Against the accrual-basis performance on the P/L, unsettled receivables are subtracted, and depreciation expenses, which do not involve cash movement, are added to convert it to a cash basis. When preparing a cash flow statement, it is necessary to be mindful of this conversion from accrual basis to cash basis. Accounting System in Indonesia The cloudification of accounting systems is advancing in Indonesia, with the three major local cloud systemsAccurate, Zahir, and Jurnalleading the market. However, in reality, it is said that fewer than 8% of domestic companies have implemented accounting systems. This is why new cloud-based accounting systems continue to be launched in what might seem like an already saturated Indonesian market. It suggests that both domestic and international IT startups see significant potential for cloud accounting systems to expand their market share locally. In Indonesia, automated journal entries due to the widespread use of accounting systems have become commonplace, and over the ... 続きを見る

Why the Accounting System Is Considered More Mission-Critical Than the Production Management System

Over the past two months, even among Japanese companies in Indonesia, there have been increasing cases where core system servers were infected with the WannaCry ransomware (ransom = payment for release), rendering them inaccessible. In such cases, the hard disks were formatted, and the database backups were restored to recover the systems.

The demand was to send US$300 to a specified Bitcoin address (approximately 0.1 BTC) to decrypt the encrypted server hard disks. This US$300 amount is close to the estimated cost of having a system company format an infected PC and restore it from backup data. It seems strategically set, anticipating that companies might pay in Bitcoin depending on the urgency and importance of the data.

Recently, while restoring a production management system server infected with WannaCry, the president of the company remarked, "It’s fortunate amidst misfortune that it wasn’t the accounting system server that got infected." That comment stuck with me, but just a week later, the situation escalated into an unfunny incident where the accounting system server was infected with WannaCry.

If the accounting system is paralyzed, it becomes impossible to prepare the raw data needed to create the previous month’s P/L and B/S for submission to an accounting consulting firm. As a result, tax reporting—the most critical issue for business operations in Indonesia—cannot be completed.

Naturally, financial and management reports for the Japanese headquarters cannot be prepared either. The immense damage to the local subsidiary’s image, both externally and internally, is immeasurable, making the sentiment "It’s fortunate amidst misfortune that it wasn’t the accounting system server" a natural reaction.

In the case of a production management system, even if it’s down for 2-3 weeks due to a WannaCry infection, as long as the site maintains sufficient raw material and product inventory, manual preparation of documents like delivery notes might cause slight delays, but it won’t escalate to halting physical shipments.

- Production Management System Downtime

While there’s a risk of disrupting daily operations, efforts to keep operations running outside the system using Excel are possible. - Accounting System Downtime

As long as accurate figures are prepared by month-end, daily operations disrupted mid-month due to a system downtime can be input collectively afterward without issue. However, if it’s not restored by month-end, the negative impact internally and externally is significant.

In essence, in terms of business operation priorities, it’s inevitable that:

What Does It Mean for Production Management and Accounting Systems to Be Integrated?

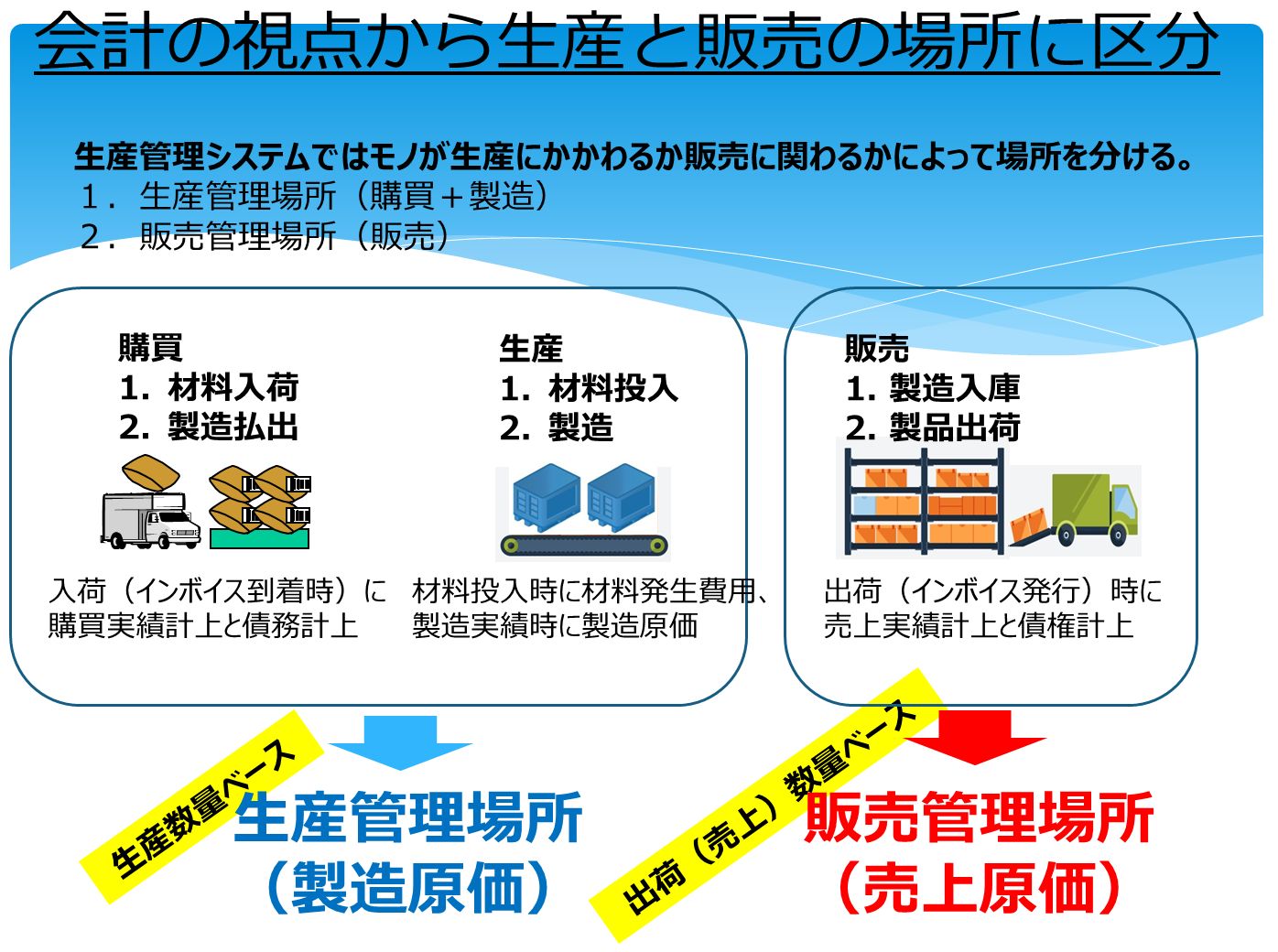

The production management system covers purchasing management, production management, and sales management. When entering purchase performance in purchasing management and sales performance in sales management, it generates receivables/payables data in the accounting system or automatically posts journal entries to the ledger (Posting).

Integration between production management and accounting means that inventory issuance performance in the production management system generates accounting entries, automatically updating the ledger balances of asset accounts, and synchronizing the valuation of inventory quantities with the asset account balances in accounting.

The advantage here, beyond maintaining consistency across the entire business system, is that as long as accurate performance data is entered on the production management side, the accounting system’s input burden is reduced, and correct figures are recorded. However, if incorrect performance data is entered, incorrect figures are reflected in the accounting system as well. Correcting this requires canceling the performance entries in chronological order, making ad-hoc, flexible responses in emergencies difficult.

For instance, if production performance is entered but not corrected for NG (defective) disposals, excess work-in-process inventory accumulates in the system. Adjusting this in bulk when pointed out during an audit can result in a significant loss on the P/L. Alternatively, intentionally inflating work-in-process inventory to show profit on the books (Cost of Sales = Beginning WIP + Current Month Manufacturing Cost – Ending WIP) is akin to "drinking poison to quench thirst"—a practice that will inevitably come back to haunt you.

Adjustments made to align accounting figures will always leave a discrepancy somewhere on the production management side, requiring reconciliation in the following months. Repeatedly postponing the issue can force a large special loss to be processed at year-end.

Business Systems Record Performance on an Accrual Basis

While an accounting system is fine as long as an accurate Trial Balance (T/B) is completed at month-end closing, I believe there’s little point in integrating it with a production management system that supports daily operations mid-month, such as issuing documents based on performance input. However, within the two domains of production management and sales management, it’s necessary to be aware of where and how goods move to become expenses in accounting terms.

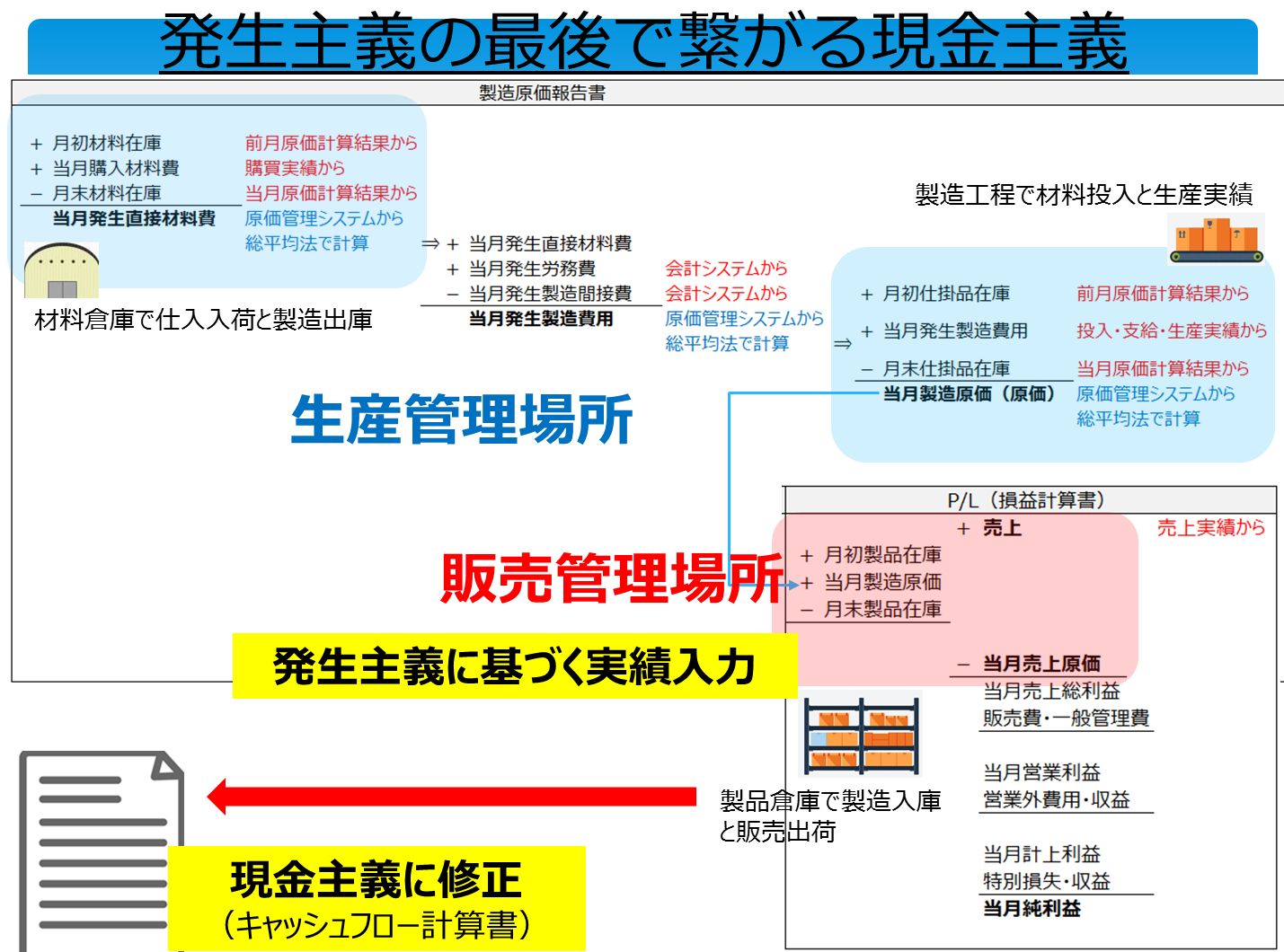

In other words, issuance of inventory (goods) based on performance input in the production management system is an incurred expense when it occurs in the production management domain, recorded as work-in-process inventory in an asset account upon receipt. In the sales management domain, receipt is recorded as manufacturing cost, and issuance is recognized as cost of sales.

ERP systems include those that link inventory issuance performance to current-month incurred expenses in the accounting system, updating inventory values in real-time using FIFO (First-In, First-Out) or moving average methods, and those that calculate incurred expenses by deducting month-end inventory from beginning inventory and current-month purchases. All performance input is conducted on an accrual basis, with the transaction occurrence date as the recording date.

Assuming this accrual-basis performance input, cash flow management involves adjusting to a cash basis to understand the movement of freely usable "pure" assets—i.e., cash and bank balances.

A company being profitable simply means showing a profit on the P/L. By preparing a cash flow statement with adjustments for:

- Receivables and payables already incurred but unsettled expenses and revenues

- Depreciation expenses

you can obtain management information on a cash basis to address immediate settlement needs.

The Difficulty of Systems Operating in Sync Across Sales/Purchasing, Production, and Accounting

In 2024, incidents like Glico’s failed core system migration led by Deloitte, halting shipments of Putchin Pudding, and Kubota’s production stoppage due to a core system overhaul led by Accenture, highlight recent SAP implementation troubles.

The "integrated mechanism" of SAP HANA covering sales/purchasing, manufacturing, and accounting is a marvel of functional beauty. However, it’s easy to imagine the enormous effort required for initial requirement gathering, development to resolve gaps during implementation, and company-wide cutoff adjustments during the switchover.

In Indonesia, larger manufacturing companies may adopt SAP as part of a global core system standardization led by headquarters, typically executed by major Japanese SIers over months of business trips. In such cases, the Indonesian subsidiary often simply uses what’s provided.

As someone offering core system implementation services with our own product in Indonesia, albeit on a smaller scale, I can’t help but speculate about whether the initial costs for licenses and implementation support, plus annual license maintenance running costs, are justified. There’s also a "big company disease" vibe—opting for a well-known package with pricey consultants to avoid accountability for selection decisions—but these aren’t the root causes of the troubles.

I’ve heard claims that "SAP HANA is ill-suited for Japanese manufacturing," but it’s not a matter of suitability. Rather, it’s the inherent difficulty of implementing a single "integrated mechanism" package across a large organization with many involved departments that poses the challenge.