The world-standard format representing corporate activities—movements of goods, amounts, and cash—is embodied in the three financial statements: the Profit and Loss Statement (P/L), the Balance Sheet (B/S), and the Cash Flow Statement (C/F). Even as business processes become increasingly systematized, this is knowledge that should be systematically understood to generate new ideas based on the essence of operations. Accounting System in Indonesia The cloudification of accounting systems is advancing in Indonesia, with the three major local cloud systemsAccurate, Zahir, and Jurnalleading the market. However, in reality, it is said that fewer than 8% of domestic companies have implemented accounting systems. This is why new cloud-based accounting systems continue to be launched in what might seem like an already saturated Indonesian market. It suggests that both domestic and international IT startups see significant potential for cloud accounting systems to expand their market share locally. In Indonesia, automated journal entries due to the widespread use of accounting systems have become commonplace, and over the ... 続きを見る

The Standard Format Representing a Company’s Goods, Amounts, and Cash: The Three Financial Statements

Whether it’s a company or a sole proprietorship, the essence of all economic activities lies in the movements of goods, amounts, and cash. Even with the automation of operations through system implementation, this is knowledge that must be systematically understood to generate new ideas based on real-world phenomena. This is fundamentally different from information that can simply be found by searching online.

The world-standard format representing these movements of goods, amounts, and cash consists of the three financial statements: the Profit and Loss Statement (P/L, often called the Income Summary in Indonesia), the Balance Sheet (B/S), and the Cash Flow Statement (C/F). Therefore, understanding the general flow of how these statements are prepared is essential.

There are several key points in the process of preparing these three financial statements:

- Capital stock is money invested by shareholders, which transforms into goods, equipment, etc., through investment.

- Purchased goods become Cost of Goods Sold (COGS) when sold.

- Profit is carried forward as retained earnings, serving as the source of the company’s asset growth.

- There is a discrepancy between accrual-based profit and cash flow differences.

- P/L shows the flow of revenues and expenses, B/S shows the stock, and C/F shows the flow of cash inflows and outflows.

When I was a student, even those in the humanities were told to study English and accounting before graduating. In recent years, programming has been added to that list. I believe that not only entrepreneurs but also generalists with less specialized expertise increasingly need the ability to view operations holistically within the broader context of the company organization.

Converting Transactions into Slide Puzzle Movements

To simply understand the general flow of how the three financial statements are generated, consider opening a smartphone shop, purchasing 10 units of a product, and selling 4 of them. Converting this example into the movements of a slide puzzle, where the left and right sides always balance, makes it easier to grasp.

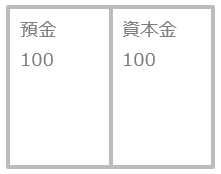

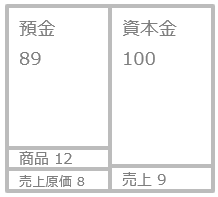

1. Transferred 100 juta from my personal account to the company’s account upon starting the business.

When 100 juta is transferred from my personal savings account to the shop’s account, a "Deposits" piece worth 100 juta is created for the shop. To balance the left and right, the source of this—the "Capital Stock" piece (statutory capital)—is placed on the right.

If, later, the shop’s deposit balance runs low and I transfer additional funds from my personal savings account to the shop’s account, the source would not be Capital Stock but a "Borrowings" piece.

Capital Stock represents the total value of shares held by shareholders as stated in the company’s incorporation certificate. If a venture capital firm (VC) attracted to the shop’s future potential invests (i.e., fundraising), the Capital Stock piece increases through a third-party allotment.

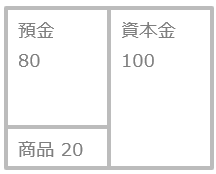

2. Purchased 10 smartphones at 2 juta each.

The "Deposits" piece decreases by 20 juta and transforms into a "Merchandise" piece, dispersing the breakdown of Capital Stock into Deposits and Merchandise while keeping the left and right balanced.

This method records purchased goods as COGS only when sold (Perpetual Inventory Method). Alternatively, there’s a method where all goods are expensed as costs upon purchase, and COGS is calculated by subtracting the ending inventory from the sum of beginning inventory and purchase costs (Periodic Inventory Method).

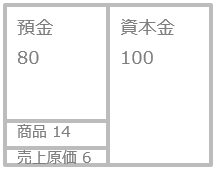

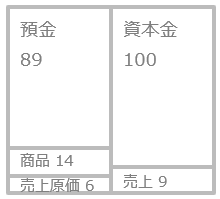

3. Sold 3 smartphones for 9 juta, paid via debit card.

Selling 3 smartphones with a cost of 2 juta each reduces the "Merchandise" piece by 6 juta, transforming it into a "COGS" piece, keeping the left and right balanced.

The cost expensed at the time of sale is called COGS, while expenses that occur regularly at month-end, such as staff salaries, are called period costs.

Simultaneously with the COGS occurrence, selling 3 units at 3 juta each increases the "Deposits" piece by 9 juta, with the source—a "Sales" piece of 9 juta—balancing the left and right.

By reflecting each transaction in a piece on either the left or right and maintaining balance, the accounting mechanism can be explained without delving into complex journal entry rules.

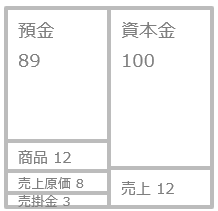

4. Sold 1 smartphone for 3 juta, with payment deferred to next month.

Selling 1 smartphone with a cost of 2 juta reduces the "Merchandise" piece by 2 juta, transforming it into a "COGS" piece, balancing the left and right.

Simultaneously with the COGS occurrence, selling 1 unit at 3 juta does not increase "Deposits" but creates an "Accounts Receivable" piece. The source—a "Sales" piece increasing by 3 juta—balances the left and right.

This "Accounts Receivable" piece disappears when payment is received next month, increasing the "Deposits" piece by 3 juta to balance the left and right.

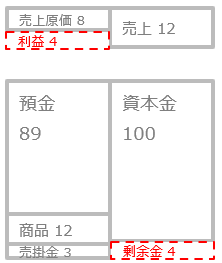

5. Finalizing the Month’s Profit

Isolating Sales and COGS, a "Profit" piece of 4 juta fills the indented gap on the left, finalizing the month’s profit as 4 juta.

The Profit and Loss Statement (P/L) determines profit from the flow of expenses and revenues for the month.

For the remaining pieces, a "Retained Earnings" piece of 4 juta fills the indented gap on the right, finalizing the company’s asset status and its breakdown as of month-end.

The Balance Sheet (B/S) finalizes the stock, i.e., the shop’s asset status.

Capital Stock is capital invested by shareholders, while Retained Earnings is capital accumulated in the shop through profitable operations.

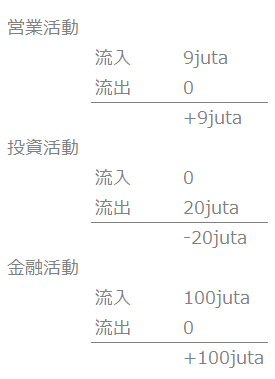

6. Classifying Deposit Movements

If the deposit balance increases from zero at the beginning of the month to 89 juta at month-end, it means deposits have increased by 89 juta compared to the start. This can be understood by comparing the B/S, which shows the stock status at month-end.

To understand the details, the transaction history must be traced as follows:

The 100 juta inflow at startup is based on "Financing Activities" from the Capital Stock on the right side of the B/S. The 20 juta outflow for purchasing smartphones is based on "Investing Activities" from the Merchandise purchase on the left side of the B/S. The 9 juta inflow from sales is based on "Operating Activities" reflected on the P/L.

The Cash Flow Statement (C/F) examines these cash movements in "Deposits," serving as the backing for the deposit balance stock on the B/S. In corporate activities, where running out of funds for payments means game over, understanding cash flow is critical.

The Relationship Between Profit/Loss and Cash Flow

In Indonesia, the SAGE ACCPAC accounting system is quite popular, but I find it lacking in the following two areas:

- It does not generate journal vouchers.

- The Cash Flow Statement (C/F) is not a standard feature.

This may be because it’s an American accounting package, where the practice of issuing journal vouchers and obtaining paper-based approvals, as is common in Japan, does not exist.

However, since the Cash Flow Statement became mandatory as one of the three financial statements under International Financial Reporting Standards (IFRS), I believe future accounting software packages will need to include the creation of C/F using the Direct Method.

In accounting, the profit/loss (expenses and revenues) on the P/L does not necessarily align with the cash flow (inflows and outflows) on the C/F. Even if the P/L shows a profit, a cash shortage can lead to a "profitable bankruptcy."

For example, the journal entry for repaying a bank loan is:

- (Dr) Borrowings (Decrease in Liabilities) (Cr) Cash (Decrease in Assets)

This results in a decrease in cash—an outflow—but since there’s no change in expense or revenue items, it’s not recorded on the P/L. This arises because cash flow-related entries are not always tied to profit/loss.

Cash Flow is Cash-Based, Profit/Loss is Accrual-Based

There are two methods for recognizing profit/loss: cash basis and accrual basis. The accrual basis primarily adopts two standards: shipment basis and inspection basis.

Cash Basis recognizes profit/loss (revenues and expenses) at the same point as cash flow, but in today’s world, where credit transactions (on account) are common, it’s normal for cash flow timing to differ from the provision of goods and services.

Accrual Basis recognizes profit/loss at the time goods or services are provided, divided into shipment basis and inspection basis.

(Accrual Basis)

- Upon Shipment

(Dr) A/R Accrued (Cr) Sales - Upon Invoice Issuance

(Dr) A/R (Cr) A/R Accrued - Upon Purchase

(Dr) Purchase (Cr) A/P Accrued - Upon Invoice Arrival

(Dr) A/P Accrued (Cr) A/P

A/P Accrued (accrued expenses) and A/R Accrued (accrued revenues) are transitional accounts. Since goods or services have not yet been provided, they are recorded on the Balance Sheet (B/S) and not recognized as profit/loss.

In Indonesian automotive parts factories, it’s common to record sales and receivables at the time of shipment and purchases and payables at the time of receipt. In such cases, no accounting entries occur when invoices (actual payment requests) are issued or received. Instead, at settlement, the receivables/payables recorded on the receipt date are cleared based on the invoice.

In addition to the accrual basis condition (transfer of goods or services), the Realization Basis, which recognizes profit/loss upon acquiring cash or cash equivalents (monetary assets like receivables or notes), is sometimes distinguished.

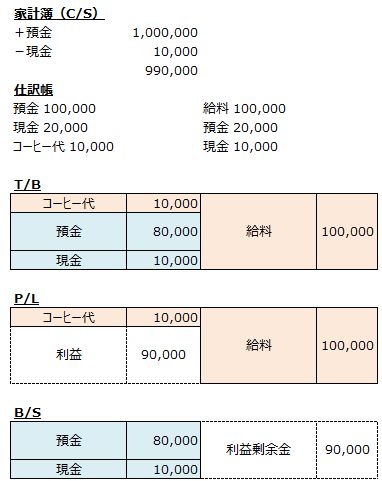

Flow from General Accounting to Financial Statements

A household budget tracks cash inflows and outflows to know the current cash balance, but it doesn’t show what the outflows were spent on or what remains as possessions.

Thus, double-entry bookkeeping records each transaction from two perspectives, classifying it into five categories: Assets, Liabilities, Net Assets, Expenses, and Revenues.

In accounting systems, general accounting covers Journals, General Ledger (G/L), and Trial Balance (T/B), while financial statements refer to the three financial statements: P/L, B/S, and C/F.

Originally, daily transactions were recorded in a journal list, then posted to the General Ledger by account. These two ledgers should be distinctly separated by level, but in business systems, their roles don’t differ significantly.

Whether unapproved or approved, all data is stored in the G/L table. The only difference is whether the output is viewed by voucher or by account, both capable of outputting amounts in debit/credit sets.

This is an example of how accounting operations, through systematization, unify two different levels of ledgers into a single system.

- Journals exist in the ledger as unapproved or approved (posted) states. The ledger’s balance becomes the Trial Balance, which can be divided into a block of Assets, Liabilities, and Net Assets, and a block of Expenses and Revenues.

- The Expenses and Revenues portion of the Trial Balance directly becomes the P/L. The protruding part of this block is profit, matching the size of the indented part of the Assets, Liabilities, and Net Assets block.

- By fitting profit into the indented part of the Assets, Liabilities, and Net Assets block as Retained Earnings (profits accumulated in the company, not distributed to shareholders), the B/S is completed in balance.

- The B/S shows the company’s wealth at a specific point, while the P/L shows the company’s profit over a period. Profit, derived from revenues minus expenses on the P/L, accumulates as Retained Earnings on the right side of the B/S. Since the left and right sides of the B/S match, assets increase by the amount of Retained Earnings growth.