When defective materials or spoilage (spoilage after becoming work-in-progress) occur, rather than directly reducing work-in-progress (or manufacturing costs like material costs or processing costs), transferring them indirectly to other accounts through inter-account transfers is the same as with depreciation or allowance for doubtful accounts. Accounting System in Indonesia The cloudification of accounting systems is advancing in Indonesia, with the three major local cloud systemsAccurate, Zahir, and Jurnalleading the market. However, in reality, it is said that fewer than 8% of domestic companies have implemented accounting systems. This is why new cloud-based accounting systems continue to be launched in what might seem like an already saturated Indonesian market. It suggests that both domestic and international IT startups see significant potential for cloud accounting systems to expand their market share locally. In Indonesia, automated journal entries due to the widespread use of accounting systems have become commonplace, and over the ... 続きを見る

What Is Transfer of Manufacturing Costs?

In manufacturing, the costs incurred to produce products are called manufacturing costs (Cost of Goods Manufactured, COGM). From the beginning product inventory and the current period’s manufacturing costs, the cost of what is sold is termed cost of goods sold (COGS). No new expense accounts are added; it’s just a designation.

For example, when spoilage occurs during the manufacturing process, the factory moves the spoiled items to an NG (non-good) warehouse, isolating them from normal work-in-progress.

- Beginning WIP Inventory + Current Period (Material Costs + Labor Costs + Manufacturing Overhead) – Ending WIP Inventory = Manufacturing Costs

The ending WIP inventory is recorded as lower due to the spoiled items isolated in the NG warehouse, meaning the spoilage cost ends up included in the manufacturing costs.

To clarify the amount of spoilage costs within manufacturing costs, separate journal entries are made. This can be done by directly transferring materials to spoilage costs or indirectly via inter-account transfers (Transfer to Other Account).

- Direct Transfer of Materials to Spoilage Costs

(Debit) Spoilage Costs (Credit) Materials - Indirect Transfer of Materials

(Debit) Spoilage Costs (Credit) Inter-Account Transfer

In this case, the formula for calculating manufacturing costs is adjusted as follows:

- Beginning WIP Inventory + Current Period (Material Costs + Labor Costs + Manufacturing Overhead + Spoilage Costs) – (Ending WIP Inventory + Inter-Account Transfer) = Manufacturing Costs

Since spoilage costs are part of manufacturing costs, the total manufacturing cost amount doesn’t change; it’s merely a “transfer of expenses within manufacturing costs.”

Next, if a product is dropped and broken in the product warehouse, to clarify that the responsibility lies with the sales department rather than manufacturing, it’s transferred from COGS to selling, general, and administrative expenses (SG&A).

- Direct Transfer of Products to Inventory Shrinkage Costs

(Debit) Inventory Shrinkage Costs (Credit) Products - Indirect Transfer of Products

(Debit) Inventory Shrinkage Costs (Credit) Inter-Account Transfer

In this case, the formula for calculating COGS becomes:

- Beginning Product Inventory + Current Period Manufacturing Costs – (Ending Product Inventory + Inter-Account Transfer) = COGS

As a result, the broken product, initially included in COGS, is deducted from COGS and recorded as SG&A.

Having worked with many talented Indonesian engineers and consultants, I’ve found that those who truly understand these principles are rare.

Total Average Unit Cost and Manufacturing Costs

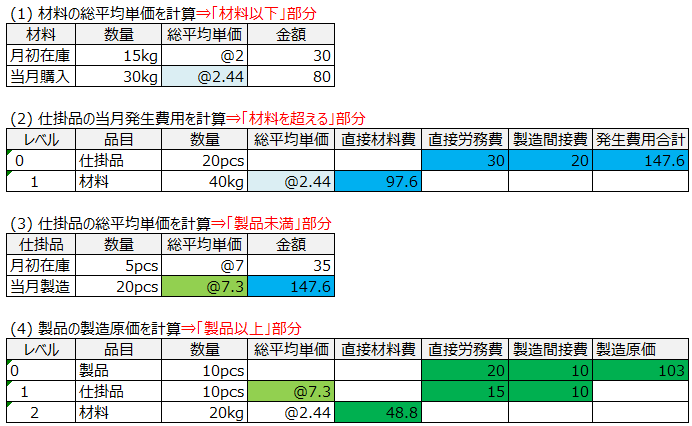

The current month’s manufacturing costs for products are:

- Total average unit cost of input WIP × accumulated amount + own process costs

The total average unit cost of input WIP is:

- (Beginning WIP Inventory Amount + Current Month WIP Manufacturing Costs) / (Beginning WIP Quantity + Current Month WIP Production Quantity)

The current month’s manufacturing costs for WIP are:

- Total average unit cost of input materials × accumulated amount + own process costs

The total average unit cost of input materials is:

- (Beginning Material Inventory Amount + Current Month Material Purchase Amount) / (Beginning Material Quantity + Current Month Material Purchase Quantity)

Thus, for an item at the top level (Level 0), the manufacturing cost is “(Total average unit cost of input items × actual input quantity) + own process costs.” When that item becomes an input for another, its input amount is calculated based on the total average unit cost derived from the prior manufacturing costs and beginning inventory amount.

Cost Element (Portion) Management

Manufacturing costs flow according to the account linkage chart as follows:

- Beginning Material Amount + Current Month Purchased Materials – Ending Material Amount = Current Month Direct Material Costs

- Beginning WIP Amount + (Current Month Direct Material Costs + Current Month Processing Costs) – Ending WIP Amount = Current Month Product Manufacturing Costs

- Beginning Product Amount + Current Month Product Manufacturing Costs – Ending Product Amount = Current Month COGS

When managing this by separating direct material costs and labor costs into portions, the material cost portion flows from materials through WIP to products:

- Beginning Materials + Current Month Purchased Materials – Ending Materials = Current Month Direct Material Costs

- Beginning WIP + Current Month Direct Material Costs – Ending WIP = Current Month Product Manufacturing Costs (Direct Material Cost Portion)

- Beginning Products + Current Month Product Manufacturing Costs – Ending Products = Current Month COGS (Direct Material Cost Portion)

Processing costs flow from WIP to products:

- Beginning WIP Processing Costs + Current Month WIP Processing Costs – Ending WIP Processing Costs = Current Month Product Manufacturing Costs (Processing Cost Portion)

- Beginning Product Processing Costs + Current Month Product Manufacturing Costs (Processing Cost Portion) – Ending Product Processing Costs = Current Month COGS (Processing Cost Portion)

Types of Inter-Account Transfers

Deduction means “subtracting the over-recorded portion of manufacturing costs or COGS.” Using inter-account transfer (WIP) deducts from manufacturing costs, while using inter-account transfer (Products) deducts from COGS.

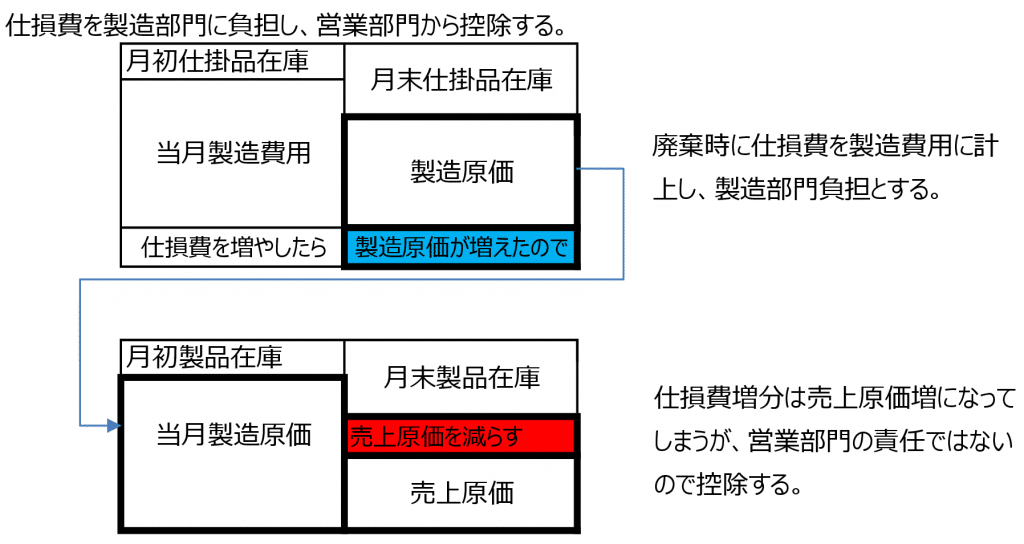

Record in Manufacturing Costs (Spoilage Costs) and Deduct from COGS

When defective materials or spoilage occur, instead of directly reducing materials, WIP, or products, they are indirectly transferred to another account, spoilage costs (Loss due to Spoiled Work), via inter-account transfer.

- Manufacturing Costs = Beginning WIP + (Current Month Manufacturing Costs + Spoilage Costs) – Ending WIP

- COGS = Beginning Products + Current Month Manufacturing Costs – (Inter-Account Transfer + Ending Products)

(Debit) Spoilage Costs 2 (Credit) Inter-Account Transfer (Products) 2

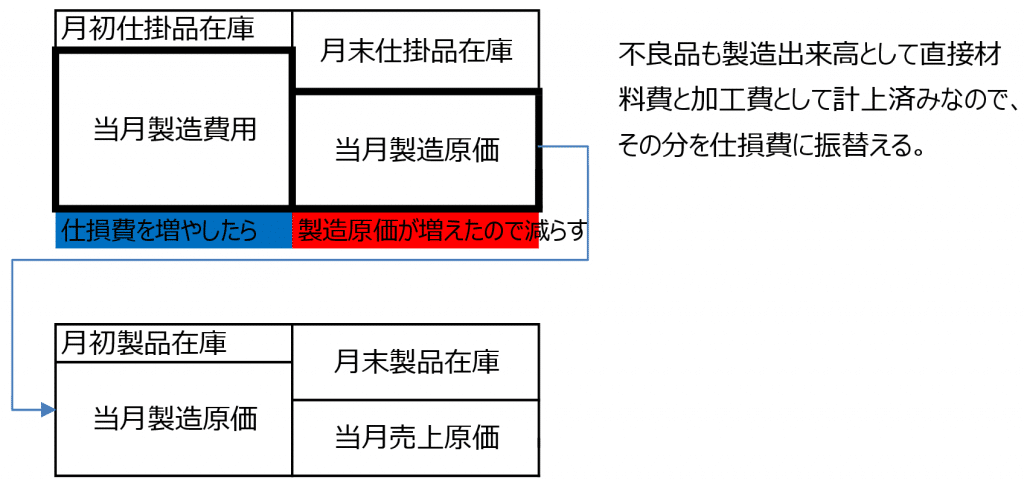

Record in Manufacturing Costs (Spoilage Costs) and Deduct from Manufacturing Costs (WIP)

Spoilage is transferred from direct material costs to spoilage costs within manufacturing costs.

- Manufacturing Costs = Beginning WIP + (Current Month Manufacturing Costs + Spoilage Costs) – (Inter-Account Transfer + Ending WIP)

(Debit) Spoilage Costs 2 (Credit) Inter-Account Transfer (WIP) 2

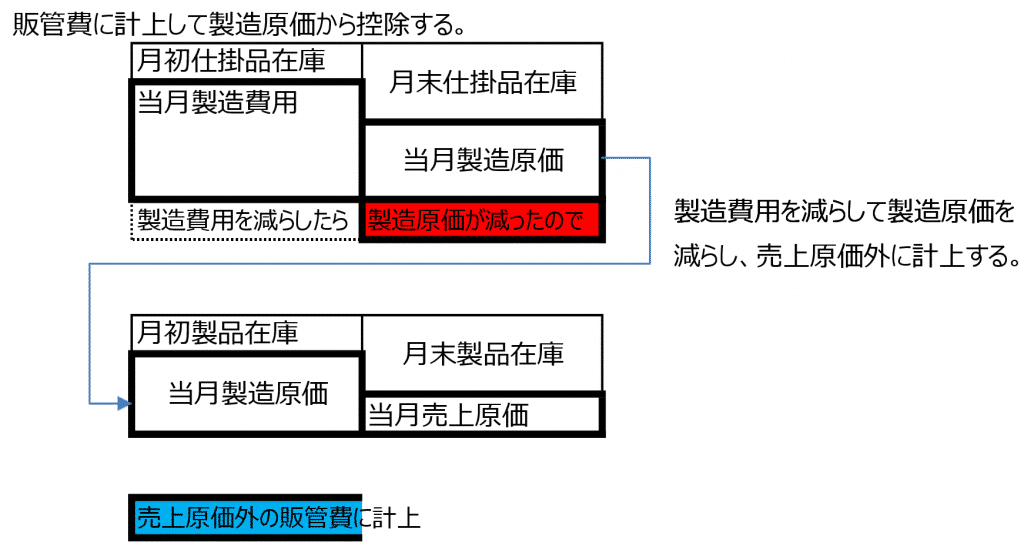

Record in SG&A and Deduct from Manufacturing Costs (WIP)

For large customer returns, claims are excluded from manufacturing costs and recorded as SG&A or extraordinary losses.

- Manufacturing Costs = Beginning WIP + Current Month Manufacturing Costs – (Inter-Account Transfer + Ending WIP) ⇒ Manufacturing Costs Decrease

- COGS = Beginning Products + Manufacturing Costs – Ending Products ⇒ COGS Decreases

- Gross Profit = Sales – COGS ⇒ Gross Profit Increases

- Operating Profit = Gross Profit – SG&A ⇒ Transferred to SG&A, Operating Profit Decreases

(Debit) SG&A 2 (Credit) Inter-Account Transfer 2

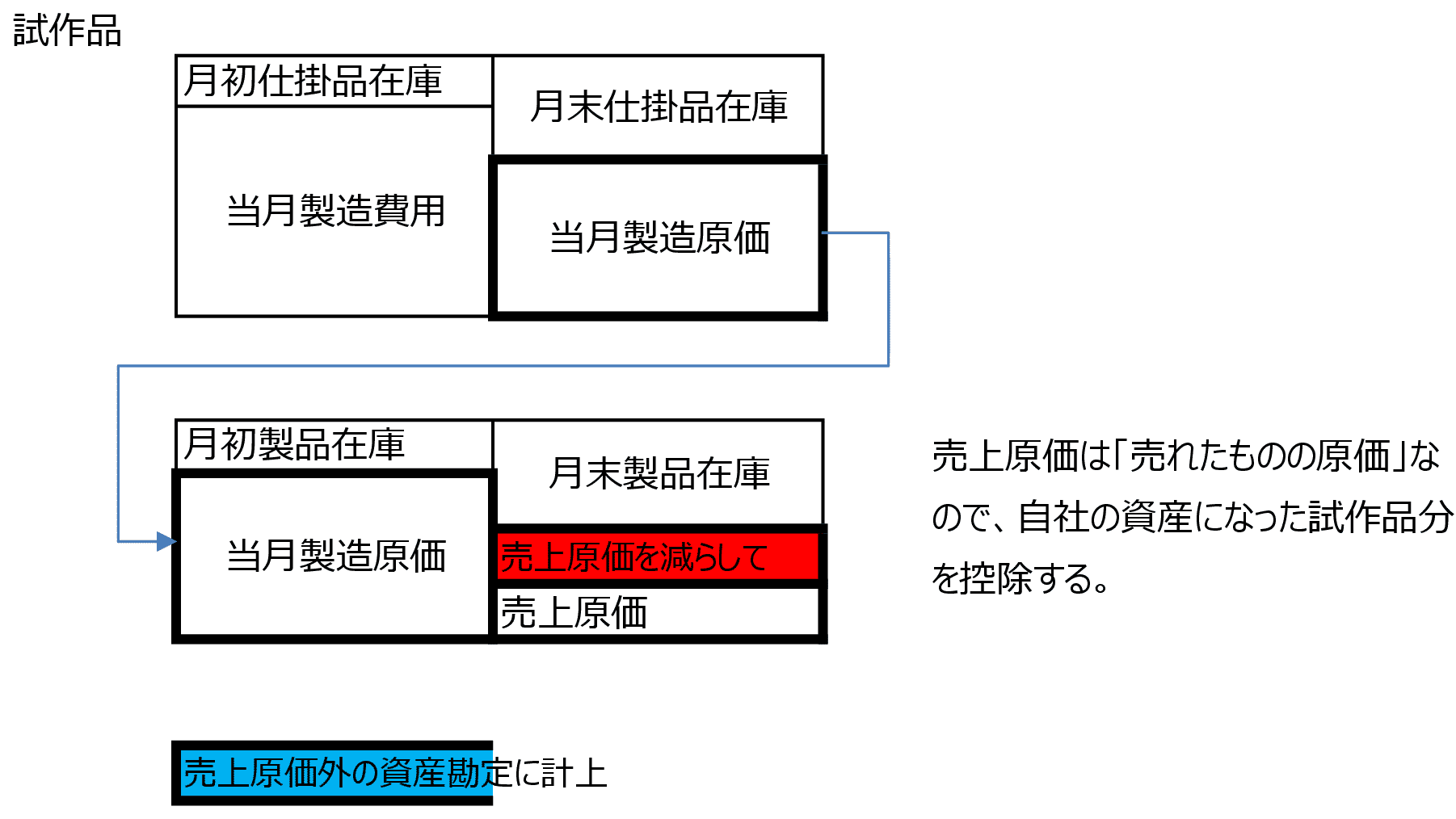

Record as Assets and Deduct from COGS (Products)

When self-manufactured products are transferred to assets, ending product inventory decreases due to prototypes, increasing COGS. Inter-account transfer (Products) indirectly deducts this from COGS.

- COGS = Beginning Products + Current Month Manufacturing Costs – (Inter-Account Transfer + Ending Products)

(Debit) Prototypes 2 (Credit) Inter-Account Transfer (Products) 2

Manufacturing Cost Calculation Process Using the Total Average Method

When production management systems record output as “10 good units, 2 defective units,” the WIP or product yield is 12 units, with direct material and processing costs already incurred for the 2 defective units.

Spoilage is confirmed upon disposal by recording disposal output, reducing inventory quantity. Until disposal, if it’s WIP, it’s included in the current month’s manufacturing costs’ direct material portion; if it’s a product, it’s in the WIP portion, automatically flowing into COGS.

- Material Total Average Unit Cost = (Beginning Material Amount + Current Month Purchase Amount) / (Beginning Quantity + Purchase Quantity)

- Material Incurred Costs = Material Total Average Unit Cost × Usage Quantity

- WIP Manufacturing Costs = Material Incurred Costs + Own Process Costs

- WIP Total Average Unit Cost = (Beginning Inventory + WIP Manufacturing Costs) / (Beginning Quantity + Current Month Production Quantity)

- Product Manufacturing Costs = (WIP Total Average Unit Cost × Usage Quantity) + Own Process Costs

How to Display Indirect Deduction of Spoilage Costs on the P/L

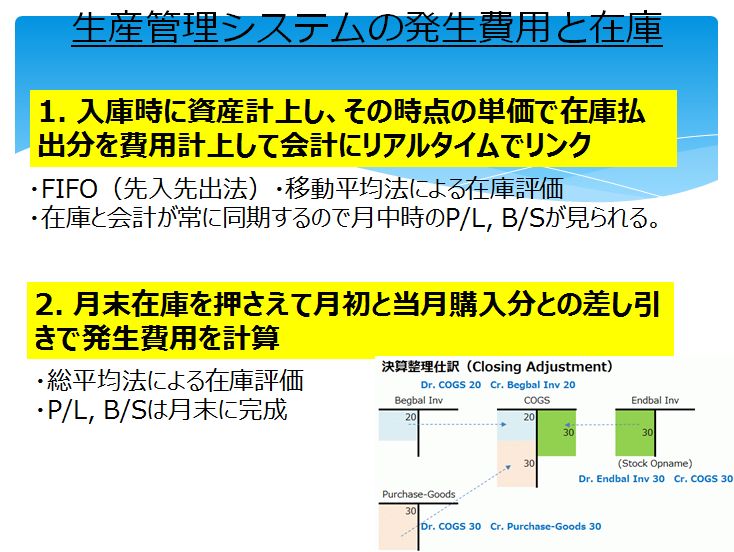

ERP systems either continuously adjust inventory accounts and expense issued amounts, or process purchases mid-month in a purchase account, transferring beginning inventory to ending inventory via the purchase account to expense them.

When reflecting spoilage recorded in output data into costs and accounting, the common P/L presentation for both systems uses inter-account transfers to indirectly deduct from costs.

Transferring Direct Material Costs Recorded in Manufacturing Costs to Spoilage Costs

Since it’s just a transfer from direct material costs to spoilage costs within manufacturing costs, neither manufacturing costs nor COGS change, and gross profit remains unaffected.

- (Debit) Spoilage Costs 10 (Credit) WIP 10

- Manufacturing Costs (COGM) 80 = Beginning WIP 100 + (Current Month Manufacturing Costs 40 – WIP 10 + Spoilage Costs 10) – Ending WIP 60

Or:

- (Debit) Spoilage Costs 10 (Credit) WIP Inter-Account Transfer 10

- Manufacturing Costs (COGM) 80 = Beginning WIP 100 + (Current Month Manufacturing Costs 40 + Spoilage Costs 10) – (WIP Inter-Account Transfer 10 + Ending WIP 60)

- COGS 170 = Beginning Products 200 + COGM 80 – Ending Products 110

- Sales Responsibility COGS – COGM = 90

Recording Spoilage Costs in Manufacturing Costs and Deducting from COGS

Adding spoilage from disposal to manufacturing costs increases COGS and reduces gross profit. Since spoilage isn’t sales’ responsibility, deducting it from COGS keeps gross profit unchanged.

- (Debit) Spoilage Costs 10 (Credit) WIP 10

- Manufacturing Costs (COGM) 90 = Beginning WIP 100 + (Current Month Manufacturing Costs 40 + Spoilage Costs 10) – Ending WIP 60

- COGS 170 = Beginning Products 200 + (COGM 90 – WIP 10) – Ending Products 110

Or:

- (Debit) Spoilage Costs 10 (Credit) Product Inter-Account Transfer 10

- Manufacturing Costs (COGM) 90 = Beginning WIP 100 + (Current Month Manufacturing Costs 40 + Spoilage Costs 10) – Ending WIP 60

- COGS 170 = Beginning Products 200 + COGM 90 – (Product Inter-Account Transfer 10 + Ending Products 110)

- Sales Responsibility = COGS – COGM = 80

Transferring Direct Material Costs Recorded in Manufacturing Costs to Extraordinary Losses

Deducting amounts included in manufacturing costs as direct material costs lowers COGS, increasing gross profit and operating profit. Recording them as extraordinary losses reduces net income, balancing the books.

- (Debit) Extraordinary Losses 10 (Credit) WIP 10

- Manufacturing Costs (COGM) 70 = Beginning WIP 100 + (Current Month Manufacturing Costs 40 – WIP 10) – Ending WIP 60

Or:

- (Debit) Extraordinary Losses 10 (Credit) WIP Inter-Account Transfer 10

- Manufacturing Costs (COGM) 70 = Beginning WIP 100 + Current Month Manufacturing Costs 40 – (WIP Inter-Account Transfer 10 + Ending WIP 60)

- COGS 160 = Beginning Products 200 + COGM 70 – Ending Products 110

- Sales Responsibility = COGM – COGM = 90