Accrual accounting recognizes revenue and expenses at the time a transaction occurs, regardless of cash flow, so sales (revenue) and purchases (expenses) are recognized at the point of shipment or receipt. In contrast, realization accounting recognizes them when the transfer of goods or provision of services is complete and consideration is established, meaning sales (revenue) and purchases (expenses) are recognized at the point of invoice issuance or arrival. Accounting System in Indonesia The cloudification of accounting systems is advancing in Indonesia, with the three major local cloud systemsAccurate, Zahir, and Jurnalleading the market. However, in reality, it is said that fewer than 8% of domestic companies have implemented accounting systems. This is why new cloud-based accounting systems continue to be launched in what might seem like an already saturated Indonesian market. It suggests that both domestic and international IT startups see significant potential for cloud accounting systems to expand their market share locally. In Indonesia, automated journal entries due to the widespread use of accounting systems have become commonplace, and over the ... 続きを見る

Management of Receivables and Sales Based on Shipment

In the accounting practices of Indonesia’s automotive parts industry, there are cases where accrued receivables (A/R Accrued), sales, purchases, and accrued payables (A/P Accrued) are recorded in the month the transaction occurs to prepare the profit and loss statement (P/L) and balance sheet (B/S) for that month.

Invoices are merely units for managing the aging of claims and payments, representing only the movement of money.

- Record unrealized receivables and sales on the shipment date of October 5

(Debit) A/R Accrued 100 (Credit) Sales 100 - Record unrealized receivables and sales on the shipment date of October 10

(Debit) A/R Accrued 100 (Credit) Sales 100 - Record unrealized receivables and sales on the shipment date of October 20

(Debit) A/R Accrued 100 (Credit) Sales 100

When the month ends here, sales are recorded on the P/L on an accrual basis, and the unrealized receivables (A/R Accrued) are listed under assets on the B/S. However, they are only recorded in the general ledger (G/L) of the accounting system and are not yet recognized as receivables (A/R).

The following month, when the invoice is issued, the balance of A/R Accrued in the G/L is cleared by transferring it to the A/R account in the receivables management of the accounting system.

- Transfer to receivables upon invoice issuance on November 5

(Debit) A/R 300 (Credit) A/R Accrued 300

Management of Payables and Purchases Based on Receipt

Since receivables are recorded based on shipment, it would be unfair not to record payables based on receipt as well.

- Record unrealized payables and purchases on the receipt date of October 5

(Debit) Purchase 100 (Credit) A/P Accrued 100 - Record unrealized payables and purchases on the receipt date of October 10

(Debit) Purchase 100 (Credit) A/P Accrued 100 - Record unrealized payables and purchases on the receipt date of October 20

(Debit) Purchase 100 (Credit) A/P Accrued 100

Similarly, at the end of the month, purchases are recorded on the P/L on an accrual basis, and unrealized payables (A/P Accrued) are listed under liabilities on the B/S. However, they are only recorded in the G/L of the accounting system and are not yet recognized as payables (A/P).

The following month, when the invoice arrives, the balance of A/P Accrued in the G/L is cleared by transferring it to the A/P account in the payables management of the accounting system.

- Transfer to payables upon invoice arrival on November 5

(Debit) A/P Accrued 300 (Credit) A/P 300

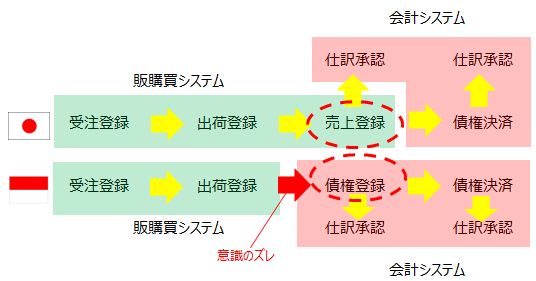

Integration Method from ERP System to Accounting System

Shipment and receipt processes are entered through the sales and purchase management module of the ERP system. The accounting entries mentioned above must be generated based on the transaction date and interfaced with the G/L or A/R and A/P management.

Unit of Journal Entries at Receipt/Shipment

At the time of receipt (or shipment), the invoice has not yet arrived (or been issued), and only the delivery order (D/O) is available. To link to A/P (or A/R) when the invoice arrives (or is issued), the delivery order number (D/O Number) is entered as a key field to search for receipt (or shipment) information.

Journal entries for recording unrealized receivables and payables (A/R Accrued and A/P Accrued) are generated at the time of receipt (or shipment), but the unit of the entry varies depending on whether the accounting system includes item codes.

- For monthly consolidated invoices: Unit of "Vendor Code + Account Code"

- For invoices per shipment: Unit of "Vendor Code + D/O Number + Account Code"

- When the accounting system issues invoices: Unit of "Line Item"

Unit of Journal Entries at Invoice Arrival (Issuance)

Typically, one invoice corresponds to multiple receipts (or shipments). From the receipt (or shipment) performance details entered in the ERP system by item number, only records with a status of having been interfaced to the G/L as unrealized payables (or receivables) are listed. These are checked against the details of the arrived (or issued) invoice, and the invoice number is entered for the correct records.

Here, data is interfaced with the receivables and payables (A/R and A/P) management, generating clearing entries for the unrealized payables (or receivables) balance in the G/L. As long as the balance can be reduced to zero, the unit of the interfaced data does not need to match that of the receipt (or shipment).

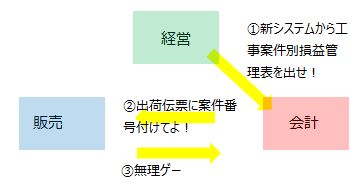

The Chasm Between Management, Sales/Purchase Staff, and Accounting Staff

In the typical sales process of a manufacturing company in Indonesia, a salesperson registers an order, a logistics staff issues a shipment instruction and generates a delivery order (D/O), ships the product along with the D/O to complete the shipment, and an accounting staff issues an invoice and tax invoice (Faktur Pajak). Receivables (A/R) arise when the claim is made with the signed original D/O returned from the customer, and sales are recorded accordingly.

In Indonesia, after the logistics department completes the shipment, there may be a delay of about a week before the accounting department issues the invoice, such as when waiting for the customer’s inspection completion report or consolidating multiple D/Os into one invoice. This makes it difficult to confirm whether invoicing has been properly executed for the shipments.

This reflects a disconnect between goods (shipments) and money (invoices). While upstream salespeople can track the shipment status of order data, they often neglect to check whether the accounting department has correctly issued invoices and recorded A/R for those shipments.

Conversely, downstream accounting staff have limited visibility into how the logistics department handles shipments based on the order information registered by the sales department. As a result, it is not always clear which order the original D/O collected by the accounting department corresponds to.

One day, when management orders the accounting staff to submit profit and loss data by project, the accounting staff requests the sales or logistics staff to "include the order number on the D/O."

However, salespeople may create quotations by project lot, issue delivery instructions for multiple projects combined, or offer special discounts like free provision or "Buy 1 Get 1." In such cases, when a D/O spans multiple projects (orders), it becomes difficult to clearly link the D/O to specific orders.

Salespeople tend to operate intuitively and manage documentation somewhat loosely (a stereotype), while accounting staff are highly rational and meticulous. This creates friction between the two.

Management, unaware of the on-the-ground situation, complains, "Why can’t you calculate profit and loss by project?" Sales staff retort, "Sales work can’t be handled so rigidly." Implementing a system leads to dissatisfaction among all parties—management, sales, and accounting—building tension and straining the company atmosphere.

In a small company, salespeople can resolve this chasm by ensuring the sales they record are properly invoiced and settled by the accounting department. However, in large manufacturing firms with rigid vertical organizational structures and clearly defined roles, system implementers caught in the middle witness this misalignment and flounder.

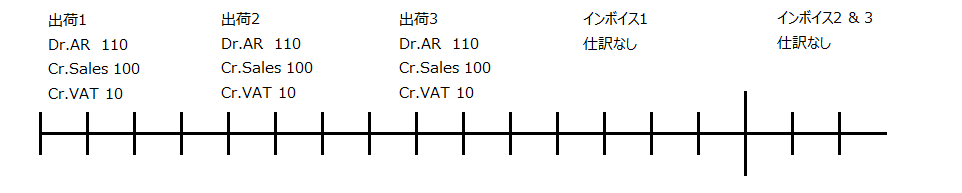

The Flow from Recording Sales on a Shipment Basis to Recognizing Receivables

Needless to say, sales are a profit and loss account, while A/R receivables are an asset account.

In an ERP system, based on order registration, shipment instructions are issued, and upon shipment completion, sales are recorded, generating the following entry on the accounting side:

- (Debit) A/R 10 (Credit) Sales 10

This assumes sales are recorded on a shipment basis (accrual basis), with invoices issued simultaneously with shipment and A/R recorded accordingly.

When shipment and invoice issuance occur simultaneously, the sales department can record sales at the time of shipment, and the accounting side only needs to clear the entry upon settlement, naturally resolving the chasm between sales and accounting.

However, in Indonesia’s automotive parts industry, even though invoices are issued collectively at month-end, the above entry is generated at the shipment date as the recording date. At the time of invoice issuance, no accounting entry is generated, and clearing is done based on the shipment date (recording date) or item code.

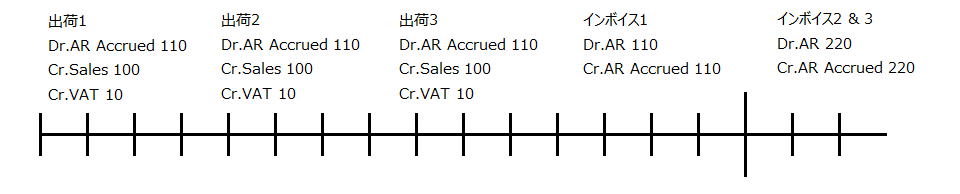

In Indonesia, invoice issuance typically lags shipment registration by about a week, generating the following entry on the accounting side:

- (Debit) A/R Accrued 10 (Credit) Sales 10

The A/R recording date is the invoice issuance or arrival date. At the shipment stage, the temporary receivables account A/R Accrued is used, and A/R is recorded by the accounting department at the time of invoice issuance (or sales recognition).

At Invoice Issuance

- (Debit) A/R 10 (Credit) A/R Accrued 10

The bottleneck in system implementation in Indonesia lies in the A/R recording portion, stemming from the timing discrepancy between sales recognition managed by the sales department (logistics department) based on shipment and A/R recognition managed by the accounting department based on invoice issuance.

On the other hand, when only an accounting system is implemented, receivables are recorded based on invoices after managing orders and shipments in Excel outside the system. This results in a smaller negative impact from system implementation but also a smaller positive impact.

The Meaning of Accrual Accounting and Invoice Dates

Currently, VAT applications in Indonesia are processed online via coretax, eliminating the need to develop Faktur Pajak form layouts in production management or accounting systems. However, the focus shifts to how to integrate sales and purchase data with coretax.

The import format for E-Faktur prior to 2024 was CSV, but for coretax from 2025 onward, it is XML.

For domestic transactions in Indonesia, the month of the Faktur Pajak date must match the month of the invoice date. This indicates that the tax processing month is based on the invoice date, serving merely as a rule to facilitate smooth tax processing.

Thus, if a domestic supplier’s shipment and delivery span across months, even if the invoice date is the last day of the previous month, purchases may be recorded at the beginning of the current month based on the accrual principle in accounting.

Invoices are merely units for claiming money, and there is no need to always record accounting purchases or sales based on the invoice date. Invoices are simply documents that set payment deadlines for consolidated claim units.

Discrepancies Between Delivery Dates and Invoice Dates in Domestic Transactions

In short-lead domestic transactions from shipment to delivery, common cases where the delivery date differs from the invoice date’s month include:

- Delivered on July 1, but the supplier insists on recording it in the previous month’s sales, so the D/O (Delivery Order) date is set as June 31.

- The D/O was prepared on June 31, but delivery was delayed and arrived on July 1.

These differ only due to the supplier’s circumstances, but the event is the same for the company. Tax processing is based on the invoice date, so VAT entries are recorded in June:

- June 31

(Debit) VAT-in 33 (Credit) Payables 33

Purchases are recorded in July, when the supplier shipped and delivered, based on the accrual principle:

- July 1

(Debit) Purchase 300 (Credit) Payables 300

Discrepancies Between Invoice Dates and Delivery in Imports

The greatest significance of recording goods not yet arrived at invoice arrival is to recognize and manage on-board inventory in accounting. If a company records sales at shipment based on the accrual principle, it might be fairer to record purchases at the supplier’s shipment as well.

However, for long-lead transactions like imports, recording purchases at the supplier’s shipment could be considered unfair. A compromise is to record purchases at invoice arrival, with VAT also recorded at that time:

- June 15

(Debit) Goods in Transit 300 (Credit) Payables 333

(Debit) Prepaid VAT-in 33

When the goods arrive in Indonesia on July 15, goods in transit are transferred to the purchase account:

- July 15

(Debit) Purchase 300 (Credit) Goods in Transit 300

Timing of Sales and Receivables Recognition on an Accrual Basis

Accrual accounting is one approach to recognizing profit and loss. Typically, if payment is not made through cash or deposits on the sales recording date, it is recorded as accounts receivable (A/R):

- Accrual accounting requires revenue or expenses to be recorded at the time an economic event occurs or changes, regardless of cash inflows or outflows.

- When settlement is not made on the sales recording date, accounts receivable (A/R) are recorded.

- When settled on the sales recording date

(Debit) Bank 100 (Credit) Sales 100 - When not settled on the sales recording date

(Debit) A/R 100 (Credit) Sales 100

- When settled on the sales recording date

Sales on an accrual basis are recognized upon "completion of goods delivery" or "completion of service provision." If settlement is not made on the sales recording date, accounts receivable (A/R) are recorded.

An invoice is merely a written unit of a claim confirmed as "eligible for billing and payment," so it is not correct to record receivables upon invoice issuance.

Perspectives of Sales and Accounting Departments on Sales and Receivables Recording Dates

From the sales department’s perspective, synchronizing inventory movements with the timing of receivables and sales recognition unifies order backlog management, inventory management, and performance management on an accrual basis, making work easier. However, from the accounting department’s perspective, aligning invoice movements with the timing of receivables and sales recognition simplifies tax processing.

Recording Sales and Receivables Simultaneously at Shipment

This approach is based on recording sales at shipment, considering the sales recording date as the date receivables rights are established (rights confirmation principle) for receivables aging management. No accounting entries are made at the time of monthly consolidated invoice issuance, adhering most closely to the accrual-based shipment principle and leaning toward the sales department’s perspective.

Most Japanese automotive parts manufacturers in Indonesia likely follow this accounting practice.

- (Debit) A/R 111 (Credit) Sales 100

- (Credit) VAT Payable 11

At Invoice Issuance

- No entry

Recording Sales at Shipment, Receivables Based on Invoice

For the accounting department’s administrative convenience, if receivables are to be recorded at invoice issuance, revenue is recorded on an accrual basis at shipment, but the receivables that should arise are temporarily recorded as unrealized receivables (A/R Accrued). At invoice issuance, the temporary receivables are offset with actual receivables (A/R), aligning the receivables recording date with the invoice issuance date for aging management.

- (Debit) A/R Accrued 111 (Credit) Sales 100

- (Credit) VAT Payable 11

At Invoice Issuance

- (Debit) A/R 110 (Credit) A/R Accrued 110

Since 2022, VAT (PPN) has been 11%, and from January 2025, it will increase to 12%. However, the full 12% applies only to certain luxury goods. For regular transactions, the taxable amount DPP (Dasar Pengenaan Pajak) is multiplied by 11/12 to calculate the adjusted taxable amount DPP nilai lain for applying the 12% rate, resulting in an effective tax amount equivalent to 11%.

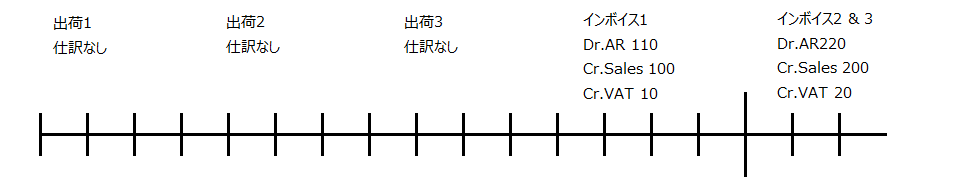

Recording Sales and Receivables Simultaneously Based on Tax Invoice VAT

Under international accounting standards, sales should be recorded on an accrual basis at shipment. However, in Indonesia, invoices must always include a Faktur Pajak (Tax Invoice) as the basis for VAT recording. When VAT is recorded based on the Faktur Pajak, sales must be recorded in the same month as the invoice date, even if it deviates from the accrual principle.

Recording sales and receivables based on invoices makes receivables management easiest for the accounting department. However, for the sales department, performance recognized as receivables for shipments in the current month is deferred to the next month, complicating management and deviating from accrual principles and international accounting standards for revenue recognition.

- No entry (inventory moves, but no accounting entry is generated)

At Invoice Issuance

- (Debit) A/R 111 (Credit) Sales 100

- (Credit) VAT 11

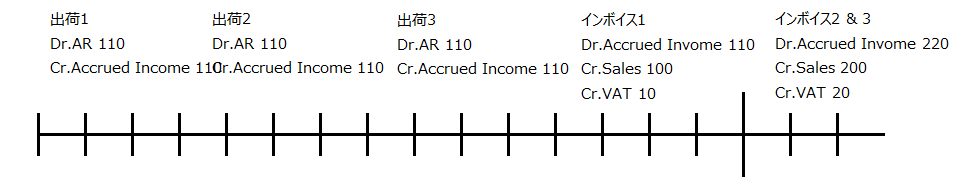

Recording Receivables at Shipment, Sales Based on Tax Invoice VAT

To recognize receivables at the shipment date and align sales with VAT based on the Faktur Pajak while clarifying the target shipment performance, the accrued income account (Accrued Income) is used.

- (Debit) A/R 110 (Credit) Accrued Income 110

At Invoice Arrival

- (Debit) Accrued Income 111 (Credit) Sales 100

- (Credit) VAT 11

Why Inventory Management Must Always Be Done on an Accrual Basis

If accurate current inventory cannot be tracked on an accrual basis, precise ordering and shipment plans cannot be established. Moreover, for calculating the cost of sales in accounting, inventory management must be conducted on an accrual basis.

By aligning inventory management with the actual flow of goods received and issued, the cost of sales on the P/L is accurately calculated. Since the cost of sales (expense) is recorded on an accrual basis, sales (revenue) must also be recorded on an accrual basis; otherwise, gross profit will diverge from reality.

For exports under FOB (Free On Board) terms, the sales recording date is set as the B/L (Bill of Lading) date because, under trade conditions where "the seller bears costs and risks until loading onto the ship, and the buyer bears them thereafter," the B/L date marks the delivery date of the goods.

In this case, inventory management also reduces inventory assets as of the B/L date.