In developing an attendance management and payroll system in Indonesia, it is necessary to calculate and deduct individual income tax (PPh21) and health insurance (BPJS) from the total payment amount, which consists of basic salary and allowances.

-

-

Accounting System in Indonesia

The cloudification of accounting systems is advancing in Indonesia, with the three major local cloud systemsAccurate, Zahir, and Jurnalleading the market. However, in reality, it is said that fewer than 8% of domestic companies have implemented accounting systems. This is why new cloud-based accounting systems continue to be launched in what might seem like an already saturated Indonesian market. It suggests that both domestic and international IT startups see significant potential for cloud accounting systems to expand their market share locally. In Indonesia, automated journal entries due to the widespread use of accounting systems have become commonplace, and over the ...

続きを見る

Attendance System

In Indonesia, the mainstream method for recording attendance is by stamping a time card (kartu absensi) with a mechanical "click" (known as absen), which marks the clock-in and clock-out times. Some time card systems also store the data in internal memory, allowing it to be extracted as a CSV file via USB.

However, many devices have small memory capacities of around 2–4MB. If the necessary data per record (in bytes), number of employees, data retention period, and required capacity for the master database are not properly sized in advance, there is a risk that attendance data might be overwritten without being retrieved, causing unexpected issues after the system goes live.

To prevent proxy stamping and reduce the burden of aggregating attendance data, three main authentication methods are used: employee cards, fingerprint recognition, and hand vein authentication (Hand punch). These can also be combined, such as using an employee card together with fingerprint authentication.

Fingerprint recognition devices are available from around 30,000 yen, while hand vein authentication devices cost over 200,000 yen. If long queues form in front of the machines in the morning, employees on the verge of being late could end up clocking in late, which can be an issue. As a result, purchasing additional devices can become a significant investment.

For fingerprint and hand vein authentication, employees must pre-register their biometric data to create a matching table with employee codes, which is stored in the device’s memory. Attendance data is also stored in the device's memory and is manually downloaded by HR staff via utility software, either in CSV format or to an Access database over a network.

The downloaded attendance data is categorized into absence (absen), tardiness (keterlambatan), early leave (Ijin), and overtime (Overtime) before being processed for payroll calculations.

For overtime and early leave, prior requests (Overtime request, Leave request) are usually required. The recorded attendance data is compared with the registered overtime request information to determine the final payment amount.

Human Resource Management System

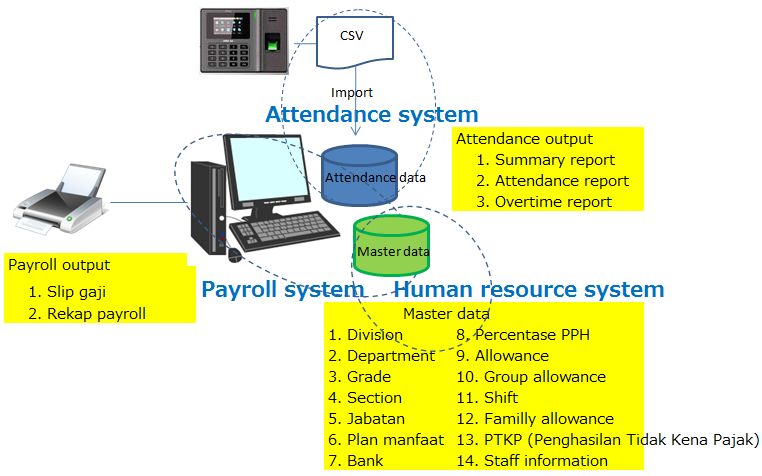

To calculate salaries based on attendance data, a master database is needed to manage employee information such as the year of hire, position, address, and family structure, which are necessary for calculating allowances.

Some systems separate the HR management system from the payroll system, allowing for the registration of non-essential employee data. However, in principle, HR and payroll systems are inseparable.

Payroll System

The master data required for Indonesia’s payroll system is illustrated in the diagram above. These parameters—such as tax rates, contribution rates, and overtime coefficients—are used in salary calculations, and pay slips are issued at the end of the month.

As of August 2013, due to repeated labor protests, overtime wage coefficients have significantly increased.

Overtime pay for weekdays is now 1.5 to 2 times the base hourly wage, while holiday overtime pay can be double, triple, or even quadruple, placing a heavy financial burden on companies. As a result, even when order volumes increase and businesses become busier, profitability remains elusive, leading to a situation where break-even points keep shifting further away.

PPh21 (Personal Income Tax)

While it is often said that Indonesian income tax is company-borne, this essentially functions like Japan’s withholding tax system. In practice, employees negotiate their salaries based on net income after tax deductions.

Each March, companies issue "Bukti Potong PPh21" tax withholding certificates, which employees must submit to the tax office. Failure to do so is considered non-compliance, leading to long queues at HR departments and a surge in staff taking half-day leave during this period.

As a side note, although most Indonesian companies follow a fiscal year from January to December, tax filings are due at the end of March, similar to Japan.

Consequently, employees rush to submit their withholding certificates in March, and external auditors conduct financial statement reviews and voucher checks during this time. After a provisional closing at the end of December, adjustments based on audit findings are entered in a "13th month" accounting period, making the process more complex.

Jamsostek (Abolished in 2014) → BPJS

Indonesia's social security system consists of labor accident insurance (JKK), death insurance (JKM), pension (JHT), and health insurance (JPK), and all full-time employees are required to enroll, just like in Japan. Previously, this was managed by the state-owned company Jamsostek.

The system is broadly similar to Japan’s social insurance for salaried workers, with contribution amounts varying based on salary and the number of dependents.

However, Indonesia lacks an equivalent to Japan’s National Health Insurance (for self-employed individuals) and National Pension systems. That said, tax obligations apply to both salaried employees and the self-employed, and NPWP (taxpayer identification number) registration is required, including for spouses.

As of January 2015, enrollment in BPJS Kesehatan (Badan Penyelenggara Jaminan Sosial), which replaced Jamsostek, is encouraged. This system includes pension (JHT) and health insurance (JPK).

Family Structure

Family structure information is necessary because personal income tax deductions (Penghasilan Tidak Kena Pajak, PTKP) vary based on marital status and the number of children, in addition to basic personal deductions.

PTKP represents the non-taxable portion of income and affects monthly payroll tax (PPh21) calculations, year-end adjustments, and annual tax filings.

Employee Information

This includes general details such as education, religion, position, and years of service. The impact of these factors on payroll varies by company. Some companies apply complex calculation methods, requiring customization of payroll systems to accommodate specific rules.

Allowance Master

This master data defines various types of bonuses and allowances, including THR (Tunjangan Hari Raya), the holiday bonus, and other calculation coefficients.

Salary Components

During labor protests, the terms "Upah Minimum Propinsi (UMP)" and "Upah Minimum Kabupaten (UMK)"—which refer to minimum wages—frequently appear.

- Gaji pokok (Basic salary)

- Tunjangan tetap (Fixed allowance)

- Tunjangan transport (Transport allowance)

- Potongan transport (Transport deduction)

- Potongan Absensi (Absence deduction)

- Uang makan (Meal allowance)

- Uang lembur (Overtime)

- Tunjangan lain-lain (Other allowances)

- Potongan lain-lain (Other deductions)

- Tunjangan pengobatan (Medical allowance)

- Tunjangan Asuransi (Insurance incentive)

- Tunjangan Premi Jamsostek (Jamsostek premium allowance)

- Potongan premi Jamsostek (Charge of Jamsostek premium)

- Bonus (Bonus)

- Tunjangan Hari Raya

- Tunjangan Pajak (Tax allowance)

- Potongan pajak (Tax cuts)