The costs incurred based on input results are direct material costs, the costs incurred based on production volume are manufacturing costs, and the costs incurred based on shipment are the cost of goods sold. When input results and production results span across months, the input results for the current month remain as ending work-in-process inventory, and if production results are not recorded by the end of the following month, the work-in-process remains without any costs incurred. Cost Management in Indonesia Mass production factories, such as two- and four-wheeler parts manufacturers common in Indonesia, have multiple manufacturing processes. In such cases, processing costs are calculated for each process, and the method of aggregating these costs into the product is called process costing. In this approach, labor costs and manufacturing overheads are recorded at the end of the month by the accounting department, transferred to inventory assets, and then allocated accordingly. On the other hand, in factories producing custom-made items under individual order production, job order costing is used, where costs are aggregated by order number or project number. In this case, ... 続きを見る

The Importance of Cost Management

In corporate accounting, revenue (sales) and expenses (purchases) are recognized at the time a transaction occurs, whether based on delivery (shipment) or inspection criteria. Therefore, the profit calculated by subtracting expenses from revenue for a month does not match the actual cash and deposit balance. Even if the payment terms with the supplier of materials and the customer buying the products are both set to the end of the following month, the pressure of cash flow for material purchase payments at the end of the month varies depending on the company due to the following conditions:

- Cash and deposit balance derived from sales or capital

- Depreciation expenses that reduce apparent profit

- Payments for manufacturing fixed costs other than material costs incurred during the month

- Payments for selling, general, and administrative expenses and non-operating expenses

- Salary payments that come before receiving payments from customers

Even if sales increase due to discounting in sales management, a smaller gross profit can lead to a loss when accounting for SG&A and non-operating expenses. However, raising the selling price isn’t easy due to market price considerations, so the focus shifts to cost reduction at the production management stage, where internal effort can make a difference. That said, managing manufacturing costs too meticulously only increases the management burden, so the benchmark for the level of cost management becomes “whether the results can be utilized for production management.”

- Financial Accounting Perspective (From Cost Management to Accounting): Convert production volume-based results from the shop floor into monetary terms (manufacturing cost reports) and link them to accounting (P/L).

- Management Accounting Perspective (From Cost Management to Production Management): Analyze productivity by comparing actual results against standard costs or budgeted costs.

Costs Incurred, Manufacturing Costs, and Cost of Goods Sold

Materials become costs incurred not when purchased but when input, remaining as work-in-process inventory until production results are recorded. They become manufacturing costs when production results are recorded and cost of goods sold when shipped.

- Shipment-Based Costs Incurred

Three-Way Method: Cost of Goods Sold = Beginning Product Carryover + Manufacturing Costs - Ending Product Balance

Total Average Method: Cost of Goods Sold = Total Average Product Unit Price × Shipment Quantity - Production Result-Based Costs Incurred

Three-Way Method: Manufacturing Costs = Beginning Work-in-Process Carryover + Costs Incurred This Month - Ending Work-in-Process Balance

Total Average Method: Total Average Unit Price of Input Items × Input Quantity + Processing Costs - Input Result-Based Costs Incurred

Three-Way Method: Material Costs Incurred = Beginning Material Carryover + Purchase Costs This Month - Ending Material Balance

Total Average Method: Material Costs Incurred = Total Average Unit Price of Materials × Input Quantity

When input results and production results are always recorded together, all costs incurred should be aggregated within some SKU (Stock Keeping Unit) item number. If the beginning inventory is 0 and the costs incurred this month are 100, the following holds true, and on the receipt and disbursement ledger, production results for products are recorded with the total average unit price at the time of receipt:

- Beginning Work-in-Process 0 + Costs Incurred This Month 100 - Ending Work-in-Process 0 = Manufacturing Costs This Month 100

Difference Between Items with Only Input Results vs. Those with Production Results

If both input results and production results are recorded in the current month due to end-of-month production, the production result is recorded as a manufacturing quantity of 100. However, if production results span into the next month, the production result is recorded as a manufacturing quantity of 0 and a work-in-process quantity of 100. This is the difference between whether the input of 100 remains as ending work-in-process or is recorded as manufacturing costs.

When input results and production results span across months, costs incurred inevitably remain in the current month’s ending work-in-process inventory. If production results are not recorded by the end of the following month, the work-in-process remains without any costs incurred.

- Beginning Work-in-Process 0 + Costs Incurred This Month 100 - Ending Work-in-Process 100 = Manufacturing Costs This Month 0

When creating a manufacturing cost report by item, if work-in-process inventory has item codes, costs can simply be aggregated by item. However, items without item codes must also be displayed as costs incurred on the cost report, recorded as ending work-in-process.

In standard costing, ending work-in-process inventory does not arise, but when performing actual cost accounting, the ending balance of work-in-process (including beginning carryover) includes the following two:

- Ending Inventory: Work-in-Process with Item Codes

- Ending Work-in-Process Inventory: Items with Only Input Results

Two Ways to Classify Manufacturing Costs

In Indonesian, the term “mutasi” refers to moving or changing something, derived from the English word “mutation.” This “mutasi” is broadly divided into four categories: Goods Receive, Goods Issue, Movement, and Transfer.

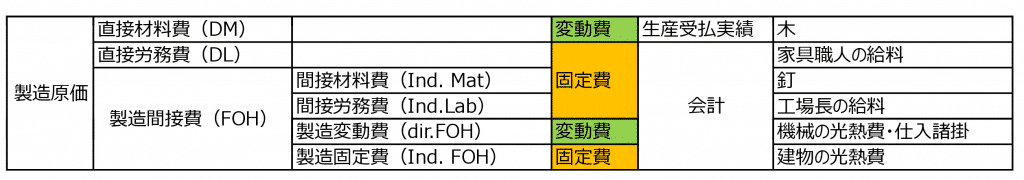

Manufacturing overhead is divided into subgroups: indirect material costs, indirect labor costs, and expenses. Variable costs are direct material costs derived from production receipt and disbursement results, while fixed costs are expenses obtained from accounting, categorized into indirect and direct costs.

In addition to direct material costs, variable costs include overtime pay (Over Time) and purchasing incidentals (Charge), but the majority of variable costs consist of direct material costs and outsourcing processing fees.

Actual Allocation of Fixed Costs in the Perpetual Method

The Perpetual Method, one of the inventory valuation methods, tracks inventory amounts in accounting asset accounts (materials, work-in-process, products) whenever receipt or disbursement occurs. In systems integrating accounting and production management, direct material costs maintain unit prices using FIFO (First-In, First-Out) or update them with the moving average method, while direct labor costs and manufacturing expenses are pre-allocated by setting standard allocation rates in the Bill of Materials (BOM). Variance Analysis in Actual Cost Accounting vs. Standard Cost Accounting In standard cost accounting, not only direct material costs (things), which are variable costs, but also direct labor costs (people) and manufacturing overhead costs (machines), which are typically fixed costs, are treated as if they were variable costs. Then, material costs are analyzed into price variance and quantity variance, labor costs into wage rate variance and labor hour variance, and overhead costs into efficiency variance, capacity variance, and budget variance. 続きを見る

However, even if direct materials are evaluated in real-time using FIFO or the moving average method and journal entries are made with the perpetual method, allocating direct labor costs and manufacturing expenses based on actual amounts per item requires generating journal entries in a batch process at the end of the month.

Journal entry for debt arising from material purchases:

- (Debit) Materials (Credit) Accounts Payable (AP)

Inputting materials into work-in-process without allocating manufacturing overhead:

- (Debit) Work-in-Process (Credit) Materials

Receiving the electricity bill for the month from the power company PLN (initially recorded as an operating expense):

- (Debit) Utilities (Credit) Accounts Payable (AP)

Transferring utilities to manufacturing overhead:

- (Debit) Manufacturing Overhead (Credit) Utilities

Allocating manufacturing overhead to products:

- (Debit) Products (Credit) Work-in-Process

- (Credit) Manufacturing Overhead

In Indonesian tax regulations, there is no obligation to allocate manufacturing overhead to work-in-process, so it seems the prevailing approach is to allocate it only to products, as in this example, rather than going through a complicated process.

Additionally, in FIFO, material inventory movement (mutasi) is recorded monthly under the assumption that there are no changes in material purchase prices within the same month. To calculate the disbursement (material input) valuation amount in the perpetual method, material costs are managed with two keys: material code and purchase month, such as “the cost of materials purchased in month X is Y yen.”

Handling Fixed Costs in Months Without Production

Whether there is production or not, as long as there is a factory, depreciation expenses for machinery are incurred. Ideally, the portion that becomes products in the current month should be part of the manufacturing costs for that month.

- Beginning Work-in-Process (Rp.0) + Manufacturing Costs This Month (Rp.100) - Ending Work-in-Process (Rp.0) = Manufacturing Costs This Month (Rp.100)

Fixed asset management systems have a function to suspend depreciation expense recording for machinery in months without production. However, since tax regulations require depreciation to be recorded monthly—whether by the straight-line method or declining balance method—the only option seems to be transferring it to SG&A expenses.

When transferring depreciation expenses originally related to production to SG&A, it must go through an “other account transfer” account, explicitly stating the incurred amount before indirectly transferring it.

Transferring it to work-in-process (assets) could be considered, but in a typical factory, if the work-in-process account grows significantly while there is no physical work-in-process inventory in the warehouse, auditors might point out:

- Why is work-in-process recorded when there’s no work-in-process inventory?

In general, in project accounting or construction accounting, it is recorded in the work-in-process account or construction-in-progress expenditure account and later transferred to products.