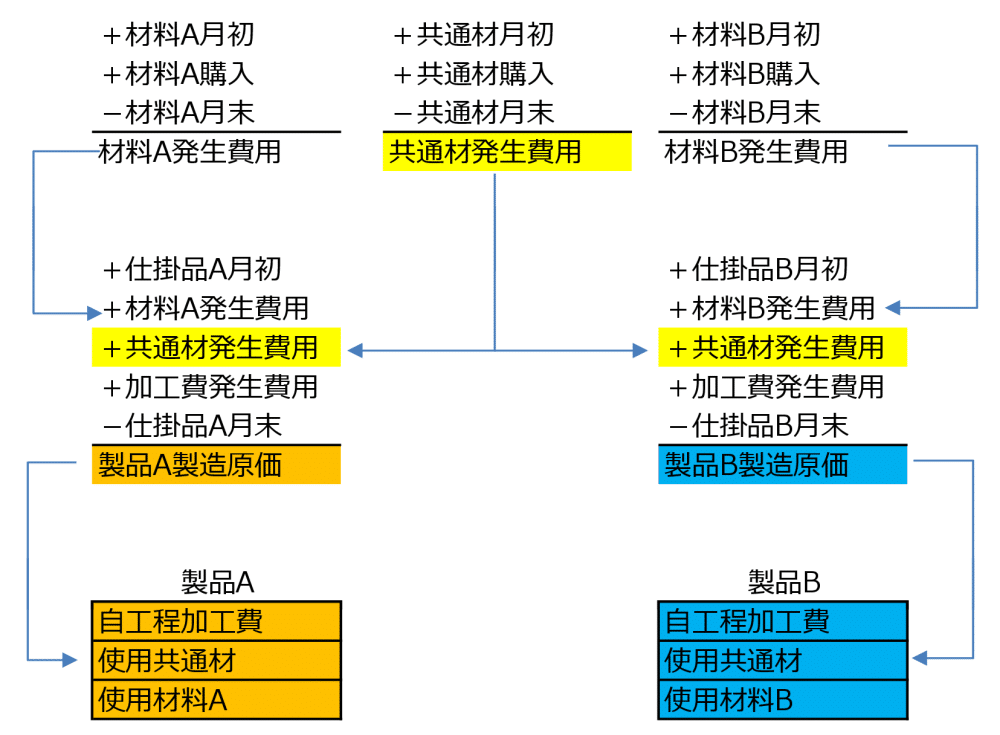

Incurred costs of common materials that cannot be calculated using the trichotomy

In the case of common materials, the cost incurred during the month can be calculated from the beginning of the month, the purchase of the month and the inventory at the end of the month using the trichotomy.

With the weighted average method, it is possible to calculate not only common material costs but also manufacturing costs for each product based on the parent-child relationship of input results.

- Cost of common materials

Actual input quantity of common materials x Total average unit price - Cost of common materials included in Product A manufacturing cost

Actual quantity of common materials used x total average unit price